Did you know that authenticating via Availity gives you access to all the private information on our website? Login via Availity

Share

- Home

- Latest Updates

- No Surprises Act

Share

- Latest Updates

-

- Availity

- SEPA Provider Information

- No Surprises Act

-

Medical Policy Update HBSPA

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Medical Policy Update HBCBSPA

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Medical Policy Update HBCBSDE

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Medical Policy Update HBCBSWV

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Medical Policy Update HBSNENY

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 30, 2023

- October 2, 2023

- September 2023

- August 2023

- July 2023

- June 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Medical Policy Update HBCBSWNY

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 30, 2023

- October 2, 2023

- September 2023

- August 2023

- July 2023

- June 2023

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

- May 2025

- June 2025

- July 2025

- August 2025

-

Provider News HBSPA

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 10, October 2024

- Issue 11, November 2024

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Provider News HBCBSPA

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 10, October 2024

- Issue 11, November 2024

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Provider News HBCBSDE

- Issue 11, November 2024

- Issue 10, October 2024

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Provider News HBCBSWV

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 10, October 2024

- Issue 11, November 2024

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Provider News HBSNENY

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 10, October 2024

- Issue 11, November 2024

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Provider News HBCBSWNY

- Issue 9, September 2024

- Issue 8, August 2024

- Issue 7, July 2024

- Issue 6, June 2024

- Issue 5, May 2024

- Issue 4, April 2024

- Issue 3, March 2024

- Issue 2, February 2024

- Issue 1, January 2024

- Issue 12, December 2023

- Issue 11, November 2023

- Issue 10, October 2023

- Issue 9, September 2023

- Issue 8, August 2023

- Issue 7, July 2023

- Issue 6, June 2023

- Issue 10, October 2024

- Issue 11, November 2024

- Issue 12, December 2024

- Issue 1, January 2025

- Issue 2, February 2025

- Issue 3, March 2025

- Issue 4, April 2025

- Issue 5, May 2025

- Issue 6, June 2025

- Issue 7, July 2025

- Issue 8, August 2025

-

Special Bulletins HBSPA

- Prosthetics & Orthotics in DE PA and WV

- Annual Update to Fee Schedule & Pricing Methodology

- Two New Types of Associate MHP in PA & DE

- Additional Documentation for Quality Improvement

- New Inpatient Facility Diagnosis Guidelines

- Inadvertent Claim Denials for Physical Medicine Services

- National Asthma & Allergy Awareness Month

- Quick Claims Functionality in Availity

- National Infant Immunization Week

- Reimbursement Changes for Respiratory Panels

- Changes to Rx Processing

- Highmark Responds to Change Healthcare Cyber Event

- CHIP Coverage Includes Allergy Medications

- National Nutrition Month

- Highmark Participating Providers Impacted by Change Healthcare Cyber Event

- CoverMyMeds Auth Requests

- Change Healthcare Cyber Event

- Heart Health Month

- Hemophilia and Bleeding Disorder Drug Program

- Annual HEDIS® Medical Record Reviews

- Inpatient Admissions

- HEDIS Changes in 2024

- Medical Policy S-558

- 2 Weeks to Highmark’s Transition to Availity

- Medical Policy S-60

- CDC Adds Meningitis

- Federal Employee Program

- Medicare Part D

- Acute Care Facilities

- Transition From NaviNet to Availity

- MID Program Changes

- Claims Culprit

- Physical Medicine Management

- Prior Authorization Changes March 2024

- New NAIC Code for SEPA

- U.S. Antibiotic Awareness Week

- Medical Policy S-9

- National Diabetes Awareness Month

- Reminder: 24/7 Availability Requirements

- ICD-10 Exclusionary Codes

- Self-Service Tools

- CPT Category II Codes for Diabetes

- New COVID-19 Booster Vaccines

- EDI Update: Highmark Accepting 275

- RSV Vaccines

- FEP Claims

- Use of Self-Service Tools

- New Credentialing Enhancements

- HEDIS Measure

- Annual SPH Analytics Survey

- Return Reissued Contracts

- DELAYED: Pharmacy Authorization Submissions

- Annual Update to Highmark’s Professional Fee Schedule

- Physical Medicine Management New High

- Central PA Teamsters

- New Medicare Advantage Rates

- Medical Policy U-5 Assisted Reproductive Technology

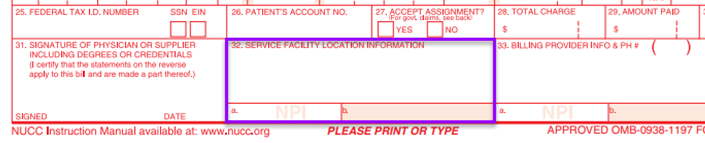

- Paper Claims

- Use of Self-Service Tools

- Update: Stabilize and Transfer

- New Capabilities Added to Provider Data

- Reminder: Submitting Auth Requests

- Important Reminder: Include Rendering

- NEW! Enhanced Clinical Documentation

- Improving Diabetes Treatment

- U. S. Digestive Health Out Of Network For Highmark Members Starting July 1, 2024

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Highmark Will Implement A Prepayment Edit

- Prior Authorization Changes Sept 2024

- Change Healthcare Cyber Incident – Data Breach Announcement

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Reimbursement for LCSWS Will Return to Previous Rate

- Express Scripts Pharmacy to No Longer Stock

- Error Corrected: Place of Service Updated for Medical Policy I-283

- Annual Phone Survey to verify Provider Directory Information

- Farxiga Added to Medicare Formularies as a Tier 3 Preferred Brand Name

- Tips for Submitting Corrected Claims

- Error Corrected: Medical Policy S-269 to be Updated on Aug. 12

- Revised Prescription Medication Policy for Weight Loss Medications

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Physical Medicine Management: High Performing Network Program Update

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- U.S. Digestive Health Returns to Highmark Network Effective September 20, 2024

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Medical Review Committee Openings

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Lead Poisoning Prevention: A Call to Action in Pennsylvania

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Update: Some eviCore-Managed Services Moving to Highmark

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- CHIP Update: No Assigned PCP Name on New Member ID Cards

- eAWV/Vatica Program Overview and Manual for 2025 Now on the PRC

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- Live Chat Pilot for Pennsylvania Providers Launching December 16

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Programs for 2025: High Performing Network and High Performing Provider

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- Temporary Pause: Successful Provider Live Chat Pilot in Pennsylvania

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- UPDATE: Two Additional eviCore-Managed Codes Moving to Highmark

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Provider Live Chat in Pennsylvania Resumes February 14

- Credentialing Update: Psychologists and BH Organizational Providers

- UPDATE: CVS Health to Join Hemophilia and Bleeding Disorder Drug Program

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- Quick Claims Just Got Quicker: Expanded Payer Options for Senior Health and Senior Solutions

- Reminder for CHIP Providers: HPV Vaccine is Recommended Starting at Age 9

- Reimbursement Changes for Highmark Inpatient DRG Methodologies for Acute Care Facilities

- Four Reimbursement Policies to be Updated on May 30, 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- Highmark PCP Value-Based Fee Schedule Adjustment Update for 2025

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Correction: Diagnosis Table Added to Medicare Advantage Medical Policy I-254

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Special Bulletins HBCBSPA

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Medical Review Committee Openings

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Lead Poisoning Prevention: A Call to Action in Pennsylvania

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Update: Some eviCore-Managed Services Moving to Highmark

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Prior Authorization Changes Sept 2024

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Express Scripts Pharmacy to No Longer Stock

- Highmark Will Implement A Prepayment Edit

- Change Healthcare Cyber Incident – Data Breach Announcement

- Additional Documentation Required For Quality Improvement Organization Audits

- Physical Medicine Management: New High Performing Provider Program To Launch Jan. 1, 2025

- Central PA Teamsters Health And Welfare Fund Members Will Have Access To Highmark Provider Network

- New Medicare Advantage Rates: Highmark Reprocessing Affected Claims

- New Inpatient Facility Diagnosis Guidelines Available On PRC Via Availity

- Inadvertent Claim Denials For Physical Medicine Services Being Addressed

- May Is National Asthma And Allergy Awareness Month

- Quick Claims Functionality In Availity Now Available For Highmark Providers

- National Infant Immunization Week Is April 22-29

- Changes To RX Processing Under The Channel Alignment Program

- Highmark Responds To Change Healthcare Cyber Event

- National Nutrition Month

- Assistance For Highmark Participating Providers Impacted By Change Healthcare Cyber Event

- Update: Change Healthcare Cyber Event

- Heart Health Month

- Annual HEDIS Medical Record Reviews To Begin In February 2024

- HEDIS Changes In 2024

- Medical Policy S 558

- 2 Weeks To Highmark’s Transition To Availity

- Medical Policy S 60

- CDC Adds Meningitis And Monkeypox Vaccines

- Federal Employee Program

- Medicare Part D Most Generics Available For 100-Day Supply In 2024

- Acute Care Facilities

- Transition From Navinet To Availity

- Claims Culprit

- Prior Authorization Changes Occurring On March 1 2024

- Authorization Changes Postponed for MSK Procedures

- Update: Enhancements to NaviNet Preauthorization Experience

- U.S. Antibiotic Awareness Week & World Antimicrobial Resistance Awareness Week

- Medical Policy S9

- National Diabetes Awareness Month Promoting Good Vision Health

- Reminder 24/7 Availability Requirements For Highmark Credentialed Practitioners

- ICD-10 Exclusionary Codes For Members Intolerant To Statin Therapy

- CPT Category II Codes

- New Covid-19 Booster Vaccines Added To The Preventive Schedule

- RSV Vaccines

- New Credentialing Enhancements And Search Capabilities For PDM Tool

- HEDIS Measure

- Annual SPH Analytics Survey

- Update Stabilize And Transfer OON Protocol Will Not Be Reinstated

- New Capabilities Added To Provider Data Maintenance Tool

- Reminder Submitting Auth Requests For Medical Injectables In Navinet

- Important Reminder Include Rendering Provider Information On All Claims

- New Enhanced Clinical Documentation For Continued Stay Review In Navinet

- Improving Diabetes Treatment Through Patient Centric Care

- Error Corrected

- Annual Phone Survey to Verify Provider Directory Information

- August is National Immunization Awareness Month

- Errors Corrected: Medical Policies S-269 to be Updated on Aug. 12

- Reimbursement for LCSWs Will Return to Previous Rate

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Prosthetics and Orthotics Procedure Codes to be Adjusted in DE, PA, and WV

- Annual Update to Highmark’s Professional Fee Schedule & Pricing Methodology

- Two New Types of Associate Mental Health Practitioners in PA and DE

- Reimbursement Changes for Respiratory Panels that Test for 5 or More Pathogens

- CHIP Coverage Now Includes Over The Counter Allergy Medications

- CoverMyMeds Auth Requests: Always Include BIN, PCN, and RXGroup Information

- Hemophilia and Bleeding Disorder Drug Program: New Pharmacy and Drugs Added

- Inpatient Admissions: Reconsideration Requests for No Clinical Information Denials

- MID Program Changes: Mandatory Drug Category to Be Eliminated

- Physical Medicine Management – Training Webinars on Nov. 28 and Dec. 7

- Self-Service Tools for Authorization Status

- EDI Update: Highmark Accepting 275 Attachments for Additional Documentation; Increased Use of 278 Requests

- FEP Claims Will Be Reviewed by Clinical Editing Tool Starting December 1, 2023

- Use of Self-Service Tools for Claim Status & Claim Investigation Expanding to FEP

- Return Reissued Contracts for Outpatient Therapy Daily Dollar Maximum

- Delayed: Pharmacy Authorization Submissions Moving to New Auth Automation Hub

- Annual Update to Highmark’s Professional Fee Schedule & Pricing Methodology

- Medical Policy U-5 Assisted Reproductive Technology Has Been Updated for DE, PA, and WV

- Paper Claims Must Be Completely and Correctly Filled Out to be Processed

- Use of Self-Service Tools Now Required for Routine Claims Inquiries

- Tips for Submitting Corrected Claims

- Farxiga Added to Medicare Formularies as a Tier 3 Preferred Brand Name

- A New Centralized PRC for All Six Highmark Regions to Launch This Fall

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Physical Medicine Management: High Performing Network Program Update

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- CHIP Update: No Assigned PCP Name on New Member ID Cards

- eAWV/Vatica Program Overview and Manual for 2025 Now on the PRC

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- Live Chat Pilot for Pennsylvania Providers Launching December 16

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Programs for 2025: High Performing Network and High Performing Provider

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- Temporary Pause: Successful Provider Live Chat Pilot in Pennsylvania

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- UPDATE: Two Additional eviCore-Managed Codes Moving to Highmark

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Provider Live Chat in Pennsylvania Resumes February 14

- Credentialing Update: Psychologists and BH Organizational Providers

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- Quick Claims Just Got Quicker: Expanded Payer Options for Senior Health and Senior Solutions

- UPDATE: CVS Health to Join Hemophilia and Bleeding Disorder Drug Program

- Reminder for CHIP Providers: HPV Vaccine is Recommended Starting at Age 9

- Reimbursement Changes for Highmark Inpatient DRG Methodologies for Acute Care Facilities

- Four Reimbursement Policies to be Updated on May 30, 2025

- Highmark PCP Value-Based Fee Schedule Adjustment Update for 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Correction: Diagnosis Table Added to Medicare Advantage Medical Policy I-254

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Special Bulletin HBCBSDE

- Prosthetics & Orthotics in DE PA and WV

- Annual Update to Fee Schedule & Pricing Methodology

- Two New Types of Associate MHP in PA & DE

- Additional Documentation for Quality Improvement

- New Inpatient Facility Diagnosis Guidelines

- Inadvertent Claim Denials for Physical Medicine Services

- National Asthma & Allergy Awareness Month

- Quick Claims Functionality in Availity

- National Infant Immunization Week

- Reimbursement Changes for Respiratory Panels

- Changes to Rx Processing

- Highmark Responds to Change Healthcare Cyber Event

- National Nutrition Month

- Highmark Participating Providers Impacted by Change Healthcare Cyber Event

- CoverMyMeds Auth Requests

- Change Healthcare Cyber Event

- Heart Health Month

- Hemophilia and Bleeding Disorder Drug Program

- Annual HEDIS® Medical Record Reviews

- Inpatient Admissions

- HEDIS Changes in 2024

- Medical Policy S-558

- 2 Weeks to Highmark’s Transition to Availity

- Medical Policy S-60

- CDC Adds Meningitis

- Federal Employee Program

- Medicare Part D

- Acute Care Facilities

- Transition From NaviNet to Availity

- MID Program Changes

- Claims Culprit

- Physical Medicine Management

- Prior Authorization Changes March 2024

- U.S. Antibiotic Awareness Week

- Medical Policy S-9

- National Diabetes Awareness Month

- Reminder: 24/7 Availability Requirements

- ICD-10 Exclusionary Codes

- Self-Service Tools

- CPT Category II Codes for Diabetes

- New COVID-19 Booster Vaccines

- EDI Update: Highmark Accepting 275

- RSV Vaccines

- FEP Claims

- Use of Self-Service Tools

- New Credentialing Enhancements

- HEDIS Measure

- Annual SPH Analytics Survey

- DELAYED: Pharmacy Authorization Submissions

- Annual Update to Highmark’s Professional Fee Schedule

- Physical Medicine Management New High

- Central PA Teamsters

- New Medicare Advantage Rates

- Medical Policy U-5 Assisted Reproductive Technology

- Paper Claims

- Use of Self-Service Tools Routine

- Update: Stabilize and Transfer

- New Capabilities Added to Provider Data

- Reminder: Submitting Auth Requests

- Important Reminder: Include Rendering

- NEW! Enhanced Clinical Documentation

- Improving Diabetes Treatment

- U. S. Digestive Health Out Of Network For Highmark Members Starting July 1, 2024

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Highmark Will Implement A Prepayment Edit

- Prior Authorization Changes Sept 2024

- Change Healthcare Cyber Incident – Data Breach Announcement

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Reimbursement for LCSWS Will Return to Previous Rate

- Express Scripts Pharmacy to No Longer Stock

- August is National Immunization Awareness Month

- Annual Phone Survey to Verify Provider Directory Information

- Error Corrected

- Delaware Law Mandates Annual Behavioral Health Wellness Check

- Reminder Primary Care and Chronic Care Management Reimbursement

- Changing: The Process for Appealing Credentialing Decisions for Professional Providers in DE and WV

- Tips for Submitting Corrected Claims

- Farxiga Added to Medicare Formularies as a Tier 3 Preferred Brand Name

- Error Corrected Medical Policy S-269 to be Updated on Aug 12

- How to Request Step Therapy Exceptions for Providers and Member

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- U.S. Digestive Health Returns to Highmark Network Effective September 20, 2024

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Update: Some eviCore-Managed Services Moving to Highmark

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Management: High Performing Provider Program Update

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- New DE Law: Doctor Referral NOT Required for Mammograms When Patient Is 40 Years or Older

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- UPDATE: Two Additional eviCore-Managed Codes Moving to Highmark

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Credentialing Update: Psychologists and BH Organizational Providers

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- UPDATE: CVS Health to Join Hemophilia and Bleeding Disorder Drug Program

- Four Reimbursement Policies to be Updated on May 30, 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Correction: Diagnosis Table Added to Medicare Advantage Medical Policy I-254

- Update: Delaware Speech Therapy Mandate

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Speech Therapy Mandate: Claims Processing Systems Now Fully Updated

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Special Bulletins HBCBSWV

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Prior Authorization Changes Sept 2024

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Express Scripts Pharmacy to No Longer Stock

- Highmark Will Implement A Prepayment Edit

- Change Healthcare Cyber Incident – Data Breach Announcement

- Reimbursement For LCSWs Will Return To Previous Rate

- Additional Documentation Required For Quality Improvement Organization Audits

- Physical Medicine Management: New High Performing Provider Program To Launch Jan. 1, 2025

- Central PA Teamsters Health And Welfare Fund Members Will Have Access To Highmark Provider Network

- New Medicare Advantage Rates: Highmark Reprocessing Affected Claims

- Prosthetics And Orthotics Procedure Codes

- New Inpatient Facility Diagnosis Guidelines Available On PRC Via Availity

- Inadvertent Claim Denials For Physical Medicine Services Being Addressed

- May Is National Asthma And Allergy Awareness Month

- Quick Claims Functionality In Availity Now Available For Highmark Providers

- National Infant Immunization Week Is April 22-29

- Changes To RX Processing Under The Channel Alignment Program

- Highmark Responds To Change Healthcare Cyber Event

- National Nutrition Month

- Assistance For Highmark Participating Providers Impacted By Change Healthcare Cyber Event

- CoverMyMeds Auth Requests: Always Include BIN, PCN, And RXGroup Information

- Update: Change Healthcare Cyber Event

- Heart Health Month

- Annual HEDIS Medical Record Reviews To Begin In February 2024

- HEDIS Changes In 2024

- Medical Policy S 558

- 2 Weeks To Highmark’s Transition To Availity

- Medical Policy S 60

- CDC Adds Meningitis And Monkeypox Vaccines

- Federal Employee Program

- Medicare Part D Most Generics Available For 100-Day Supply In 2024

- Acute Care Facilities

- Transition From Navinet To Availity

- Claims Culprit

- Mid Program Changes Mandatory Drug Category To Be Eliminated

- Prior Authorization Changes Occurring On March 1 2024

- U.S. Antibiotic Awareness Week & World Antimicrobial Resistance Awareness Week

- Medical Policy S9

- National Diabetes Awareness Month Promoting Good Vision Health

- Reminder 24/7 Availability Requirements For Highmark Credentialed Practitioners

- ICD-10 Exclusionary Codes For Members Intolerant To Statin Therapy

- Self-Service Tools For Authorization Status

- CPT Category II Codes

- New Covid-19 Booster Vaccines Added To The Preventive Schedule

- RSV Vaccines

- FEP Claims Will Be Reviewed By Clinical Editing Tool

- Use Of Self-Service Tools For Claim Status & Claim Investigation

- New Credentialing Enhancements And Search Capabilities For PDM Tool

- HEDIS Measure

- Annual SPH Analytics Survey

- Delayed Pharmacy Authorization Submissions

- Update Stabilize And Transfer OON Protocol Will Not Be Reinstated

- New Capabilities Added To Provider Data Maintenance Tool

- Reminder Submitting Auth Requests For Medical Injectables In Navinet

- Important Reminder Include Rendering Provider Information On All Claims

- New Enhanced Clinical Documentation For Continued Stay Review In Navinet

- Improving Diabetes Treatment Through Patient Centric Care

- Error Corrected

- August Is National Immunization Awareness Month

- Annual Phone Survey to Verify Provider Directory Information

- Error Corrected Medical Policy S-269 To Be Updated On Aug

- Annual Update To Highmark’s Professional

- Reimbursement Changes For Respiratory Panels

- Hemophilia And Bleeding Disorder Drug Program

- Inpatient Admissions Reconsideration Requests

- Physical Medicine Management Training Webinars

- Providers Encouraged To Submit Electronic Authorizations

- EDI Update Highmark Accepting 275 Attachments

- Annual Update To Highmark’s Professional Fee Schedule

- Medical Policy U 5 Assisted Reproductive Technology

- Paper Claims Must Be Completely

- Use Of Self-Service Tools Now Required For Routine

- Tips For Submitting Corrected Claims

- Highmark West Virginia Relinquished Washington County

- Changing The Process for Appealing Credentialing Decisions

- Farxiga Added To Medicare Formularies

- A New Centralized PRC For All Six Highmark Regions To Launch This Fall

- Revised Prescription Medication Policy For Weight Loss Medications

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Update: Some eviCore-Managed Services Moving to Highmark

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- eAWV/Vatica Program Overview and Manual for 2025 Now on the PRC

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Management: High Performing Provider Program Update

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- UPDATE: Two Additional eviCore-Managed Codes Moving to Highmark

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Credentialing Update: Psychologists and BH Organizational Providers

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- Quick Claims Just Got Quicker: Expanded Payer Options for Senior Health and Senior Solutions

- UPDATE: CVS Health to Join Hemophilia and Bleeding Disorder Drug Program

- Four Reimbursement Policies to be Updated on May 30, 2025

- Highmark PCP Value-Based Fee Schedule Adjustment Update for 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Special Bulletins HBSNENY

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Prior Authorization Changes Sept 2024

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Express Scripts Pharmacy to No Longer Stock

- Highmark Will Implement A Prepayment Edit

- Change Healthcare Cyber Incident – Data Breach Announcement

- MSK Procedures Preauthorization Date Moving to July

- Highmark Expands Free Market Health to Our Pharmacy Market in New York

- Additional Documentation Required for Quality Improvement Organization Audits

- Physical Medicine Management New High Performing Provider Program to Launch Jan

- Central PA Teamsters Health and Welfare Fund Members will have Access to Highmark Provider Network

- New Medicare Advantage Rates: Highmark Reprocessing Affected Claims Received Between March

- New Inpatient Facility Diagnosis Guidelines

- Inadvertent Claim Denials for Physical Medicine Services Being Addressed

- Reminder Maintaining Accurate Directory Information and Accessibility Standards

- May is National Asthma and Allergy Awareness Month

- Use of Self-Service Tools Now Required for Claim Status & Claim Investigation

- Quick Claims Functionality in Availity Now Available for Highmark Providers

- Updated PT OT and Home Health Prior Auth Changes Occurring on May

- National Infant Immunization Week is April

- Changes to Rx Processing under the Channel Alignment Program

- Highmark Responds to Change Healthcare Cyber Event Funding Assistance Program

- National Nutrition Month: Helping Patients and Parents Make Informed Food Choices

- Assistance for Highmark Participating Providers Impacted by Change Healthcare Cyber Event

- CoverMyMeds Auth Requests Always Include BIN, PCN and RX Group Information

- Update Change Healthcare Cyber Event

- More Options for Medicare Advantage Quest Is No Longer the Exclusive Lab

- Heart Health Month Helping Patients with Diabetes Avoid Cardiovascular Complications

- Annual HEDIS Medical Record Reviews to Begin in February 2024

- HEDIS Changes in 2024 Diabetes Cervical and Colorectal Cancer Screening

- Medical Policy S-558: Minor Formatting Error Corrected

- 2 Weeks to Highmarks Transition to Availity

- Medical Policy S-60 HCPCS Codes Removed from Archived Policy

- Legacy Claims Processing Changes for Medicare Crossover and ASK Claims

- Issues Identified Advanced Imaging Auth Requests and eviCore Listed Incorrectly

- All Dental Claims Moving to United Concordia Effective March

- CDC Adds Meningitis and Monkeypox Vaccines to 2024 Preventive Schedule

- Utilization Management of Outpatient Speech Therapy Moving to Helion Arc

- Issue Identified: Advanced Imaging Auth Requests Being Incorrectly Rejected

- Access to PaySpan Ending in April 2024

- Federal Employee Program High Cost Drugs to Require Prior Authorization

- Medicare Part D: Most Generics Available for 100-Day Supply in 2024

- Acute Care Facilities Itemized Bills Required for Local

- Transition From NaviNet to Availity: Start Using the New Provider Portal Today

- Claims Culprit: Sequela Code Errors Lead to Increased Denials

- RP-019N Update Change to New York Reimbursement Direction

- Prior Authorization Changes Occurring on March

- Post Acute Care for Landmark Members Prior Auth Changes Occurring January

- Highmark Blue Shield Moving New York Providers to Group Contracts

- US Antibiotic Awareness Week World Antimicrobial Resistance Awareness Week

- Medical Policy S-9 to be Updated on December 4 2023

- National Diabetes Awareness Month Promoting Good Vision Health

- Reminder 24/7 Availability Requirements for Highmark Credentialed Practitioners

- ICD-10 Exclusionary Codes For Members Intolerant To Statin Therapy

- Physical Medicine Update: Prior Authorization Changes Moved Back to April

- CPT Category II Codes for Diabetes Hypertension and Pregnancy-Related Care

- New COVID-19 Booster Vaccines Added to The Preventive Schedule

- RSV Vaccines Approved for Infants, Pregnant Women, and Older Adults

- This Page about Advanced Imaging and Cardiology: Prior Auth Changes Occurring in The New Year

- FEP Claims Will be Reviewed by Clinical Editing Tool Starting January 1, 2024

- All Highmark Member Claims Must be Sent to Highmark Blue Shield

- Dental Providers: Changes to How You Update Your Information

- New Credentialing Enhancements and Search Capabilities for PDM Tool

- Annual Fee Schedule Update Will Occur on October 1, 2023

- PIM Forms Must be Submitted Electronically

- HEDIS Measure: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- Annual SPH Analytics Survey

- Delayed: Pharmacy & Medical Injectable Authorization Submissions

- Submission of Claims Older Than January 1, 2023

- Update: Stabilize and Transfer OON Protocol Will Not be Reinstated

- New Capabilities Added to Provider Data Maintenance Tool

- Reminder: Submitting Auth Requests for Medical Injectables in NaviNet

- Important Reminder: Include Rendering Provider Information on All Claims

- New! Enhanced Clinical Documentation for Continued Stay Review in NaviNet

- Improving Diabetes Treatment Through Patient-Centric Care

- Annual Phone Survey to Verify Provider Directory Information

- Error Corrected: Place of Service Updated for Medical Policy I-283

- Errors Corrected: Medical Policies S-269 and X-583 to be Updated on Aug. 12

- August is National Immunization Awareness Month

- Tips for Submitting Corrected Claims

- Farxiga Added to Medicare Formularies as a Tier 3 Preferred Brand Name

- Highmark to Align HCRA Processes With NY State Recommendations

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- Amendment to Participation Agreement: Addresses Updated for Notices Section as a Result of New Highmark Location

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- MA Medical Policy Update: Corrected I-83 Bortezomib to Be Published on Dec. 2

- Medical Policy Correction: S-175-003 Epidural Steroid Injection

- Medical Policy L-124 Somatic Biomarker Testing – On Hold Until Further Notice

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Management: High Performing Provider Program Update

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- Correction: Medical Policy M-148 Coding Information

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Credentialing Update: Urgent Care Centers and Practices, Psychologists, and BH Organizational Providers

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- Four Reimbursement Policies to be Updated on June 30, 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Error Corrected: Medical Policy U-5-006 Assisted Reproductive Technology

- Update: New York Behavioral Health Mandate – Part AA of Chapter 57

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Expedited Review for RadCard and MSK Authorization Requests

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- New York Claims Processing Delay: June 23 – July 16

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Special Bulletins HBCBSWNY

- Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

- Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

- Prior Authorization Changes Sept 2024

- How To Submit Prior Authorization Requests for Outpatient Physical Medicine Services

- Express Scripts Pharmacy to No Longer Stock

- Highmark Will Implement A Prepayment Edit

- Change Healthcare Cyber Incident – Data Breach Announcement

- MSK Procedures Preauthorization Date Moving to July

- Highmark Expands Free Market Health To Our Pharmacy Market In New York

- Highmark Plans Transition Of Essential Plan Administration To Wellpoint Starting January 1, 2025*

- Additional Documentation Required For Quality Improvement Organization Audits

- Physical Medicine Management: New High Performing Provider Program To Launch Jan. 1, 2025

- Central PA Teamsters Health And Welfare Fund Members Will Have Access To Highmark Provider Network

- New Medicare Advantage Rates: Highmark Reprocessing Affected Claims

- How To Bill For Cosmetic Procedures Without A Valid CPT Code

- New Inpatient Facility Diagnosis Guidelines Available On PRC Via Availity

- Inadvertent Claim Denials For Physical Medicine Services Being Addressed

- Reminder: Maintaining Accurate Directory Information And Accessibility Standards

- May Is National Asthma And Allergy Awareness Month

- Use Of Self-Service Tools Now Required For Claim Status & Claim Investigation

- Quick Claims Functionality In Availity Now Available For Highmark Providers

- Updated: PT, OT, and Home Health

- National Infant Immunization Week Is April 22-29

- Changes To RX Processing Under The Channel Alignment Program

- Highmark Responds To Change Healthcare Cyber Event

- National Nutrition Month

- Assistance For Highmark Participating Providers Impacted By Change Healthcare Cyber Event

- CoverMyMeds Auth Requests: Always Include BIN, PCN, And RXGroup Information

- Update: Change Healthcare Cyber Event

- More Options For Medicare Advantage: Quest Is No Longer

- Heart Health Month

- Annual HEDIS Medical Record Reviews To Begin In February 2024

- HEDIS Changes In 2024

- Medical Policy S 558

- 2 Weeks To Highmark’s Transition To Availity

- Medical Policy S 60

- Legacy Claims

- Issues Identified

- All Dental Claims Moving To United Concordia

- CDC Adds Meningitis And Monkeypox Vaccines

- Utilization Management Of Outpatient Speech Therapy Moving To Helion Arc

- Issue Identified Advanced Imaging Auth Requests Being Incorrectly Rejected

- Access To PaySpan Ending In April 2024

- Federal Employee Program

- Medicare Part D Most Generics Available For 100-Day Supply In 2024

- Acute Care Facilities

- Transition From NaviNet To Availity

- Claims Culprit

- RP-019N Update

- Prior Authorization Changes Occurring On March 1 2024

- Post Acute Care For Landmark Members

- Authorization Changes Postponed for MSK Procedures

- Highmark Blue Cross Blue Shield Moving New York Providers To Group Contracts

- U.S. Antibiotic Awareness Week & World Antimicrobial Resistance Awareness Week

- Medical Policy S9

- National Diabetes Awareness Month Promoting Good Vision Health

- Reminder 24/7 Availability Requirements For Highmark Credentialed Practitioners

- ICD-10 Exclusionary Codes For Members Intolerant To Statin Therapy

- Physical Medicine Update

- CPT Category II Codes

- New Covid-19 Booster Vaccines Added To The Preventive Schedule

- RSV Vaccines

- Advanced Imaging And Cardiology

- FEP Claims Will Be Reviewed By Clinical Editing Tool

- All Highmark Member Claims Must Be Sent To Highmark Blue Cross Blue Shield

- Dental Providers Changes To How You Update Your Information

- New Credentialing Enhancements And Search Capabilities For PDM Tool

- Annual Fee Schedule Update Will Occur On October

- PIM Forms Must Be Submitted Electronically

- HEDIS Measure

- Annual SPH Analytics Survey

- Delayed Pharmacy & Medical Injectable Authorization Submissions

- Submission Of Claims Older Than January

- Update Stabilize And Transfer OON Protocol Will Not Be Reinstated

- New Capabilities Added To Provider Data Maintenance Tool

- Reminder Submitting Auth Requests For Medical Injectables In NaviNet

- Important Reminder Include Rendering Provider Information On All Claims

- New Enhanced Clinical Documentation For Continued Stay Review In Navinet

- Improving Diabetes Treatment Through Patient Centric Care

- Error Corrected

- Farxiga Added to Medicare Formularies as a Tier 3 Preferred Brand Name

- Highmark to Align HCRA Processes With NY State Recommendations

- Tips for Submitting Corrected Claims

- Errors Corrected: Medical Policies S-269 and X-583 to be Updated on Aug. 12

- Annual Phone Survey to Verify Provider Directory Information

- Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

- Express Scripts Pharmacy to No Longer Stock 32 Medications

- HEDIS Tips: CPT II Coding for Diabetes, Hypertension, and Pregnancy-Related Care

- Amendment to Participation Agreement: Addresses Updated for Notices Section as a Result of New Highmark Location

- Medicare Update: No Cost-Sharing for Pre-Exposure Prophylaxis for HIV Prevention

- Reminder: Emergency Department Claim Audits Using CMS Criteria

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Error Corrected: Medical Policy S-280 003 Updated on Oct. 14

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

- 2025 Medicare Advantage Formulary Changes

- Delayed Publication: MP Z-105 Prescription Digital Therapeutics

- CMS Clarifies “Substantive Portion” for Prolonged Preventive Services

- National Diabetes Awareness Month: Promoting Annual Vision Exams

- National Influenza Vaccination Week (NIVW) – Dec. 2-6, 2024

- MA Medical Policy Update: Corrected I-83 Bortezomib to Be Published on Dec. 2

- Medical Policy Correction: S-175-003 Epidural Steroid Injection

- Medical Policy L-124 Somatic Biomarker Testing – On Hold Until Further Notice

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Physical Medicine Management: High Performing Provider Program Update

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Accessibility Expectations: Changes for Professional Providers in All Regions

- HEDIS Changes for 2025: Mammogram Assessments, Blood Pressure Control, and More

- Correction: Highmark to Adopt Medical Policy S-510, not S-210, from MCG

- Correction: Medical Policy M-148 Coding Information

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Credentialing Update: Urgent Care Centers and Practices, Psychologists, and BH Organizational Providers

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

- Four Reimbursement Policies to be Updated on June 30, 2025

- Resolved: Availity Access Issue; Prior Auth Requests Can Resume

- National Infant Immunization Week – April 21-28, 2025

- Attachments Enabled When Submitting New Claims in Availity

- Error Corrected: Medical Policy U-5-006 Assisted Reproductive Technology

- Update: New York Behavioral Health Mandate – Part AA of Chapter 57

- Publishing Dates for Three Medical Policies Moved to May

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

- National Asthma and Allergy Awareness Month

- Highmark Launches Member Awareness Campaign for Measles Vaccination

- Updated Information: Submitting Retrospective Review Requests

- Well-Child Visits – How to Document Three Critical HEDIS Measures

- Expedited Review for RadCard and MSK Authorization Requests

- Now Available: Latest Edition of MCG Care Guidelines

- MA Member Benefit Update: Fitness Vendor to Change on Aug. 1

- HEDIS® Pediatric Immunization Measures: Protecting Children, Preventing Disease

- New York Claims Processing Delay: June 23 – July 16

- HEDIS: Avoidance of Antibiotic Treatment for Acute Bronchitis/Bronchiolitis

- How to Review Credentialing Status and Request a Copy of Your Contract

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

- Transition to Availity Authorization Process Temporarily Delayed

- BCBSA Provider Settlement

-

Portal Message Library HBSPA

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Additional Documentation Required for Quality Improvement Organization Audits

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Resolved: Temporary Issue Affecting Authorization Process

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

New Medicare Advantage Rates: Highmark Reprocessing Affected Claims

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Prosthetics and Orthotics Procedure Codes to be Adjusted in DE, PA, and WV

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Annual Update to Highmark’s Professional Fee Schedule & Pricing Methodology

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Rate Change Five Drugs in the Medical Injectable and Site of Care HIT Programs

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

New Inpatient Facility Diagnosis Guidelines Available on PRC Via Availity

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Inadvertent Claim Denials for Physical Medicine Services Being Addressed

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Quick Claims Functionality in Availity Now Available for Highmark Providers

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Reimbursement Changes for Respiratory Panels

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Issue Identified: Delayed Response Times for Secure Messages in Availity

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Highmark Responds to Change Healthcare Cyber Event: Funding Assistance Program and Access to Legacy Portals Extended

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

CHIP Coverage Now Includes Over-the-Counter Allergy Medications

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Assistance for Highmark Participating Providers Impacted by Change Healthcare Cyber Event

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

CoverMyMeds Auth Requests: Always Include BIN, PCN, and RXGroup Information

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Issue Identified: One-Day Delay in EFT Payments From PNC ECHO to Providers

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Issue Identified: Claim Inquiries Submitted Feb. 5-9 Provider Portal Inadvertently Closed

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

2 Weeks to Highmark’s New Provider Portal Transition – Are You Registered?

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

2024 UDC Program to Launch and Monthly Webinar Series Announced

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Update: Change Healthcare Cyber Event

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Prior Authorization Changes Occurring on Sept. 30, 2024

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Change Healthcare Cyber Incident – Data Breach Announcement

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

How to Submit Prior Authorization Requests for Outpatient Physical Medicine Services

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

U. S. Digestive Health Out Of Network For Highmark Members Starting July 1, 2024

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Electronic Authorization Tool Update: Enhanced Functionality and Important Reminders

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Rate Change: Five Drugs in the Medical Injectable and Site of Care HIT Programs

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Reimbursement For LCSWs Will Return To Previous Rate

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Express Scripts Pharmacy To No Longer Stock A Limited Set Of Medications

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Register For 2024 MA Stars Primary Care Incentive Program Metrics Overview Webinars

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Revised Prescription Medication Policy for Weight Loss Medications

-

Medicare Advantage Medical Policies Are Once Again Accessible from the PRC

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Express Scripts Pharmacy to No Longer Stock 32 Medications

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Issue Resolved: Authorization Requests Now Being Processed in the Availity Portal

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

U.S. Digestive Health Returns to Highmark Network Effective September 20, 2024

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

New Medical Management Options for Eligibility & Benefits Inquiries in Availity

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Reminder: Emergency Department Claim Audits Using CMS Criteria

-

ECHO Check Number to Display in Claim Status

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Member Benefit Period Information to Display in Eligibility & Benefits Response

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Eight Breast MRI Codes to be Removed from Prior Authorization List

- Prior Authorization Update: Some eviCore-Managed Services Moving to Highmark

- Prior Authorization Changes Occurring on Feb. 1, 2025

- Update: Express Scripts Will Continue to Stock Freestyle Libre, Rhopressa, and Rocklatan

- Medicare Advantage: How to Bill for Out-of-Area Members

- Reminder: For Drug Wastage Claims, Use Modifiers JW and JZ — It’s Required!

-

Senior Health: Submit Using 1500 Claim Submission, NOT Quick Claims

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Live Chat Pilot for Pennsylvania Providers Launching December 16

- Helion Prior Auth End Dates Moving to Fixed 180-Day Period; No Need to Resubmit Auths on Jan. 1

- Some Maternity Ultrasound Claims Are Being Inadvertently Denied

- Continuous Glucose Monitors: Prior Authorization to Be Required in 2025

- Issue Resolved: Funds Remitted for Dec. 4 Are Now Appearing in Remittance Viewer

- Accessibility Expectations: Changes for Professional Providers in All Regions

- Temporary Pause: Successful Provider Live Chat Pilot in Pennsylvania

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- UPDATE: Two Additional eviCore-Managed Codes Moving to Highmark

-

eAWV/Vatica Compensation Reports Now Available on the PFA Platform

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- POSTPONED: Authorization Enhancement for Physical Medicine, Home Health, and Hospice Requests

- Provider Live Chat in Pennsylvania Resumes February 14

-

Resolved: Issue Impacting Applications in Highmark’s Payer Spaces

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Upcoming Highmark Production Maintenance

- New Functionality in Predictal: Ability to Withdraw Pending Authorization Request

- Electronic Retrospective Review Requests Now Available via Availity

-

Issue Resolved: HIPAA Transactions Can Now Be Completed in Availity

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

-

Issue Resolved: Funds Now Displaying; Payments on Target

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Quick Claims Just Got Quicker: Expanded Payer Options for Senior Health and Senior Solutions

- Highmark PCP Value-Based Fee Schedule Adjustment Update for 2025

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Attachments Enabled When Submitting New Claims in Availity

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Updated Quarterly Fee Schedules Including MID Reimbursement Changes

-

Resolved: Processing Issue for Some Facility Payments

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Updated Information: Submitting Retrospective Review Requests

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Upcoming Highmark Production Maintenance

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Network Exception Question: Answer “No” Unless Requesting Out-of-Network Exception

- Issue Resolved: Auth Requests Can Now Be Submitted Electronically

-

Upcoming Highmark Production Maintenance

lock

Authentication Required

This link requires authentication. If you are not already logged in you will need to log into Availity and link to this site from there.

- Transition to Availity Authorization Process Temporarily Delayed

-