Unit 1: Product Overview

Highmark and its affiliates operate health insurance plans in Delaware, New York, Pennsylvania, and West Virginia. We offer a variety of health insurance plans in these service areas that are supported by our provider networks.*

Through its various product offerings, Highmark serves a wide array of large and small businesses, governmental agencies, individuals, and retirees.

All covered services are subject to specific benefit exclusions that are governed by the terms of the applicable contract and medical policy in effect at the time services are performed and are subject to change without prior notice.

*Please see Chapter 3 Unit 1: Network Participation Overview for information about Highmark’s provider networks and to learn how to participate in the networks.

**Medicare Advantage will not be addressed in this unit. Please see Chapter 2 Unit 2: Medicare Advantage Products & Programs for information on Medicare Advantage.

Highmark's Corporate Entities

Highmark is licensed to offer products under various corporate entities in Delaware, New York. Pennsylvania, and West Virginia. These corporate entities include, but may not be limited to, the following:

- Highmark Blue Cross Blue Shield (DE): Serving the entire state of Delaware.

- Highmark Blue Shield (NENY): Serving 13 counties of Northeastern New York.

- Highmark Blue Cross Blue Shield (WNY): Serving 8 counties of Western New York.

- Highmark Blue Cross Blue Shield (PA): Serving Western and Northeastern Pennsylvania.

- Highmark Blue Shield (PA): Serving Central Pennsylvania, the Lehigh Valley, and 5 counties in Southeastern Pennsylvania.

- Highmark Blue Cross Blue Shield (WV): Serving all of West Virginia.

- Highmark Choice Company: Serving the Western, Central, and Northeastern Regions of Pennsylvania.

- Highmark Health Insurance Company: Serving Western and Central Pennsylvania and the Lehigh Valley.

- Highmark Coverage Advantage: Serving Western Pennsylvania.

- Highmark Benefits Group: Serving Central Pennsylvania and the Lehigh Valley.

- Highmark Select Resources: Serving Central Pennsylvania and the Lehigh Valley.

- Highmark Senior Health Company: Serving Pennsylvania’s Western, Central, and Northeastern Regions.

- Highmark Senior Solutions Company: Serving West Virginia.

Reminder: Always verify benefits.

In response to rising health costs, more customers are choosing health plans that require their employees to have more cost-sharing. These plans include higher deductibles, copayments, and/or coinsurance. Be sure to verify a member’s benefits and cost-sharing obligations at the time they receive services from you. Specific member information can be found on Availity®.

What We Mean by Program and Product

When used in this manual, program and product have approximately the same meaning, but somewhat different usage. They both refer to the patient’s type of insurance coverage. They help to differentiate the types of insurance coverage, especially under a single insurance company.

- Program refers to the type of coverage (e.g., HMO, PPO, EPO, POS)

- Product refers to the brand name of the program (e.g., Freedom Blue PPO, PPO Blue, Connect Blue, BlueCare Custom PPO).

Essential Health Benefits

Essential Health Benefits are defined as a set of health care services that must be covered by certain health plans -- such as Highmark. The Affordable Care Act (ACA) ensures that health plans offer coverage that includes the following essential health benefits:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services

- Chronic disease management

- Pediatric services, including oral and vision care

Highmark, and all insurance carriers, must include coverage for essential health benefits in order to be certified and offer products through the Health Insurance Marketplace.

Medicare Advantage Products

Medicare Advantage plans are available for individuals who are enrolled in both Medicare Part A and Part B.

For information on Medicare Advantage plans, please see Chapter 2 Unit 2: Medicare Advantage Products & Programs.

Partnership Products

Highmark recognizes that there are specific differences between the various regions that we serve; therefore, different strategies are being used to allow members to receive high quality care through lower-cost facilities within their communities.

In Pennsylvania, Highmark has partnered with certain hospitals, health systems, and independent providers to develop products that offer a variety of benefit structures and tiering options. These products are available in select counties served by these providers and include, but are not limited to, the following:

- Community Blue Flex Pennsylvania Mountains Healthcare Alliance

- Community Blue Flex Penn Highlands Region (available in the four-county Penn Highlands Region of western Pennsylvania)

- Lehigh Valley Flex Blue (Lehigh Valley Health Network [LVHN])

Managed care programs integrate the delivery and financing of medical care. The programs offer health care coverage through a network of contracted physicians who provide care to people who subscribe to the plan called members.

Managed care programs provide preventive coverage to members and use its network of physicians to assist in determining the appropriateness and the efficiency of the members’ care to promote and maintain good health while conserving resources.

Highmark currently offers the following types of managed care programs:

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service (POS) and Open Access Programs

- Health Maintenance Organizations (HMOs)

- Independent Practice Associations (IPAs)

The following terms are commonly used in reference to managed care programs:

Authorization: The official acknowledgement from Highmark that services/items requested meet the definition of “medically necessary and appropriate.”

Covered Services: Those medically necessary and appropriate services and supplies that are provided as part of a benefit plan.

Exclusions: Items or services that are not covered as part of a benefit plan.

Primary Care Physician (PCP): PCP is a practitioner selected by a member in accordance with the member’s managed care program requirements. The practitioner provides, coordinates, or authorizes the health care services covered by the managed care program. The PCP may be a general practitioner, family practitioner, internist, pediatrician, or certified registered nurse practitioner (CRNP).

Preferred provider organization (PPO) programs typically offer members the ability to obtain care from a network participating provider at the higher in-network level of benefits and without the requirement to select a primary care physician (PCP).

PPO plans are offered in all of Highmark’s service areas in Delaware, New York, Pennsylvania, and West Virginia.

Outpatient Authorization Requirements

Highmark’s list of outpatient procedures/services requiring authorization apply to PPO products. These are the same authorization requirements that apply to other Highmark products (such as HMO and Medicare Advantage products).

The List of Procedures/DME Requiring Authorization is available on the Provider Resource Center by selecting Claims & Authorization from the top menu and then Obtaining Authorization.

General Characteristics of PPO Programs

PPO programs are generally characterized by the following:

- Benefits are offered at two levels (in-network and out-of-network) with the higher level of benefits received by using network participating providers. Some programs offer tiering at the in-network level of benefits, based on which providers render service.

- Members are usually not required to select PCPs to coordinate their care.

- Members can seek care without referrals.

- All practitioners are paid fee-for-service for care rendered to PPO members.

Note: See specific benefit details for the Medicare Advantage PPO products which vary from traditional PPOs.

In-Network and Out-of-Network Reimbursement

Payments made under PPO programs are based on the lesser of the applicable Highmark fee schedule allowance or the provider’s charge.

PPO programs provide higher-level reimbursement for services received from in-network providers and lower-level reimbursement for services received outside the network.

Network providers agree to accept Highmark’s allowance as payment in full for covered services, and to collect applicable co-payments, coinsurance and/or deductible amounts from their patient.

Network Providers for Delaware PPO Programs

Highmark Blue Cross Blue Shield (DE)'s provider network, which spans the state of Delaware supports the PPO products. This extensive network, the largest in the state, provides PPO members with access to leading health care professionals in all specialties and to all hospitals in the state.

In addition, ancillary providers in the network include, but are not limited to, suppliers of durable medical equipment, orthotics and prosthetics, home infusion therapy, and ambulance transportation.

Network Providers for New York PPO Programs

This extensive network provides PPO members with access to leading health care professionals in all specialties and to hospitals across all 200 networks in Highmark Blue Cross Blue Shield (WNY) and 200+ networks in Highmark Blue Shield (NENY). We also contract with ancillary providers, which include, but are not limited to, suppliers of durable medical equipment, orthotics and prosthetics, home infusion therapy, and ambulance transportation.

Payments made under PPO programs are based on the terms of each provider’s contract as it relates to the service rendered. PPO programs provide reimbursement for services received from network providers at the in-network fee schedule rate and reimbursement for services received outside the network at the out-of-network fee schedule rate. The percentage of member coinsurance for in-network and out-of-network services is determined by the specific member contract.

Network Providers for Pennsylvania PPO Programs

The foundation of PPO programs is the network. In the Central Region of Pennsylvania, the Premier Blue Shield network of preferred professional providers is located in the 21 counties of central Pennsylvania and the Lehigh Valley. Also included in the network are institutional and ancillary providers that contract with Highmark Blue Shield (PA) in this region. The Premier Blue Shield network also serves Highmark members with PPO plans in the Northeastern Region. In the 29 counties of western Pennsylvania, members have access to an additional network of professional, institutional, and ancillary providers. These providers will be reimbursed at the higher benefit level for covered services.

In addition, PPO products are available in Pennsylvania that use the select Community Blue networks and are designed to provide an affordable choice for customers seeking quality, lower-cost coverage and to encourage members to use hospitals and physicians who offer high quality and efficient care.

Also available are Community Blue Flex plans that give members two levels of in-network benefits, an “Enhanced Value Level” and a “Standard Value Level,” to let them choose the providers who will give them the most for their health care dollars. With Community Blue Flex, health care professionals and hospitals are grouped into two levels of in-network benefits. What the member pays for care is based on the level of benefits they choose. The plans give members more control over their health care costs.

Note: In Pennsylvania’s Central Region, the Premier Blue Shield network of preferred professional providers provides high-level access for out-of-area Blue Plan PPO members through BlueCard. The Keystone Health Plan West (KHPW) managed care network supports BlueCard PPO programs in the 29-county Western Region of Pennsylvania.

Network Work Providers for West Virginia PPO Programs

Highmark Blue Cross Blue Shield (WV)'s provider network is the basis for the PPO products. This extensive network provides PPO members with access to leading health care professionals in all specialties and to hospitals all across West Virginia. Also included in the network are ancillary providers, which include, but are not limited to, suppliers of durable medical equipment, orthotics and prosthetics, home infusion therapy, and ambulance transportation.

West Virginia Small Business Plan

The West Virginia Small Business Plan (WVSBP) is a PPO program created by the West Virginia State Legislature. The program makes health insurance coverage available to small businesses that meet certain eligibility criteria

Coverage is provided through health insurance plans offered by private insurance carriers. Highmark West Virginia is currently the only company that participates in the program.

Two features are unique to this program:

- First, carriers that participate can use the West Virginia Public Employees Insurance Agency’s (PEIA) reimbursement rates for West Virginia providers. In most instances, PEIA’s rates are significantly lower than those of private carriers.

- Second, all West Virginia providers who furnish services to PEIA members are automatically deemed to participate in the WVSBP unless the provider withdraws through an annual opt-out process administered by the PEIA each spring.

For its WVSBP product, Highmark West Virginia uses its regular PPO network minus those providers who have opted out of the WVSBP through the PEIA.

REMINDER: Always verify benefits! For inquiries about eligibility, benefits, claim status, or authorizations, Highmark encourages providers to use the electronic resources available to them – Availity and the applicable HIPAA transactions – prior to placing a telephone call to the Provider Service Center.

Exclusive Provider Organization (EPO) plans provide members with coverage for a wide range of services when they are received from in-network providers. EPOs function like a PPO, but offer no out-of-network benefits except for emergency services. Members are not required to select a PCP to coordinate covered care, but it is recommended.

By utilizing the local Blue Plan PPO network, EPOs allow access to the largest provider network in the Highmark service area, as well as a large provider network across the country.

EPO Availability

Highmark offers EPO plans in the Western and Central Regions of Pennsylvania, Western (ASO groups only) and Northeastern regions of New York, and in Delaware.

The following are general characteristics of EPO plans:

- There is no coverage when a member receives services from an out-of-network provider, except emergency services, which are covered at the in-network level.

- Members are not required to select PCPs to coordinate their care, but it is recommended.

- Some plans offer “tiering” of benefits, based on which providers render services.

- Highmark’s list of outpatient procedures/services requiring authorization will apply to EPO plans.

- Providers are required to contact Clinical Services to obtain authorization for in-network inpatient admissions.

Highmark’s Community Blue plans utilize a select network of high-quality practitioners and facilities within the Community Blue network. Community Blue plans provide an affordable choice for members who are seeking greater levels of cost-savings with quality, cost-efficient care. With Community Blue plans, both in-network and out-of-network benefit levels are offered. Community Blue qualified High Deductible Health Plan (HDHP) options are available with a Health Savings Account (HSA).

Community Blue plans also offer “tiered” plans, which give the greatest level of cost-savings while still giving members the power to choose the care, the place, and the price that is right for them in their community.

Community Blue plans are offered in Pennsylvania service areas.

General Types of Community Blue Plans

Community Blue EPO is offered in Pennsylvania’s Western Region. With all Community Blue EPO plans, members must receive services from providers participating in the Community Blue network. There is no out-of-network coverage, except for emergency services.

Community Blue Flex is offered in the Western Region, while Community Blue Premier Flex is offered in the Central Region. Both are available as PPO or EPO plans. Flex plans have a “tiered” benefit design and offer two levels of in-network options for added cost savings:

- Enhanced Value offers a lower level of cost-sharing for the member.

- Standard Value has a higher level of cost-sharing for the member.

Connect Blue is a Community Blue EPO plan design offered only in Pennsylvania’s Western Region. Connect Blue also offers a “tiered” benefit design; however, there are three levels of in-network options for even more added cost-savings:

- Preferred Value offers the lowest level of cost-sharing for the member.

- Enhanced Value has a middle level of member cost-sharing.

- Standard Value has the highest level of cost-sharing for the member.

Community Blue HMO is only offered in Pennsylvania’s Western Region. Members must select a PCP and must receive services from providers participating in the Community Blue network. Similar to other HMO plans, there is no out-of- network coverage, except for emergencies.

Total Health Products

Community Blue Total Health is a specific flex EPO/PPO plan design that includes reduced member cost-sharing for a PCP office visit when a member uses a provider affiliated with a Patient Centered Medical Home (PCMH), Accountable Care Alliance (ACA), or Accountable Care Organization (ACO).

The plan also has reduced cost-sharing for certain services for members with chronic conditions such as asthma, chronic obstructive pulmonary disease (COPD), coronary artery disease (CAD), congestive heart failure (CHF), diabetes, high cholesterol, and hypertension.

REMINDER: Always verify benefits! With the variety of products offered and various networks, it is more important than ever to always verify a member’s specific benefits prior to rendering services.

For inquiries about eligibility, benefits, claim status, or authorizations, Highmark encourages providers to use the electronic resources available to them – Availity and the applicable HIPAA transactions – prior to placing a phone call to the Provider Service Center.

Point of Service (POS) is a managed care benefit plan in which a member selects a primary care physician (PCP) and maximizes benefit coverage by securing care directly from, or under authorization by, the selected PCP. Members may incur additional out-of-pocket expenses or reduced benefits for using non-network providers.

Point of Service plans contain some elements of the fully managed care provided by HMOs, plus some of the freedom of choice provided by traditional benefit plans. Unlike an HMO, which typically covers services only when provided in the HMO network under the direction of the member’s PCP, a POS plan allows the member to select treatment by his or her PCP or choose to go to any other provider at the time care is needed (at the “point of service”). Benefits are highest when the member sees his/her PCP or is referred to another network provider by the PCP.

Point of Service plans are offered in Highmark’s Delaware, West Virginia, and New York service areas.

Highmark Delaware POS Plans

Point of Service members have coverage for eligible services by both in-network and out-of-network providers. Members who opt to have covered services either rendered by, or coordinated through, their PCP will receive the highest level of benefits. Referral authorizations are required for in-network specialist visits in most cases for the highest level of benefits.

Members may also seek care from a network participating provider without a referral authorization; however, the lower out-of-network benefit level would apply. Members seeking services from non-network providers will also have a greater out-of-pocket cost under the out-of-network coverage.

Under this managed care plan, authorization and pre-certification are required for hospital admissions both in and out of network. In addition, other targeted care may require authorization.

Highmark New York POS Plans

Point of Service members have coverage for eligible services by both in-network and out-of-network providers. Members are required to select a physician as their primary health gatekeeper who will render services directly to the member or coordinate their care with other specialists and/or facilities within the New York networks. POS members are also required to use Quest Diagnostics for laboratory services. Referrals are not required on any New York POS member services.

Members seeking services from non-network providers do not require a referral but will have a greater out-of-pocket cost under the out-of-network coverage. Members can be billed the difference between the allowed fee schedule amount and the physician/facility charge.

New York’s POS Wrap, or EX plan, functions like a PPO plan with access to the national BCBS PPO network but requires that the member enrolled in the plan reside within the 13-county service area of Northeastern New York or the 8-county service area of Western New York. EX members are required to select a primary care physician and use Quest Diagnostics for elective laboratory procedures. Effective September 1, 2018, referrals are no longer required for New York POS plans.

Under this managed care plan, authorization and pre-certification are required for hospital admissions both in- and out-of-network. In addition, other targeted care may require authorization.

The provider may not bill the member for services covered except for any applicable co-pays, co-insurance, or permitted deductibles. A copayment, or copay, is a set amount paid to the provider by the member at the time of service. This amount is deducted from the reimbursement we make to you. Some of the services that require copayments are office visits, emergency room visits, diagnostic services, hospital admissions, and therapies. Copayments vary depending on the type of contract, provider (PCP or specialist) and service involved. Office visit copayments appear on most member identification cards.

In some cases, members are responsible for a coinsurance for covered services. Providers should submit the claim to Blue Cross Blue Shield for processing and then collect from the member their responsibility. Some products also have deductible amounts prior to copayments or coinsurance becoming applicable. Providers should submit the claim to Blue Cross Blue Shield to determine the member responsibility.

Highmark West Virginia POS Plans

Providers in Highmark Blue Cross Blue Shield (WV)’s PPO networks also participate in the POS network. In addition, Highmark in West Virginia contracts with PCPs to coordinate the care of POS plan members. All POS plan members must select a network PCP.

Standard POS plans include deductibles, copayments, and annual limits. Pre- certification/authorization is required for inpatient admissions and other selected services. Additional preventive services are also typically covered (e.g., annual physical exams, well baby care).

REMINDER: Always verify benefits! All services are subject to specific contract coverage and limitations. When providing service to a POS member, please verify the member’s eligibility and benefits via Availity or the applicable HIPAA electronic transaction.

Open access programs do not require members to select a network primary care physician/practitioner (PCP), though it is recommended. Like Point of Service (POS) programs, open access programs allow members to receive care outside of the network.

For out-of-network care, benefits are paid at the program’s lower level of reimbursement, and the members are responsible for filing claims and pre- certifying care.

Open Access products are offered to employer groups in Pennsylvania’s Western and Central Regions.

General Characteristics of Open Access Plans

General characteristics of open access plans include:

- Members are not required to choose a PCP, but they are strongly encouraged to do so.

- Open access product members may receive care at the higher level of benefits for covered services in:

- The 29 counties of western Pennsylvania when they access physicians, hospitals, or other health care providers within the Western Region network.

- The 21 counties of central Pennsylvania when they access physicians, hospitals, or other health care providers within the Premier Blue Shield professional network and the Highmark Blue Shield (PA) facility network.

- Members may change PCPs upon request.

- Both PCPs and specialists are paid fee-for-service for care rendered to open access product members.

- For services requiring an authorization, the ordering physician should obtain the authorization.

Payment Levels Correspond to Member Options

The open access program provides two levels of payment, corresponding to the options the member chooses when accessing care:

- If members choose to receive care from providers associated with the Premier Blue Shield network located in the 21 counties of central Pennsylvania and the Lehigh Valley or the Highmark Managed Care network in the 29 counties of western Pennsylvania, covered services will be subject to lower co-payment, co-insurance and/or deductible.

- If members choose to seek services from a provider outside the 21 county Central Region Premier Blue Shield network or the 29 county Highmark Managed Care network in the Western Region, covered services will be subject to higher co-payment, co-insurance and/or deductible.

Each employer group that offers an open access plan determines the higher and lower cost-share for its own members. A member who chooses out-of-network care is responsible for any resulting deductible, coinsurance, and/or copayment amounts, as well as the difference between the provider’s charge and the plan allowance.

When Care Cannot Be Provided By an In-Network Provider

Clinical Services, Highmark’s medical management division, may authorize a member to receive services from a non-network provider if the care he or she requires cannot be provided within the network. In such situations, reimbursement will be made at the higher, in-network level.

When caring for patients with chronic conditions, patient compliance is critical. Skipped medications or screenings can cause long-term damage; therefore, patient incentive can be a key to promoting patient compliance.

To give our members a “greater hand in their health,” Highmark created a Value-Based benefit design. In this benefit design, providers care for members with one or more chronic/targeted conditions by reducing or removing financial barriers to health care.

Benefit Options Available

Value-Based Benefits is coverage that promotes patient compliance in the management of chronic conditions. And, based on their unique employee populations, employer groups have some choices within the program. They can opt to cover all or some of the eight chronic/targeted conditions.

Employer groups can also choose to either waive or lower their employees’ cost-sharing (copays, coinsurance, etc.). These options apply to specific evidence-based, high-value medical services and prescriptions related to the selected condition(s).

Members with Value-Based Benefits who have a covered condition that an employer has selected will qualify if the member has signed up for that condition and completed the Wellness Profile. Reduced or waived cost sharing for services related to their health condition(s) will apply for the entire benefit year unless the member is required to complete certain protocols on a quarterly basis.

Targeted Conditions

The following are the chronic conditions targeted under Value-Based Benefits:

- Asthma

- Coronary artery disease (CAD)

- Congestive heart failure (CHF)

- Chronic obstructive pulmonary disease (COPD)

- Diabetes

- High blood pressure

- High cholesterol

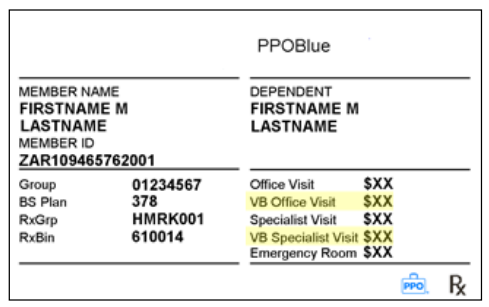

Member ID Cards May Display “VB” Copays

Highmark strongly recommends that providers ask to see a member’s current ID card at every visit. For members with Value-Based Benefits, the card may show “VB” copay amounts (highlighted in yellow on the ID card sample below) along with the standard copay amounts. Although employer groups are given the option of displaying the value-based copayment on the ID card, they may choose not to include it on their ID cards.

Options Available for Verifying Coverage

Highmark advises providers to verify eligibility and benefits prior to rendering services to our members. You can use the appropriate HIPAA-compliant electronic transaction or our convenient, easy-to-use provider portal, Availity.

Program Options Continue to Expand

Value-Based Benefits offer many options to engage members. For example, employers may choose to:

- Require that certain health protocols related to the eight chronic/targeted conditions be met each quarter so employees continue to pay less for medical services and/or prescriptions to manage these conditions.

- Offer a reward for the completion of preventive services.

- Offer a waiver of an additional copay for specific surgeries if member engages in informed decision making and completes an online questionnaire.

A health maintenance organization (HMO) is a health care plan that provides comprehensive medical, surgical, hospital, and ancillary medical services including preventive care services. HMO plans are offered in Highmark service areas in Delaware, New York, and Pennsylvania. Members must use network participating providers to receive coverage for their care -- except for emergency care in Delaware, New York, and Pennsylvania, and also urgent care in Pennsylvania (urgent care requires authorization in Delaware).

Members receive this comprehensive benefits package in exchange for exclusive use of the HMO’s established provider network and compliance with its requirements. Care and case management services and typically authorization requirements are inherent components of HMO programs and help ensure that care is medically necessary and provided in an appropriate setting.

The provider may not bill the member for services covered except for any applicable copays, coinsurance, or permitted deductibles. A copayment, or copay, is a set amount paid to the provider by the member at the time of service. This amount is deducted from the reimbursement we make to you. Some of the services that require copayments are office visits, emergency room visits, diagnostic services, hospital admissions and therapies. Copayments vary depending on the type of contract, provider (PCP or specialist) and service involved. Office visit copayments appear on most member identification cards.

In some cases, members are responsible for a coinsurance for covered services. Providers should submit the claim to Blue Cross Blue Shield for processing and then collect from the member their responsibility. Some products also have deductible amounts prior to copayments or coinsurance being applicable. Providers should submit the claim to Blue Cross Blue Shield to determine the member responsibility.

Important! (NY Only)

HMO members are also required to use Quest Diagnostics for laboratory services. Referrals are not required on any New York HMO member services.

Additionally, effective January 1, 2003, referrals were no longer required for HMO and HMO Senior members in New York. This means that primary care physicians can refer members directly to an in-network specialist without contacting the health plan for approval.

General Characteristics of HMOs

The following are general characteristics of HMO products:

- HMO products require members to select a network-participating primary care physician who provides preventive care services, directs patients to seek specialty care if required, and communicates with specialists to ensure continuity and coordination of care.

- For all HMO products, routine adult and pediatric physicals and pediatric immunizations must be performed by the member’s PCP to receive coverage.

- Members may change PCPs upon request.

- For services requiring an authorization, the ordering physician should obtain the authorization.

- Blues On Call services and preventive care benefits

Coverage Outside the Service Area

Highmark’s commercial group/individual HMO members rely on a network of medical practitioners in the service area to supply medical care. However, members still have coverage when they are outside the network service area. The type of coverage that a member has depends on two elements:

- the care required; and

- whether they are traveling or living outside the service area.

Pennsylvania HMO Plans

In Pennsylvania’s 29-county Western Region only, Highmark offers HMO products through Highmark Choice Company, which utilizes the Keystone Health Plan West (KHPW) managed care provider network. HMO coverage requires you to select a primary care physician (PCP) who will become familiar with all aspects of your health and health care and, as your personal physician, will be responsible for treating you for your basic health care needs.

In the Northeastern Region, Highmark offers HMO products that are supported by providers participating in the First Priority Health (FPH) managed care network. The FPH network of professional providers and facilities spans throughout the 13-county service area and also includes several hospitals and their participating physicians in contiguous counties in Pennsylvania, New Jersey, and New York.

HMO Members are required to obtain preventive care (such as adult and pediatric routine physicals and pediatric immunizations) from their PCP, but can go directly to a network specialist for other covered services — without a referral.

The provider may not bill the member for services covered except for any applicable co-pays, co-insurance, or permitted deductibles. A copayment, or copay, is a set amount paid to the provider by the member at the time of service. This amount is deducted from the reimbursement we make to you. Some of the services that require copayments are office visits, emergency room visits, diagnostic services, hospital admissions and therapies. Copayments vary depending on the type of contract, provider (PCP or specialist) and service involved. Office visit copayments appear on most member identification cards.

In some cases, members are responsible for a coinsurance for covered services. Providers should submit the claim to Blue Cross Blue Shield for processing and then collect from the member their responsibility. Some products also have deductible amounts prior to copayments or coinsurance being applicable. Providers should submit the claim to Blue Cross Blue Shield to determine the member responsibility.

Delaware's IPA Plans

Highmark Blue Cross Blue Shield (DE)'s managed care HMO offerings in Delaware are Independent Practice Association (IPA) plans. IPA plans provide comprehensive medical, surgical, hospital, and ancillary medical services, including preventive care services. Members are required to choose a PCP who will work with them to coordinate their health care needs. PCP referral authorizations are required to obtain care from specialists in some cases.

Delaware IPA plan members must use Highmark Delaware network participating providers to receive coverage for their care, except for emergency care. Authorization and precertification is required for hospital admissions and other targeted care.

The IPA option is also offered as a plan for those members who choose to combine the medical plan with a Health Savings Account (HSA) or a Health Reimbursement Account (HRA).

Required Care Definitions for HMO Members

The required care definitions for commercial group and direct pay HMO members are noted below. These definitions are not applicable to Medicare Advantage HMO products.

|

Care Required |

Definition |

|---|---|

|

Emergency Care |

The initial treatment:

|

|

Symptomatic Care |

Medical needs that are symptomatic but can be treated at the discretion of the physician and patient. Reasonable delays will most likely not affect the outcome of service. |

|

Routine Asymptomatic and Preventive Care |

Medically asymptomatic conditions that can be addressed at the discretion of the physician and patient. Reasonable delays will not affect the outcome of services. For HMO members, this type of care may be considered “follow-up” care when traveling outside of the service area. Follow-up care is defined as ongoing services that a member requires, even when they are traveling, for care that was initiated while they were home (e.g. allergy shots, suture removal, cast check). |

Away From Home Care® (AFHC) is a registered trademark of the Blue Cross and Blue Shield Association, an association of independent Blue Cross and Blue Shield Plans.

The Blue Cross and Blue Shield Association sponsors the AFHC Guest Membership Program through participating Blue HMOs at numerous locations throughout the United States. The Western Region commercial HMO product participates in this program both as a “home” HMO plan, offering this to our members, and also as a “host” HMO plan, where members from other Blue HMO plans may have a HMO guest membership in the western Pennsylvania, and Northeastern and Western New York service areas.

Note: This program is not available to Medicare Advantage HMO members in Pennsylvania’s Western Region. This program is also unavailable for Individual members in Western and Northeastern New York, including members in Essential Plans (Western NY).

Members Visiting The Highmark HMO Service Area

When home in a Highmark service area, our HMO members with a guest membership in another plan area who need non-emergency care may receive care only from a physician in the Highmark service area.

If the member had an established relationship with a Pennsylvania Western Region HMO, Delaware, or New York network PCP prior to their guest membership, this is the provider they should contact. If the member did not have an established PCP relationship prior to their guest membership, they should contact the Away From Home Care Coordinator at:

- In Pennsylvania: 800-249-9579

- In Delaware: 866-835-8977

- In New York: 800-888-1238 (Northeastern New York), 800-544-BLUE (2583) OR call the number on the back of ID card

A physician must authorize any covered services received while at home. In an emergency, no prior approval is required. The member should go to the nearest medical provider. If follow-up care is needed while the member is at home, it can be arranged in the same manner as described above.

The Away From Home Care® (AFHC) Guest Membership program offered through the Blue Cross and Blue Shield Association allows members enrolled in other Blue Plan HMOs across the country to receive services covered under the “host” HMO benefit program if they are temporarily or permanently residing in the 29-county Western Region in Pennsylvania, in Delaware, 8 counties of Western New York, or 13 counties of Northeastern New York.

Hosting Guest Members

A Highmark PCP may be contacted by an AFHC coordinator from Highmark to host a member from another Blue Plan who will be temporarily or permanently residing in our region.

If a network PCP is chosen to host a member from another plan, they will be contacted by the AFHC coordinator by letter. This letter will notify them of their selection as well as providing member information such as name, address, birthday, and Member ID.

During the duration of the guest membership, all Highmark authorization policies and procedures apply to the treatment of guest members. The AFHC coordinator assigned to the case will assist you with any administrative concerns.

During the time HMO members have a guest membership in another Blue HMO, these members’ names will not appear on the PCP’s membership roster (except in New York).

Note: The AFHC Guest Membership Program is not available in all areas of the country.

Claims For Guest Members

Providers should submit claims in exactly the same manner as you would a claim for a local member.

Indemnity Programs

Under Traditional indemnity plans, Highmark members can seek care directly from any participating provider without coordination from a Primary Care Physician (PCP).

Participating providers agree to accept Highmark’s allowance as payment in full for covered services. The member is responsible for any applicable copayment, deductible, or coinsurance.

Providers For Indemnity Products

Highmark's traditional indemnity network includes inpatient and outpatient facilities, professional providers, and ancillary providers such as suppliers of home infusion therapy, durable medical equipment, orthotics and prosthetics, and ambulance transportation.

Payment

Payment for eligible services is based on the Plan Allowance. Participating providers agree to accept the Highmark allowance as payment in full and to collect all applicable copayments, deductible amounts, and/or coinsurance from their patient.

Billing

At the time of service, providers can collect applicable copayments, coinsurance, and/or deductible amounts. Participating providers must submit claims to Highmark for services rendered.

Major Medical benefits supplement the hospital and medical/surgical portions of basic coverage. The member shares in the cost of medical expenses through an annual deductible and coinsurance.

Major Medical requires a program deductible for the member and each dependent. The amount of the deductible varies according to the member’s contract. A new deductible amount is required each benefit period.

Generally, when the deductible is satisfied for the member or dependent(s), major medical pays 80 percent of the Plan Allowance for covered medical expenses, and the member is liable for the other 20 percent.

In accordance with the October 1, 2010, Health Care Reform mandate, both grandfathered and non-grandfathered maximum amounts have been changed to unlimited.

Major Medical extends the coverage available under basic contracts and provides coverage for additional services, such as:

- Ambulance service

- Blood products

- Doctors’ office visits

- Durable medical equipment

- Outpatient therapy and rehabilitation services

- Prescription drugs

If the member is enrolled in a standalone Major Medical program and, during the benefit period the member or dependent’s expenses exceed the deductible, the member should complete a Major Medical claim form. The member should submit the claim along with the provider's itemized bills, to the Blue Plan through which the member is enrolled.

In addition to being offered as a standalone benefit option, Major Medical can be incorporated into the traditional benefits package. Claims processing is automated through a feature called concurrent Major Medical processing -- which does not require a separate submission of a Major Medical claim form.

Please see Chapter 6, Unit 7: Payment/EOBs/Remittances for additional information.

The following entities, which serve the noted regions, are independent licensees of the Blue Cross Blue Shield Association: Western and Northeastern PA: Highmark Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Choice Company, Highmark Health Insurance Company, Highmark Coverage Advantage Inc., Highmark Benefits Group Inc., First Priority Health, First Priority Life, Highmark Care Benefits Inc., or Highmark Senior Health Company. Central and Southeastern PA: Highmark Inc. d/b/a Highmark Blue Shield, Highmark Benefits Group Inc., Highmark Health Insurance Company, Highmark Choice Company or Highmark Senior Health Company. Delaware: Highmark BCBSD Inc. d/b/a Highmark Blue Cross Blue Shield. West Virginia: Highmark West Virginia Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Health Insurance Company or Highmark Senior Solutions Company. Western NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Cross Blue Shield. Northeastern NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Shield.

All references to “Highmark” in this document are references to the Highmark company that is providing the member’s health benefits or health benefit administration and/or to one or more of its affiliated Blue companies.

All revisions to this Highmark Provider Manual (the “manual” or “Highmark Provider Manual”) are controlled electronically. All paper copies and screen prints are considered uncontrolled and should not be relied upon for any purpose.