Unit 3: Other Government Programs

Medigap Blue, Highmark’s Medicare supplemental product for individual direct-pay customers in Pennsylvania, is designed to assist beneficiaries by paying certain amounts not covered by the Medicare program. Depending on the design of the program, a supplemental product can pay Medicare deductibles, coinsurances, and/or other specific kinds of expenses.

Standardization Among Medigap Plans

The Omnibus Budget Reconciliation Act (OBRA) required insurers throughout the United States to standardize the benefits available under their direct-pay Medigap products. The purpose of this standardization was to simplify seniors’ purchasing decisions for Medicare supplemental coverage. All “Plan A” products, for example, must provide the same benefits. Therefore, the only real points of comparison among the contenders would be price and customer service.

The legislation provided for a maximum of ten standardized benefit plans. States were permitted to limit these plans further, and the Commonwealth of Pennsylvania chose to eliminate three of the originally proposed benefit packages. All Pennsylvania insurers in the Medigap market were required to offer Plan A and Plan B; they could also offer Plans C, D, E H, and I. Highmark chose to offer Plans A, B, C, E, F, and High Deductible (HD) F, H, and I.

The plans are detailed in the chart below.

IMPORTANT: Plans E, H, and I have been closed to new enrollment; however, historic enrollment may still exist in these plans.

|

Service |

Plan A |

Plan B |

Plan C |

Plan E |

Plan U |

Plan I |

Plan F |

Plan F HD |

Plan N |

|---|---|---|---|---|---|---|---|---|---|

|

Basic Benefits (including hospice coinsurance) |

X |

X |

X |

X |

X |

X |

X |

X |

X with copays |

|

Skilled Nursing Facility Coinsurance |

X |

X |

X |

X |

X |

X |

X |

||

|

Part B Deductible |

X |

X |

X |

X |

|||||

|

Foreign Travel Emergency |

X |

X |

X |

X |

X |

X |

|||

|

Part B Excess Charges |

|

X |

X |

X |

X |

||||

|

Preventive Health Benefits |

X |

X |

|

||||||

|

At-Home Recovery |

X |

X |

Note: Basic benefits in these closed plans have no hospice coinsurance.

All six of the Medigap Blue benefit packages offered by Highmark provide the following core benefits:

- Hospital coinsurance for days 61 through 90.

- Hospital coinsurance for Lifetime Reserve Days – days 91 through 150.

- Three hundred 365 additional hospital days after Lifetime Reserve Days have been exhausted.

- First three pints of blood (not covered by Medicare).

- Medicare Part B coinsurance.

REMINDER: Always verify benefits. It is the responsibility of the provider to verify that the member’s benefit plan provides the appropriate benefits for the anticipated date of service prior to rendering service. You can verify a member’s coverage by using Availity, performing an electronic HIPAA Eligibility/Benefit Inquiry, or by calling the Provider Service Center.

Medigap Supplemental General Information

The Medicare Overcharge Measure (MOM) Act prevents the majority of all health care providers in the state of Pennsylvania from billing Medicare beneficiaries any amount in excess of the Medicare reasonable charge.

There are certain providers and suppliers who may charge beneficiaries for the difference between the billed amount and the Medicare allowance. You should contact the appropriate Medicare office for a listing of those types of providers.

When a member is enrolled in Medicare Part B and has supplemental coverage through Medigap Blue, Medicare is the primary carrier. Submit the claim to the member’s Medicare carrier first for processing.

Medicap Blue Claim Submission

If you do not submit claims electronically, and payment under the supplemental coverage has not been received within 30 days after the Medicare payment and you have checked claim status, send a copy of the Explanation of Medicare Benefits (EOMB) statement to:

Highmark

Medigap Claims

P.O. Box 898845

Camp Hill, PA 17089-8845

- Please do not highlight any information on the EOMB statement. Use an asterisk (*) or some other form of notation to indicate the patient whose claims need to be processed under their supplemental coverage.

- The member’s contract identification number and correct address should be on the EOMB statement; otherwise, please submit a completed CMS-1500 claim form.

- In the case of Medicare electronic remittance, a screen print of the electronic remittance and a copy of the 1500 Claim Form should be sent to the address listed above.

The beneficiary’s Highmark agreement number and correct address should appear in the upper left corner of all documents submitted for processing.

2.3 Signature 65

Signature 65 is designed to complement Medicare Part A and Part B covered services. Under this contract, Highmark will pay 20 percent of the Medicare Part B allowance after the Medicare annual deductible has been satisfied.

Core Benefits

Signature 65 is a Highmark group product available in Pennsylvania that provides coverage for the following core benefits (benefits vary by group):

- Medicare Part A deductible;

- Hospital coinsurance for approved Medicare benefits;

- Skilled Nursing Facility coinsurance for approved Medicare benefits;

- Three hundred 365 additional hospital days;

- The first three pints of blood per calendar year; and

- Medicare Part B coinsurance.

Carve-Out

There are many groups that prefer to purchase the same benefits for their retired employees over age 65 (those with Medicare Part A and Part B) as they do for their active employees. In these arrangements, claims are processed by Medicare first, then through Highmark.

Any payment made by Medicare is subtracted (carved-out) from the payment made by Highmark. Payment is made only for those services eligible under the group’s Highmark benefits, even if the service was eligible under Medicare Part B.

2.3 Delaware Medicare Supplemental Plans

Highmark Blue Cross Blue Shield (DE)'s Medicare complementary and supplement programs help to pay some of the expenses not paid by Medicare. This may include payment of the Medicare deductibles and/or coinsurance depending on the individual plan.

Medicfill®

Highmark Blue Cross Blue Shield (DE)'s Medicfill® coverage is a health insurance plan designed to supplement Medicare coverage after an individual has retired or become eligible for Medicare due to a disability. Medicare is the primary payer; Highmark Delaware is the secondary payer. Usually, the individual or dependent must be enrolled in and retain Medicare Parts A and B to be eligible for Medicare supplementary coverage.

Carve-Out Plans

There are many groups that prefer to purchase the same benefits for their retired employees over age 65 (those with Medicare Part A and Part B) as they do for their active employees. In these arrangements, claims are processed by Medicare first, then through Highmark Delaware. Any payment made by Medicare is subtracted (carved-out) from the payment made by Highmark Delaware. Payment is made only for those services eligible under the group’s Highmark Delaware benefits, even if the service was eligible under Medicare Part B.

2.3 West Virginia Medicare Supplemental Programs

Highmark Blue Cross Blue Shield (WV) has Medicare standardized supplemental plans and Medicare complementary plans (pre-standardized). Standardized supplemental plans are available to individuals only, while complementary plans are available to both employer groups and individuals.

The individual or dependent must be enrolled in and retain Medicare Parts A and B to be eligible for Medicare supplementary or complementary coverage.

Medifil

Medifil is Highmark Blue Cross Blue Shield (WV)'s Medicare supplemental product for individuals who are retired and over age 65 or have become eligible for Medicare due to a disability. It is designed to assist Medicare beneficiaries by paying certain amounts not covered by the Medicare program. Medicare is the primary payer; Highmark West Virginia is the secondary payer.

Highmark West Virginia offers the standardized Plans A, C, F, F (High Deductible), and N. Depending on the design of the plan, a supplemental product can pay Medicare deductibles, coinsurance, and/or other specific kinds of expenses.

Carve-Out

There are many groups that prefer to purchase the same benefits for their retired employees over age 65 (those with Medicare Part A and Part B) as they do for their active employees. In these arrangements, claims are processed by Medicare first, then through Highmark West Virginia.

Any payment made by Medicare is subtracted (carved-out) from the payment made by Highmark West Virginia. Payment is made only for those services eligible under the group’s Highmark West Virginia benefits, even if the service was eligible under Medicare Part B.

Highmark makes health care programs available to uninsured children in Pennsylvania through the subsidized Children’s Health Insurance Program of Pennsylvania (CHIP). Highmark Healthy Kids (CHIP) coverage offers programs for all uninsured children regardless of household income.

Highmark Healthy Kids (CHIP) is modeled after the Caring Program for Children, which was pioneered by Highmark through its Caring Foundation. CHIP expanded with the legislation to Cover All Kids and now offers coverage to every uninsured child in Pennsylvania, regardless of household income. CHIP covers children from birth through 18 years of age.

This program is administered by Highmark on behalf of the Commonwealth of Pennsylvania Department of Human Services (DHS).

The more a child’s family earns, the more cost sharing they will have in the form of higher premiums and copays.

- Free CHIP is funded through a portion of the state cigarette tax as well as federal funding. Families owe nothing for their child’s premium and there are no copayments for office/ER visits and drugs.

- Low-Cost CHIP includes three levels with varying costs based on family income. Families pay some of the cost of CHIP coverage for each level of Low-Cost CHIP and copays for office/ER visits and drugs. Low-Cost CHIP began receiving federal money in addition to state money when CHIP expanded under Cover All Kids.

- Full-Cost CHIP provides health care coverage to children in households who are over the income limits for Free and Low-Cost CHIP. Families pay the full cost of CHIP coverage at this level and copays for office/ER visits and drugs.

It is only through a partnership with our providers that these programs are successful, and Highmark can continue its social mission to provide health care coverage to as many children in Pennsylvania as possible.

Highmark extends its sincere appreciation to its providers for their continued commitment to provide services to children who qualify for these programs.

Please remember that you do not have to verify income or eligibility for these programs. Eligibility and income are determined before enrollment and annually thereafter by the Department of Human Services (DHS).

Utilizes Highmark Provider Networks

One of the keystones of this program is that families are “held harmless” from balance billing when covered services are provided by a network provider. To achieve that, members enrolled in CHIP prior to July 1, 2022, use the Premier Blue Shield preferred provider network to provide services to these children in the Central Region, the Keystone Health Plan West (KHPW) managed care network in the 29-county Western Region, and the First Priority Health (FPH) managed care network in the 13-county Northeastern Region. Members enrolled in CHIP after July 1, 2022, are enrolled in the Highmark Healthy Kids (CHIP) HMO network.

Prescription drugs are provided using the National Network. Vision coverage is administered by Davis Vision and dental coverage is provided by United Concordia’s network.

PROMISe™ ID Enrollment Required

Providers are required to complete a PROMISe™ ID enrollment application with Pennsylvania’s Department of Human Services (DHS) and obtain a PROMISe ID to provide services to Highmark Healthy Kids (CHIP) enrollees and receive reimbursement.

For more information about this requirement, please see the Highmark Provider Manual’s Chapter 3, Unit 1: Network Participation Overview.

Payment Directly to Participating Providers

As with our commercial group programs, Highmark pays providers in our Premier Blue Shield, KHPW, and FPH network (members enrolled in CHIP prior to July 1, 2022) and Highmark Healthy Kids (CHIP) HMO network (members enrolled after July 1, 2022) directly, and they agree to accept our payments as payment-in-full for covered services.

Highmark sends payments for services of out-of-network providers directly to the child’s parents, who are responsible for paying the charges. Out-of-network providers are not obligated to accept Highmark’s payment as payment in full. It is critical in all cases that enrollees check the network status of their provider.*

Note: Highmark will deny any claims from providers who have not completed enrollment with Pennsylvania’s DHS and obtained a valid PROMISe ID.

For more information about CHIP payment, please see the Highmark Provider Manual's Chapter 6, Unit 7: Payment/EOBs/Remittances.

*Does not apply to emergency care.

Eligibility Requirements for Highmark Healthy Kids (CHIP)

The Department of Human Services (DHS) performs eligibility and enrollment functions for children with Highmark Healthy Kids (CHIP) coverage. The Individual Markets area performs marketing and outreach for CHIP to locate children and educate the community about the CHIP program. Children must meet these eligibility guidelines:

- Be a resident of Pennsylvania prior to applying for this coverage (except newborns);

- Be a U.S. citizen, a permanent legal alien, or a refugee as determined by the U.S. Immigration and Naturalization Service;

- Be under age 19;

- Not be covered by any health insurance plan, self-insured plan, or self-funded plan and not be eligible for or covered by Medical Assistance offered through the Department of Human Services or other governmental health insurance;

- Be eligible based on family size and income*;

- For all new applicants whose annual income falls in the Low-Cost and Full-Cost CHIP ranges, they must show that the child has lost health insurance because a parent lost their job, or the child is moving from another public insurance program (not applicable if the child is under the age of two); and

- Full-Cost CHIP families must also show that access to coverage is unavailable and unaffordable.

*Depending on income levels, children may be eligible for either Free or Low-Cost CHIP insurance. If eligible for Low-Cost or Full-Cost CHIP insurance, families will be required to pay a monthly premium for their child’s health insurance (as well as some copays).

PH-95 Eligibility for Medical Assistance

In Pennsylvania, children under the age of 18 with certain disabilities or special health needs may qualify for Medical Assistance (also known as Medicaid), regardless of parental income. This eligibility is called PH-95, “Children with Special Needs.” The Pennsylvania Department of Human Services requires Highmark to review billing and claims management information to identify any child that may be potentially eligible for PH-95 Medical Assistance.

Each child identified with certain special health conditions that would likely qualify for Medicaid PH-95 Program will be sent to the treating provider for completion of a Physician Certification for Child with Special Needs form. These forms will be sent via fax.

If a child is identified as eligible for Medical Assistance per PH-95, the child will be referred to the Central Unit at County Assistance where the information will be reviewed, and a determination made.

To complete the Physician Certification for Child with Special Needs form:

- The certification must be completed by a psychologist, physician, or medical professional under the physician’s supervision and authority (e.g., physician assistant or certified nurse practitioner).

- The treating physician must note if the child is not considered disabled at all; temporarily disabled for less than 12 months; temporarily disabled for MORE than 12 months; or permanently disabled.

- The date, name of each diagnosis (the ICD-10 code and the description), and any functional limitations and their impacts must be supplied.

- The form must be signed by the treating physician.

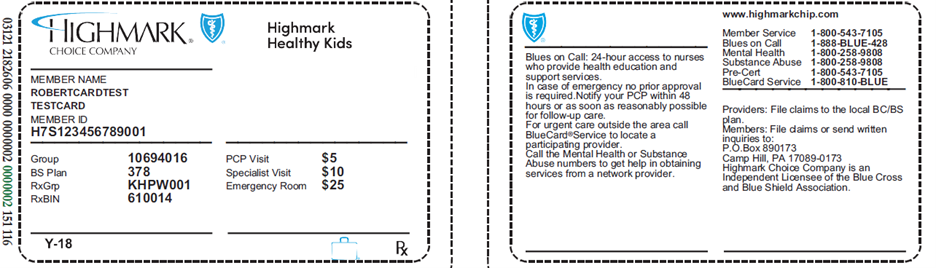

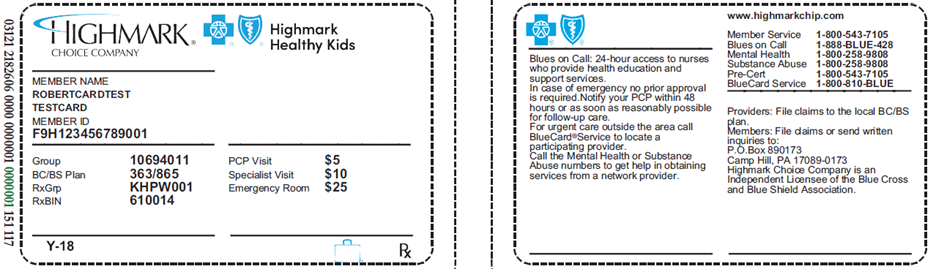

Highmark Healthy Kids (CHIP) ID Cards

A child enrolled in CHIP will have a Highmark Choice Company and Highmark Healthy Kids insurance card as any commercial or group member. The symbol “Y-18” will appear on ID cards for CHIP enrollees. It can be found in the bottom left-hand corner on the front of the card. You may use Availity to determine eligibility, coverage, and claim status.

Central PA Region

Western and Northeastern PA Regions

CHIP benefits are offered through an HMO product utilizing the PA CHIP Network.

IMPORTANT! PCP required

All Highmark Healthy Kids (CHIP) enrollees must select a PCP to manage their care.

Enrollees are encouraged to select a PCP within 10 days of enrollment in CHIP. If a PCP is not chosen, a PCP will be assigned. Enrollees can change the PCP assignment at any time.

Effective Oct. 1, 2024, the assigned PCP will no longer appear on the member ID card.

Information for PCPs of Highmark Healthy Kids (CHIP) Enrollees

Since the CHIP products offered in the Western, Central, and Northeastern Regions are managed care products, all CHIP enrollees must select a PCP to coordinate their care. All Act 146 and Managed Care regulations, including complaint and grievance rights, apply to the HMO product in PA.

Highmark Healthy Kids (CHIP) enrollees will have an identification card with the Highmark Healthy Kids in the upper right corner (see ID card samples above).

Although CHIP enrollees are required to select a PCP to oversee their care, traditional “referrals” are not required. If it is necessary to recommend that a CHIP enrollee see a specialist or other provider, PCPs should make every attempt to refer enrollees to providers within the network with a valid PROMISe ID.

Enrollees must use Highmark Healthy Kids (CHIP) HMO network providers to receive 100 percent coverage unless the non-emergency covered benefits are not available within the network and are pre-authorized by Highmark.

Member Rights and Responsibilities for CHIP enrollees are available in the Highmark Provider Manual Chapter 1 Unit 5: Member Rights and Responsibilities.

Accessibility Expectations for Highmark Healthy Kids (CHIP) Providers

To stay healthy, Highmark members must be able to see their physicians when needed. To support this goal, Highmark sets expectations for accessibility of primary care physicians (PCPs), medical specialists, behavioral health specialists, and obstetricians.

In addition, the Department of Human Services has set standards for specific time frames in which network providers should respond to Highmark Healthy Kids (CHIP) enrollee needs based on symptoms. Please note that some standards for CHIP enrollees may differ from those Highmark sets for commercial members.

|

Highmark Healthy Kids (CHIP) PCP and Medical Specialist Expectations |

|---|

Patient’s Need: |

Performance Standard: |

Emergency/life-threatening care Sudden, life-threatening symptom(s) or condition requiring immediate medical treatment (e.g., chest pain, shortness of breath) |

|

PCP urgent care appointments An urgently needed service is a medical condition that requires rapid clinical intervention due to an unforeseen illness, injury, or condition (e.g., high fever, persistent vomiting/diarrhea) |

|

PCP regular, non-urgent sick appointments Non-urgent but in need of attention appointment (e.g., headache, cold, cough, rash, joint/muscle pain) |

|

PCP initial health assessment or routine physical Routine wellness appointments

Subsequent routine appointments Progress follow-up, ongoing treatment for an injury or condition, laboratory blood draw, additional screening, medication management, testing, etc. |

|

PCP follow-up visits |

|

Specialist emergent care Any sudden, life-threatening symptom(s) or condition requiring immediate medical treatment |

|

Specialist urgent care appointments Urgent medical condition |

|

Specialist routine care appointments Routine care appointments for the following specialty types:

All other specialty provider types. |

|

Specialist follow-up visits |

|

Persons with HIV/AIDS initial routine care PCPs and specialists are to have scheduling procedures in place to allow for scheduling of appointments for enrollees whom Highmark identifies at enrollment to be HIV positive or diagnosed with AIDS. |

|

After-hours care Access to practitioners after the practice’s regular business hours. |

Acceptable process in place to respond 24 hours per day, 7 days a week to enrollee issues:

|

In-office waiting times

|

|

|

Highmark Healthy Kids (CHIP) Obstetrics and Gynecology (Ob/Gyn) and Maternity Care Expectations |

|---|

Patient’s Need: |

Performance Standard: |

Ob/Gyn or Maternity emergency |

|

Ob/Gyn or Maternity urgent care |

|

Ob/Gyn or Maternity initial routine care |

|

Ob/Gyn or Maternity subsequent, regular routine visits |

|

Ob/Gyn or Maternity follow-up visits |

|

Maternity first trimester – initial prenatal care |

|

Maternity second trimester – initial prenatal care |

|

Maternity third trimester – initial prenatal care |

|

Maternity high-risk – initial prenatal care |

|

|

Highmark Healthy Kids (CHIP) Behavioral Health Provider Expectations |

|---|

Patient’s Need: |

Performance Standard: |

Care for a life-threatening emergency Immediate intervention is required to prevent death or serious harm to patient or others. |

|

Urgent care Timely evaluation is needed to prevent deterioration of patient condition. |

|

Care for a non-life-threatening emergency Rapid intervention is required to prevent acute deterioration of the patient’s clinical state that compromises patient safety. |

|

Initial routine behavioral health office visit Patient’s condition is considered to be stable. Physical and behavioral health assessments, general physical examination, and first examination must be scheduled within 3 weeks of enrollment. |

|

Regular, subsequent routine appointments Ongoing mental health treatment for an addiction or mental health disorder, care intended to stabilize, sustain, and facilitate the member's recovery. |

|

Behavioral health follow-up visits |

|

After-hours care Access to practitioners after the practice’s regular business hours. |

Acceptable process in place to respond 24 hours per day, 7 days a week to enrollee issues:

|

In-office waiting times

|

|

Acceptable After-Hours Methods

The chart below outlines acceptable methods of handling after-hours calls from your Highmark Healthy Kids (CHIP) patients.

|

Answering Process |

Response/Message |

Comments |

|---|

Answering Service or Hospital Service |

Caller transferred directly to physician. |

|

Service pages the physician on call (see comments). |

A physician or clinical staff person is expected to return the call within 30 minutes. |

|

Answering Machine |

Message must provide the caller with a way to reach the physician on call by telephone or pager. |

Provide clear instructions on how to record a message on a pager (i.e., “you will hear a series of beeps, please enter your phone number, including area code, by pressing the number keys on your phone, then hang up”). A physician or clinical staff person is expected to return the call within 30 minutes. |

Instruct caller to leave a message (see comment). |

A physician or clinical staff person is expected to return the call within 30 minutes. |

Outreach Following Missed Appointments

PCPs and specialists must conduct affirmative outreach whenever a Highmark Healthy Kids (CHIP) enrollee misses an appointment. Three attempts to contact the enrollee must be made and documented in the enrollee’s medical record.

Attempts to contact the enrollee may include but are not limited to: written attempts; telephone calls; and home visits. However, at least one attempt must be a follow-up telephone call.

Preventive Services

Highmark Healthy Kids (CHIP) follows the Highmark Preventive Health Guidelines. This schedule is reviewed and updated periodically based on the advice of the American Academy of Pediatrics (AAP) and Bright Futures™, the U.S. Preventive Task Force, the Blue Cross and Blue Shield Association, and medical consultants. Accordingly, the frequency and eligibility of services is subject to change.

Highmark’s Preventive Health Guidelines are available on the Provider Resource Center. Select Resources & Education from the main menu. You'll find Preventive Health Guidelines under Clinical Quality & Education.

The Bright Futures periodic screens must be conducted for all eligible CHIP enrollees to identify health and developmental problems. These screens must be in accordance with the most current periodicity schedule and recommended pediatric immunization schedules based on guidelines issued by the AAP and Centers for Disease Control and Prevention (CDC).

To view the current periodicity schedule, click on the following link: Bright Futures Periodicity Schedule

Over-The-Counter (OTC) Allergy Medications

Highmark Healthy Kids includes certain OTC allergy medications. The medications require a prescription from the physician to be covered at no cost to the member. The list of covered drugs is on HighmarkCHIP.com on the CHIP Resources page. Use this link and then type in the member’s ZIP Code. This drug list is subject to change at any time.

Blood Lead Levels Testing

Pediatric preventive care must include blood lead levels testing of all children at ages one and two years old. In addition, blood lead level tests must be completed for all children aged three through six without a confirmed prior lead blood test consistent with current Pennsylvania Department of Health and Medical Assistance program requirements.

The following requirements/procedures apply for lead blood tests for Highmark Healthy Kids (CHIP) enrollees:

- The lead blood test must be performed by a laboratory that participates in the PA CHIP network.

- The lead blood test can be performed with the routine hemoglobin test for anemia at 12 months, per Bright Futures; or, one finger stick can be completed for both the hemoglobin and lead tests without a blood draw.

- You must submit claims for both the hemoglobin and lead blood tests if they are performed together.

- The lead blood test is reimbursable if submitted using procedure code 83655.

- There is no out-of-pocket cost to members for lead blood tests.

IMPORTANT: You must submit the claim with the date that the lead blood test was performed along with the results of the test.

Developmental Screenings

Developmental screenings can assist in early detection and intervention of autism, learning disabilities, and developmental delays. Currently, providers who care for CHIP enrollees are required to perform developmental screenings for patients according to AAP guidelines for annual screening of children three years of age and younger for developmental disabilities.

The following requirements/procedures apply for developmental screenings for CHIP enrollees:

- You can perform developmental screenings during well-child visits.

- You must submit claims for both the developmental screening and the well-child visit if you perform the developmental screening during a well-child visit.

- Developmental screenings are reimbursable if submitted using procedure code 96110.

- There is no out-of-pocket cost to enrollees for developmental screenings.

Maternal Depression Screening

Highmark Healthy Kids (CHIP) policy requires that maternal depression screening is covered per the Bright Futures Periodicity Schedule and CMS.

- Screening may be done in the PCP or pediatrician’s office as part of the well-child visit and covered under the child’s benefit when screening is for the direct benefit of the child.

- Validated screening tools specific to maternal depressions screening, such as the Edinburgh Postnatal Depression Scale or Post-Partum Depression Screening Scale, must be used.

- Claims for maternal depression screening under the child’s benefit are to be submitted with procedure code 96161 with diagnosis codes that designate screening is done for the welfare of the child.

- There is no out-of-pocket cost to enrollees for maternal depression screening performed as a preventative service as part of the well child visit.

Mental Health Assessments

If a PCP determines that a mental health assessment is needed, the PCP must inform the enrollee, or enrollee’s parent or legal guardian, on how to access these mental health services and coordinate access to these services, when necessary.

Authorization Requirements

Authorization for select services is required for the Highmark Healthy Kids (CHIP) HMO products.

The following services require authorization for CHIP enrollees:

- All inpatient admissions including mental health/substance abuse.

- Any service that may potentially be considered experimental/investigational or cosmetic in nature.

- Home health services.

- Selected injectable and specialty tier program drugs.

- Non-emergency outpatient advanced imaging and cardiology services (coordinated by eviCore healthcare)*.

- Durable medical equipment (DME) and orthotics and prosthetics.

- Highmark’s list of outpatient procedures requiring authorization (available on the Provider Resource Center under Claims & Authorization. Click on Obtaining Authorization).

*For more information, please see the manual’s Chapter 4 Unit 5: Outpatient Radiology and Laboratory.

The following are some examples of services on Highmark’s list of outpatient procedures requiring authorization:

- Diabetes education.

- Enteral formula.

- Nutritional counseling (except for the treatment of diabetes).

- Non-emergency mental illness and substance abuse treatment services.

- Outpatient surgical services.

- Respiratory and cardiac rehabilitation therapy.

CHIP Special Needs and Case Management

CHIP coverage includes a comprehensive, community-based, care coordination program for children with special health care needs or chronic conditions. Nurses and other health care staff work directly with Highmark Healthy Kids (CHIP) enrollees and their parents/guardians to help them understand their child’s medical condition and treatment; coordinate services among physicians; help them locate and receive the services available to meet their child’s needs; provide them with educational materials; and link to the community resources that can help their family.

For questions regarding the program, please call 866-823-0892 Monday through Friday, 8:30 a.m. to 4:30 p.m. EST. If outside of business hours, please leave a message. All calls are returned within two business days.

Information regarding the program can also be accessed here by entering your ZIP code to access the Highmark Healthy Kids (CHIP) program page for your service area. Select CHIP Resources and CHIP Special Needs and Case Management from the menu on the left for access to more detailed information about the program.

Pediatric Disease Management Program

Highmark offers a pediatric disease management program to assist Highmark Healthy Kids (CHIP) enrollees with four targeted conditions: diabetes, asthma, obesity, and tobacco use - prevention and cessation.

The program is designed to reinforce the physician’s treatment plan for the patient. Its goal is to proactively engage these enrollees and their families for better understanding of their conditions and, with assistance from Highmark Case Management staff, to help them manage their disease.

All children enrolled in Highmark Healthy Kids (CHIP) through Highmark who are identified as having diabetes, asthma, obesity, or using tobacco are automatically registered as participants in the disease management program.

The program will provide the following services to Highmark Healthy Kids (CHIP) enrollees and their families:

- Support from Highmark case management nurses and other health care staff to better manage their condition and periodically evaluate their health status;

- Educational and informational materials to assist them in understanding and managing the medications prescribed by their doctors; and

- Assistance in effectively planning for office visits with their physicians and reminders as to when those visits should occur.

The Highmark Case Management staff will notify a physician’s office by letter or a telephone call to inform them when any of their CHIP patients are enrolled in the program. The assistance in care coordination and communication among the various entities involved in the child’s care will be of benefit to the physician as well. Since membership in the program is voluntary, the CHIP enrollee who wishes to stop participating in the program can do so with a telephone call. To discuss a CHIP patient’s involvement in the program, please contact us at 866-823-0892.

Highmark Healthy Kids (CHIP) Benefits and Services

CHIP covers a wide range of benefits and services, including medical care, prescription drugs, and dental and vision services. Except for emergency care and emergency ambulance services, benefits are provided only for services performed by a network provider with a valid PROMISe ID.

Commonly used CHIP medical benefits are outlined here. For detailed benefit information, please verify a CHIP enrollee’s medical coverage via Availity® Eligibility and Benefits prior to rendering services.

|

Medical Benefits |

|

|---|---|

|

Ambulance Services |

Precertification required for non-emergent only |

|

Hospital Services |

Inpatient Care - Pre-admission review required:

Outpatient Services:

|

|

Maternity |

|

|

Medical Visits |

|

|

Mental Health |

|

|

Preventive Care (Follows the Highmark Preventive Schedule) |

Includes the following, with no cost sharing or copays:

|

|

Private Duty Nursing |

Requires Precertification |

|

Substance Abuse |

|

|

Surgical Services |

|

|

Habilitative Services |

Limited to a total of 30 outpatient visits for each type of service per benefit period. This limit does not apply when services for habilitative purposes are prescribed for the treatment of mental illness or substance abuse. |

|

Therapy and Rehabilitative Services |

|

|

Other Medical Services |

|

|

Other Highmark Health Kids (CHIP) |

Covered Services |

|---|---|

|

Dental (administered by United Concordia) |

The dental plan for CHIP enrollees meets the Minimum Essential Health Benefits requirements for pediatric oral health as required under the federal Affordable Care Act. |

|

Hearing |

|

|

Prescription Drugs |

|

|

Vision |

*Davis Vision network providers accept reimbursement as payment in full for standard services. Non-Davis network providers are reimbursed at an out-of-network fee schedule. |

Highmark Healthy Kids (CHIP) Claims Submission

All claims, except dental and vision claims, should be submitted just like any other Highmark Blue Shield claim. They may be submitted electronically or on a paper claim form. Please note that in all cases, the child is the enrollee. Report “Patient’s relationship to insured” as “self.” Do not report the name of the parent.

Electronic claims are preferred. However, if necessary, paper claims can be submitted to the following addresses:

Central Region:

Highmark Blue Shield

P.O. Box 890173

Camp Hill, PA 17089-0173

Western and Northeastern Regions:

Highmark Blue Shield

P.O. Box 898819

Camp Hill, PA 17089-8819

Dental

United Concordia Companies, Inc.

Claims Processing

P.O. Box 69421

Harrisburg, PA 17106-9421

Routine Vision

Davis Vision

Vision Care Claims Unit

P.O. Box 1501

Latham, NY 12110

Timely Filing

The Pennsylvania Children’s Health Insurance Program (CHIP) requires providers to submit all claims for services provided to Highmark Healthy Kids (CHIP) enrollees to Highmark within 180 days from the date of service or discharge.

Complaints and Grievances

Under Pennsylvania CHIP, an enrollee or enrollee’s representative, which may include the enrollee’s provider, may file a complaint or grievance. For detailed information, please see the CHIP section in the Highmark Provider Manual Chapter 5 Unit 5: Denials, Grievances, & Appeals.

FQHC/RHC Payment and Claim Submission

Section 503 of the Children’s Health Insurance Program Reauthorization Act of 2009 (CHIPRA) requires payment for services provided by Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHCs) to be at least equivalent to Medicaid Prospective Payment System (PPS) rates for all CHIP encounters. The PPS rates are all-inclusive rates for encounter services provided, except for vaccine services.

For more information, including claim submission guidelines, please see the Highmark Provider Manual Chapter 6 Unit 7: Payment/EOBs/Remittances.

Highmark Healthy Kids (CHIP) Enrollment

If you know of children who may qualify for this program, please refer them to the appropriate telephone number for the Highmark CHIP Administrative Unit (PA Western, Central, and Northeastern Regions):

800-KIDS-105 (800-543-7105); TTY Service: Dial 711

For more information on CHIP, please visit Pennsylvania’s “We Cover All Kids” website

All federal government employees and qualified retirees are entitled to health insurance benefits under the Federal Employees Health Benefits (FEHB) Program. The FEHB allows insurance companies, employee associations, and employee unions (e.g., the National Association of Letter Carriers) to develop plans to be marketed to government employees.

Federal employees are given a wide range of insurance options, from catastrophic coverage plans with high deductibles to health maintenance organizations (HMOs). Some plans are offered nationwide while others are regionally-available plans. The number of choices for individual employees varies based on where they reside.

The Blue Cross Blue Shield Association (BCBSA) fee-for-service plan is offered to federal employees nationwide. The Federal Employee Program (FEP), also known as the Service Benefit Plan, has been part of the FEHB Program since its inception in 1960. More than 50 percent of all federal employees and retirees nationwide have chosen to receive their healthcare benefits through FEP. These subscribers and their families receive health coverage through the local Blue Plan where they reside.

FEP Benefit Plan Options

Federal employees have traditionally been offered two Preferred Provider Organization (PPO) benefit packages nationally through FEP -- Standard Option and Basic Option. The same types of services are covered under both options, but at different payment levels. Additionally, FEP includes the FEP Blue FocusSM option.

- Standard Option PPO allows FEP members to seek covered services from both network participating and non-participating providers. When members use participating PPO providers, their out-of-pocket expenses, such as coinsurance and copayment amounts, will be less.

- Basic Option PPO has a lower premium than Standard Option and no deductibles, but members must use participating preferred providers to receive benefits.

- FEP Blue Focus is also a PPO product that uses the same network as the Standard and Basic options with no out-of-network benefits, except in certain situations such as emergency care. The “Core” benefits, which provide coverage for all the essentials of good preventive health, are the base of the program. The Core benefits are covered at little or no cost to members when they use network providers.

The benefits under FEP Blue Focus are divided into three key categories: Core, Non-core, and Wrap. These categories describe the cost share the member will pay based on the services used.

- Core benefits, the base of the program, have a low or no copayment and are not subject to a deductible or coinsurance. These benefits are most commonly used to receive general care and to maintain overall health and well-being, in addition to coverage for accidental injuries.

Copays under the Core benefits are ten dollars ($10) per visit for the first 10 visits for a primary care provider, specialist, or other health care provider, such as a mental health doctor. Each member on the subscriber’s coverage receives 10 visits per calendar year.

On the eleventh visit in the calendar year, the member’s cost-sharing will change to include the plan’s deductible and 30 percent coinsurance. Preventive care visits, such as an annual physical, do not count toward the 10-visit limit and are at no cost to members.

- Non-core benefits provide coverage for any unexpected medical costs that may occur during the calendar year. All these services are subject to an annual deductible and coinsurance. When the catastrophic out-of-pocket maximum is met, then services for the remainder of the calendar year are paid at 100 percent of the Plan allowance for services.

- Wrap benefits provide the final layer of protection and complete, or “wrap-up,” the FEP Blue Focus benefit package. These are benefits that members may or may not have a need to use during the year. These benefits have visit limitations and/or different copayments or coinsurance than the Core and Non-core benefit levels. The calendar year deductible does not apply to these benefits.

FEP Blue Focus does not provide benefits for some services that are covered under the Standard and Basic options, such as routine dental care. A complete list of benefit exclusions is available at fepblue.org. The appeals process for FEP Blue Focus is the same as for the Standard and Basic options.

IMPORTANT! It is important to note that additional services require prior authorization under FEP Blue Focus that do not require prior authorization under the Standard and Basic options.

For prior authorization requirements for all FEP products, including a list of services requiring prior authorization, please see the Highmark Provider Manual Chapter 5 Unit 2: Authorizations.

For a full list of services that require prior authorization, go the Provider Resource Center main menu at the top of the page, click Claims & Authorization, then Authorization Guidance, and then Obtaining Authorizations.

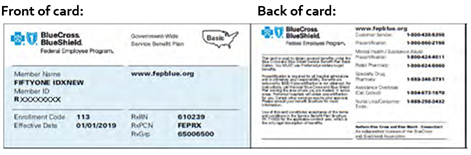

Identifying FEP Members

Members who are part of the Blue Cross Blue Shield Association’s Federal Employee Program (FEP) can be identified by the following:

- The letter "R" in front of their member ID number instead of a three letter alpha prefix.

- The BlueCross BlueShield Federal Employee Program logo on their ID card.

- The FEP Blue Focus ID card has a thin blue border around the perimeter, which distinguishes it from the Standard Option card, which has a solid white border, and the Basic Option card, which has a shaded blue front.

Note: Only the primary card holder’s name will appear on the ID card.

Sample: Standard Option ID card

SAMPLE: Basic Option ID card

Sample: FEP Blue Focus ID card

Verifying Eligibility & Benefits

Eligibility and benefits can be verified through Availity for FEP members residing in Delaware, New York, Pennsylvania, and West Virginia.

For out-of-state FEP members or FEP members in Highmark’s service areas, if Availity is not available, please call the appropriate FEP Provider Service department:

- Delaware: 800-721-8005

- New York: 800-234-6008

- Pennsylvania: 866-763-3608

- West Virginia: 800-535-5266

Delaware, Pennsylvania, and West Virginia hours: 8:30 a.m. to 5 p.m. EST, Monday through Friday

New York hours: 8:30 a.m. to 5 p.m. EST, Monday through Thursday; and 9 a.m. to 5 p.m. EST on Friday

Claim Submission

Claims for FEP members should be submitted to the local Blue Plan where services were rendered. Each local Plan is responsible for processing and paying claims for services received within that area. Highmark participating providers should submit all claims for FEP members to Highmark, except for the following:

- Lab providers should file FEP claims in the state where the lab tests were performed, not where the specimen is drawn. The provider locations are determined by the mailing address.

- DME providers should file FEP claims in the state where the provider is located, not where the DME supplies are delivered. The provider locations are determined by the mailing address.

- Facilities (UB/837I billers) must submit claims for FEP members to their local Blue Cross plan.

- In Pennsylvania, Highmark is the Blue Cross licensee in the Western and Northeastern Regions, therefore, facilities in those service areas would submit claims for FEP members to Highmark. However, in the Central and Eastern Regions, where other Blue Plans hold the Blue Cross licensing for the service areas, facilities must submit claims for FEP members to those Blue Cross plans (Capital Blue Cross in the Central Region; Independence Blue Cross in the Eastern Region).

- Since Highmark is the only Blue Cross Blue Shield licensee in Delaware and in West Virginia, facilities located in Highmark Blue Cross Blue Shield (DE) and Highmark Blue Cross Blue Shield (WV) service areas will always submit claims for FEP members to their local Highmark plan.

For special tips on professional claim submission for FEP members, please see the section on FEP Processing in the Highmark Provider Manual Chapter 6 Unit 4: Professional (1500/837P) Reporting Tips.

For more information on the Blue Cross Blue Shield Federal Employee Program, please visit fepblue.org

Highmark Blue Cross Blue Shield (WNY) offers Medicaid, Health and Recovery Plan (HARP), Child Health Plus (CHP), and effective Jan. 1, 2025, Essential Plan in our western New York service area. For more information, please review the associated Medicaid and CHP Provider Manual.

The following entities, which serve the noted regions, are independent licensees of the Blue Cross Blue Shield Association: Western and Northeastern PA: Highmark Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Choice Company, Highmark Health Insurance Company, Highmark Coverage Advantage Inc., Highmark Benefits Group Inc., First Priority Health, First Priority Life, Highmark Care Benefits Inc., or Highmark Senior Health Company. Central and Southeastern PA: Highmark Inc. d/b/a Highmark Blue Shield, Highmark Benefits Group Inc., Highmark Health Insurance Company, Highmark Choice Company or Highmark Senior Health Company. Delaware: Highmark BCBSD Inc. d/b/a Highmark Blue Cross Blue Shield. West Virginia: Highmark West Virginia Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Health Insurance Company or Highmark Senior Solutions Company. Western NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Cross Blue Shield. Northeastern NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Shield.

All references to “Highmark” in this document are references to the Highmark company that is providing the member’s health benefits or health benefit administration and/or to one or more of its affiliated Blue companies.

All revisions to this Highmark Provider Manual (the “manual” or “Highmark Provider Manual”) are controlled electronically. All paper copies and screen prints are considered uncontrolled and should not be relied upon for any purpose.