Unit 4: Professional (1500/837P) Reporting Tips

6.4 Selecting a Level of Medical Decision Making For Coding An Evaluation and Management Service

6.4 Billing First Priority Health Network PCP Services (PA Only)

6.4 Reporting Bilateral Procedures

6.4 Bilateral Procedures: Reporting and Reimbursement

6.4 Frequency Type Codes and Adjustments

6.4 Reporting Mid-Level Provider Services for Medicare Advantage (PA and WV Only)

6.4 Reporting Place of Service For Diagnostic Services Provided in a Hospital

6.4 Federal Employee Program (FEP) Claim Tips

6.4 Concurrent Major Medical Processing (PA Only)

In today’s business world, there are no requirements to submit claims on paper. Electronic transactions and online communications have become integral to health care. In fact, Highmark’s claim system places higher priority on processing and payment of claims filed electronically. This unit provides general guidelines applicable to both paper and electronic 1500/837P professional claim submissions.

If you are not already billing electronically, please refer to Chapter 1.3: Electronic Solutions - EDI & Availity for information on how to take advantage of the electronic solutions available to you.

Required Formats

Use the following table to determine the required format for submitting claims:

|

If you submit... |

Then use one of these formats... |

|---|---|

|

Electronically |

ASC X12N 837 Health Care Claim: Professional Transaction Version 005010 |

|

On paper |

1500 Health Insurance Claim Form (“1500 Claim Form”), Version 02/12 |

Telemedicine Service

For complete information on telemedicine services, including billing guidelines specific to those services, please see Chapter 2.5: Telemedicine Services.

Guidelines Specific to 1500/Paper

Please see Chapter 6.5: 1500 Claim Form Guidelines for guidelines specific to the 1500 Health Insurance Claim Form and paper claim submissions.

Avoid Form 1099-MISC Errors

The information entered for the billing provider on the claim affects how your income is reported to the Internal Revenue Service (IRS). Highmark must notify the IRS of payments of $600 or more it makes to a provider or practice within a calendar year. If you received payments of $600 or more from Highmark in any calendar year, PNC ECHO or Highmark — depending on your region — will send you a miscellaneous income statement (form 1099-Misc) at the end of January of the following year. Providers will receive their statement from PNC ECHO.

Please follow these guidelines so that Highmark reports your correct income to the IRS:

- If the income is to be reported under the practice’s name (group name) and tax identification number (TIN), please enter the group’s NPI number as the billing provider on the claim. Highmark will then issue all checks payable to the group’s name. The 1099-Misc form will also be issued under the group’s name.

- If the income is to be reported under an individual’s name and Social Security number (in the case of a sole proprietor), please enter the individual’s NPI number as the billing provider box the claim. Highmark will issue all checks payable to the individual provider’s name. The 1099-Misc form will also be issued under the individual’s name.

Note: Highmark discourages the use of Social Security numbers in lieu of business tax identification numbers whenever it requests a provider’s tax identification number. A provider who chooses to submit his or her Social Security number (SSN) as a tax identification number hereby acknowledges, understands, and agrees that Highmark will treat the SSN in the same manner in which it handles other providers’ business tax identification numbers and shall not be liable to such provider for any intentional or unintentional disclosures of such SSN.

To guarantee that your 1099 is correct, make sure that your billing agent is using the correct provider number on all claims — paper or electronic. Highmark will not make changes to Form 1099 if the claims (paper or electronic) were submitted with the performing provider incorrectly listed as the billing provider.

If you have any questions about Form 1099-Misc issues, contact PNC ECHO at the following:

- 888-834-3511

- www.providerpayments.com

Here is a detailed matrix that will show you how to submit your claims. The information in this matrix does not apply to individual health care professionals who report their services under their personal tax identification number, including sole proprietors.

|

Common Naming |

Highmark |

CMS-1500 (08/05) |

837 Professional |

|---|---|---|---|

|

Billing Provider name |

Assignment |

33 |

Loop 2010AA Billing Provider |

|

Billing Provider address |

AA or group |

33 |

Loop 2010AA Billing Provider |

|

Billing Provider Tax |

AA or group tax |

25 |

Loop 2010AA Billing Provider |

|

Billing Provider |

AA or group NPI |

33a |

Loop 2010AA Billing Provider |

|

Billing Provider |

AA or group |

33b (shaded area) |

Loop 2000A Billing Provider |

|

Rendering Provider name |

Performing |

Not applicable |

Loop 2310B Rendering Provider |

|

Rendering Provider |

Performing |

24J, upper line |

Loop 2310B Rendering Provider |

|

Rendering Provider NPI |

Performing |

24J, lower line |

Loop 2310B Rendering |

*When the billing or rendering provider’s NPI is associated with more than one Highmark-contracted specialty, the Provider Taxonomy Code correlating to the contracted specialty must be submitted in addition to the NPI. This enables the accurate application of the provider’s contractual business arrangements with Highmark.

The documentation for evaluation and management (E/M) services is based on three “key” components: history, physical exam, and medical decision making.

For purposes of medical record audits of evaluation and management (E/M) coding levels, Highmark expects that the medical records will reflect that the medical decision-making component is aligned with the complexity of the patient history and examination.

Medical Decision Making and Tools Used to Determine Complexity Level

Medical decision making refers to the complexity of establishing a diagnosis and/or selecting a management option as measured by:

- the number of possible diagnoses and/or the number of management options that must be considered;

- the amount and/or complexity of medical records, diagnostic tests, and/or other information that must be obtained, reviewed, and analyzed; and

- the risk of significant complications, morbidity, and/or mortality, as well as comorbidities associated with the patient's presenting problem(s), the diagnostic procedure(s), and/or the possible management options.

The levels of E/M services recognize four levels of medical decision making: straight-forward, low complexity, moderate complexity, and high complexity.

In the medical review process, Highmark uses a scoring tool based on the instructions in the 1995 and 1997 Centers for Medicare & Medicaid Services (CMS) E/M documentation guidelines. Points are assigned in accordance with the documented medical record to determine the complexity level of medical decision making.

Number of Diagnoses/Management Options

The number of possible diagnoses and/or the number of management options that must be considered is based on the number/types of problems addressed during the encounter, the complexity of establishing a diagnosis(es), and the management decisions that are made by the physician.

|

Table A: Number of Diagnoses AND Management Options |

Points |

|---|---|

|

Self-limiting or minor problems; stable, improved, or worsening |

1 point |

|

Established problem; stable, improved |

1 point |

|

Established problem; worsening |

2 points |

|

New problem; no additional workup planned |

3 points |

|

New problem; additional workup planned |

4 points |

An encounter is interaction between a covered Highmark member and a health care provider for which an evaluation and management service or other service(s) is rendered and results in a claim submission. Any testing, consultation, and/or referral that is being done beyond that encounter to assist the provider in medical decision making is “additional workup planned.”

Additional workup planned is an element of review, which includes a number of diagnoses and management options. The additional workup planned element contributes to indicating the complexity of a patient’s condition based on diagnostic tests. It is a key element for highly complex E/M services and constitutes any testing, consultation, and/or referral that is being done beyond the encounter to assist the provider in medical decision making.

An example of additional workup planned is recommendation for additional follow-up care, with the discussion documented in the member’s medical records. A simple instruction to patients to contact their primary physician does not constitute additional workup planned.

The examples below are based on a record review assessment and further illustrate the medical decision-making component scoring above.

Office E/M Documentation

- Established problem – worsening: An established patient sees his/her gastroenterologist due to worsening of symptoms. Two points would be assigned for “Established problem - worsening” score.

- New problem – additional workup planned: The patient presented to his/her new family practitioner with symptoms requiring additional tests and/or a referral to a specialist. In addition, the family practitioner contacts the specialist. Four points would be assigned for “New problem – additional workup planned” score.

Emergency Room/Emergency Department E/M Documentation

- New problem – no additional workup planned: A patient presents with a low grade fever and pharyngitis. An examination is provided and the patient is sent home with a prescription and instructed to follow up with their primary care physician as needed. Three points would be assigned for “New problem – no additional workup planned” score.

- New problem – additional workup planned: A patient presents with abdominal pain and hematuria. The ER/ED physician (or staff) schedules an outpatient MRI and/or communicates directly with the patient’s primary physician or other specialist and schedules an appointment for follow-up after discharge from the ER/ED, with the discussion documented in the medical record. Four points for “New problem - additional workup planned” would be scored.

Credit is not given for additional workup planned if the clinical testing and/or consultation occurred during the ER/ED encounter or in the instance when the patient is simply instructed to contact their primary physician.

Amount and/or Complexity of Data to be Reviewed

The amount and complexity of data to be reviewed is based on the types of diagnostic tests ordered/reviewed, obtaining history from others, and discussion with other health care providers.

|

Table B: Amount and/or Complexity of Data Reviewed |

Points |

|---|---|

|

Lab tests ordered and/or reviewed (regardless of number ordered) |

1 point |

|

X-rays ordered and/or reviewed (regardless of number ordered) |

1 point |

|

Procedures found in the Medicine section of CPT (90281-99199) ordered and/or reviewed |

1 point |

|

Discussion of test results with performing physician |

1 point |

|

Decision to obtain old record and/or obtain history from someone other than patient |

1 point |

|

Review and summary of old records and/or obtaining history from someone other than patient and/or discussion with other health |

2 points |

|

Independent visualization of image, tracing, or specimen (not simply review of report) |

2 points |

Risk Level of Complication and/or Morbidity or Mortality

Tables A and B (above), in conjunction with Table C (below), describe specific point value information. In order for an E/M service to be assigned a particular medical decision making level, the service must score at or above that level in two out of the three categories.

Highmark uses the following risk table, which appears in both the 1995 and 1997 CMS published guidelines, as a tool for determining the appropriate risk level for a reported E/M visit.

The assessment of risk of the presenting problem(s) is based on the risk related to the disease process anticipated between the present encounter and the next one. The assessment of risk of selecting diagnostic procedures and management options is based on the risk during and immediately following any procedures or treatment.

The highest level of risk in any one of the three categories — Presenting Problem(s), Diagnostic Procedure(s), or Management Options — determines the overall risk.

Table C: Assessment of Risk (Common Clinical Examples)

|

LEVEL |

Presenting Problem(s) |

Diagnostic Procedure(s) Ordered |

Management Options Selected |

|

Minimal |

One self-limited or minor problem (e.g., cold, insect bite, tinea, corporis) |

|

|

|

Low |

|

|

|

|

Moderate |

|

|

|

|

High |

|

|

|

Reimbursement Policy RP-057

See Highmark Reimbursement Policy RP-057: Documentation Guidelines for Evaluation and Management Services for Highmark’s documentation requirements for supporting the level of an E/M service reported and the eligibility for reimbursement based on fulfilling the required criteria.

For More Information

The E/M scoring tools used by Highmark in the medical record review process are available on the Provider Resource Center. To access, select Claims & Authorization from the main menu, and then Guidelines & Tips under Reimbursement Resources. There you'll find Documentation Guidelines For Evaluation and Management Services.

Claims must be Submitted for PCP Capitated AND Billable Services

This information applies only to primary care physicians (PCPs) participating in the First Priority Health (FPH) managed care network in the 13-county Northeastern Region of Pennsylvania.

It is critical that all services rendered to members by FPH network PCPs be submitted for adjudication. This includes capitated (prepaid) services in addition to the PCP billable procedures, which are paid fee-for-service. The data captured on these claims allow us to monitor clinical activities, comply with accrediting bodies, and provide PCPs with fair capitation payments and accurate reports. Capitated services are not subject to coordination of benefits.

The PCP must submit claims with all the required information via an 837P electronic claim transaction or a paper claim using an original 1500 Health Insurance Claim Form, Version 02/12 (photocopies, discontinued, or outdated versions will not be accepted).

PCP Billable Services

Please refer to the PCP Billable Services list for procedures that are billable for fee-for-service reimbursement.

This list is also available on the Provider Resource Center. To access, select Claims & Authorization from the main menu, and then Guidelines & Tips under Reimbursement Resources. There you'll find the list.

For More Information

Please see the manual’s Chapter 6.7: Payment/EOBs/Remittances for additional information on FPH network payment methodology.

A modifier is a two-character code — numeric, alphabetical, or alpha-numeric — that is placed after the usual procedure code. A modifier permits a provider to indicate whether a service or procedure has been altered by specific circumstances, but not changed its definition or code. Up to four modifiers can be reported for each service.

Essential Modifiers

Some modifiers that are essential to accurate claims processing and must be reported on the claim form, when applicable, are:

|

Modifier |

Definition |

|---|---|

|

LT |

Identifies procedures performed on the left side of the body. |

|

RT |

Identifies procedures performed on the right side of the body. |

|

50 |

Identifies bilateral procedures. Unless otherwise identified by a specific code, bilateral procedures should be identified by adding a 50 modifier to the appropriate procedure code. |

Our claims processing system is programmed to look for RT or LT modifiers on codes for services that may be performed bilaterally. When reporting a procedure that can be performed on either side of the body, report the appropriate RT or LT modifier. If neither the 50, RT, nor LT modifiers are reported, one of the services will be rejected as a duplicate.

|

Modifier |

Definition |

|---|---|

|

76 |

Repeat procedure by same physician. Use this modifier to report all procedures or portions of procedures that are repeated on the same date. |

The 76 modifier should be applied to the subsequent or repeat procedure only. Failure to use this modifier when appropriate will result in a rejection, as the service will be read as a duplicate.

|

Modifier |

Definition |

|---|---|

|

22 |

Unusual Procedural Services: One that is of greater complexity than that usually required for the listed procedure – identify that service by adding a 22 modifier to the standard procedure code. |

The 22 modifier distinguishes the procedure performed as an unusual service, including extenuating medical circumstances. When you report a procedure code with a 22 modifier, Highmark recommends that you submit your claim electronically through an 837 transaction and use the Paperwork (PWK) Segment to report the type and transmission of the attachment.

PWK Cover Sheet and Submission

When using the PWK segment on electronic claim submissions, please use the applicable PWK cover sheet for your service area when submitting your supporting documentation:

- Pennsylvania: PWK (Paperwork) Supplemental Claim Information Cover Sheet

- Delaware: PWK (Paperwork) Supplemental Claim Information Cover Sheet

- West Virginia: Electronic Claims Attachment Cover Sheet

The cover sheet is also available on the Provider Resource Center. Select Resources & Education from the main menu, and then click on Miscellaneous Forms which is under Forms. For additional guidance on using the PWK segment, please see Chapter 6.2: Electronic Claim Submission.

Fax or mail supporting documentation to the applicable fax number or address as indicated below:

|

Pennsylvania |

Delaware |

West Virginia |

|---|---|---|

|

Attention: Document Preparation/Image |

Attention: Document Preparation/Image |

Attention: CDC Area |

|

Fax to: 888-910-8797 |

Fax to: 888-910-9601 |

Fax to: 844-235-7266 |

|

Mail to: |

Mail to: |

Mail to: |

Claim Review and Adjudication

One of our Professional Consultants will review your claim and supporting documentation. He or she will determine whether or not additional reimbursement is warranted based on the clinical circumstances documented in the medical records, and if so, how much additional reimbursement is appropriate. Claims with a procedure code with a 22 modifier will be adjudicated and will receive one of the following message codes:

- J6056 – Unusual procedural services were reported with no supporting documentation, therefore, no additional payment can be considered.

- J6057 – Unusual procedural services were reported and the supporting documentation was considered, but does not warrant an additional payment.

- J6058 – Unusual procedural services were reported and the supporting documentation was considered for the additional payment reflected under the allowance.

Highmark will conduct a one-time review of the supporting medical documentation that was submitted with the claim. If, after reviewing the claim, Highmark determines that additional payment is not warranted, it will not review the supporting documentation a second time. In this case, Highmark will deny your claim and you will receive message code J6057.

If you submit a claim for a procedure with a 22 modifier and do not send the supporting medical records within 21 days, Highmark will process the claim without considering the 22 modifier and will notify you by including message code J6056 on your Explanation of Benefits form. Highmark will consider the procedure you reported at the standard allowance.

If you send supporting documentation to Highmark after your claim was processed, you should perform a claim inquiry through Availity. Specific instructions as to where to submit supporting documentation will be included in the response to your claim inquiry. If your organization is not already registered with Availity, go to the Register and Get Started with Availity Essentials webpage.

Assistant at Surgery: Modifiers 80, 81, 82, & AS

An assistant at surgery is defined as a physician, nurse practitioner, clinical nurse specialist, or physician assistant who is licensed and actively assists the physician in charge of a case in performing a surgical procedure.

Doctors of medicine (MDs) and doctors of osteopathic medicine (DOs) must report physician modifier 80, 81, or 82, as applicable, on claims for assistant at surgery services.

80 -- Assistant surgeon

81 -- Minimum assistant surgeon

82 -- Assistant surgeon (when qualified resident surgeon not available)

The AS modifier must be reported on the claim when billing assistant at surgery services provided by physician assistants (PA), nurse practitioners (NP), and clinical nurse specialists (CNS). This modifier is only valid for use by non-physician practitioners.

Highmark will reimburse eligible surgical procedures billed with modifiers 80, 81, 82, and AS if criteria are met. Payment may be made for surgical procedures with these modifiers only if the services of an assistant surgeon are applicable. Please see Highmark Reimbursement Policy Bulletin RP-001 Assistant at Surgery Services for reimbursement information.

In addition, please see the following medical policies for your service area for eligibility criteria for assistants at surgery:

- Commercial: Medical Policy S-16 Assistant Surgery Eligibility Criteria

- Medicare Advantage: see the Medicare Advantage Medical Policies are available on CMS’ Medicare Coverage Database website.

Note: Please see also the information on the Delaware state mandate below.

Co-Surgery: Modifiers 62

Co-surgeons are defined as two or more surgeons, working together simultaneously as primary surgeons, to perform distinct parts of an operative procedure. Co-surgery is always performed during the same operative session.

When two surgeons work together as primary surgeons performing distinct parts of a procedure, each surgeon should report their distinct operative work by adding modifier 62 - two surgeons to the applicable procedure code(s) on the claim. Highmark will reimburse eligible surgical procedures billed with modifier 62 if criteria are met. Please see Highmark Reimbursement Policy Bulletin RP-002 Co-Surgery.

- Coverage guidelines for co-surgery can be found in Medical Policy S-112 Co-Surgery for commercial members. For Medicare Advantage members, please see the Medicare Advantage Medical Policies are available on CMS’ Medicare Coverage Database website.

For additional information for Delaware, please see the Delaware state mandate information provided below.

Please Note: Co-surgery is not the same as “team surgery,” which is defined as two or more doctors, usually with different skills and of different specialties, working together to carry out various procedures of a complicated surgery.

Delaware State Mandate

Effective January 1, 2000, the Delaware Insurance Department adopted Regulation 1312 (formerly Regulation 83), which sets standards of payment for surgical assistants (including co-surgeons). The Delaware Regulation requires carriers to apply Medicare rules in determining whether surgical assistants and co-surgeons are eligible for reimbursement. Claims for assistant and co-surgery pay according to Centers for Medicare & Medicaid (CMS) guidelines (see CMS Online Manual, Pub. 100-04. Chapter 12). This regulation applies to Delaware health insurance policies that follow Delaware state mandates.

For More Information

Highmark reimbursement policies and medical policies are available on the Provider Resource Center. Reimbursement policies are found in Claims & Authorization then look under Reimbursement Programs. Medical policies are in Policies & Programs. Click on Medical Policy.

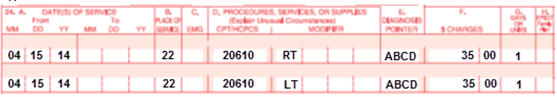

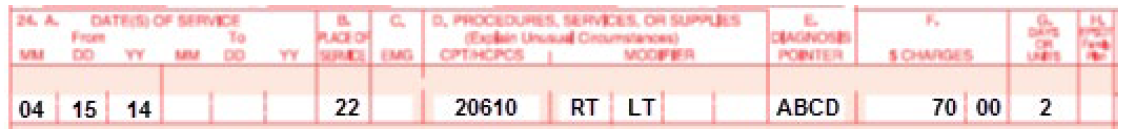

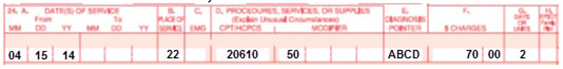

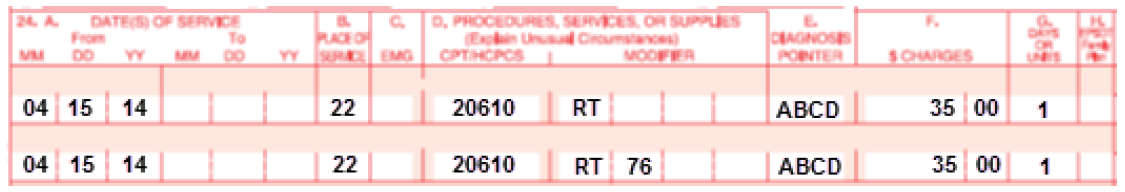

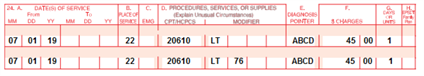

Bilateral Procedures (Examples on 02/12 1500 Claim Form)

When reporting procedures that were performed bilaterally, you must report the correct number of services to correspond with the modifier(s) you report. There are several ways to report bilateral procedures. Note: Please see the next section of this unit for changes effective July 1, 2019.

“Right” and “left” modifiers

If you report bilateral services on two lines of service, report an RT modifier on one line and an LT modifier on the other. The number of services on each line should be “1.”

If you report bilateral services on one line of service, report RT and LT modifiers. The number of services should be “2.”

“50” modifier

Bilateral procedures that are performed at the same operative session. If you report a “50” modifier to indicate bilateral procedures, report only one line of service. The number of services should always be “2.”

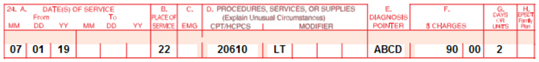

Multiple services on the same side of body

If you report multiple services performed on the same side of the body (e.g., right shoulder, right hip), you may follow either of these examples:

or

In this case, the 76 modifier must be reported on the second line that reports the same procedure code for correct payment to be made.

Effective for claims processed on and after July 1, 2019, Highmark will more closely follow the Centers for Medicare & Medicaid (CMS) reporting and reimbursement guidelines for bilateral procedures.

Bilateral procedures are procedures performed on both sides of the body during the same operative session or on the same day. Reimbursement for bilateral procedures is based on the modifier(s) reported as well as the Medicare Physician Fee Schedule (MPFS) bilateral indicator. Correct bilateral billing will ensure timely and accurate processing of these claims.

Modifiers for Bilateral Procedures

Modifier 50 applies to bilateral procedures performed on both sides of the body during the same operative session.

Modifiers RT (Right) and LT (Left) are reported when bilateral procedures occur on the same day but not during the same operative session.

MPFS Bilateral Indicators

The MPFS bilateral indicators identify whether a procedure is allowed to be performed bilaterally and if payment adjustment rules apply.

|

Indicator |

Description |

|---|---|

|

0 |

Bilateral surgery payment adjustment does not apply. |

|

1 |

Bilateral surgery payment adjustment does apply (150%). Use 50 modifier if bilateral. Units = 1. |

|

2 |

Bilateral surgery payment adjustment does not apply. Already priced as bilateral. Do not use 50 modifier. Units = 1. |

|

3 |

Bilateral surgery payment adjustment does not apply. Typically radiology or diagnostic tests. |

|

9 |

Bilateral surgery concept does not apply. |

The bilateral indicators for procedure codes can be found by using the searchable Physician Fee Schedule Look-Up Tool available at: https://www.cms.gov/apps/physician-fee-schedule/overview.aspx

Reporting Modifiers and Units of Service

When reporting procedures that were performed bilaterally, you must report the correct number of services to correspond with the modifier(s) you report.

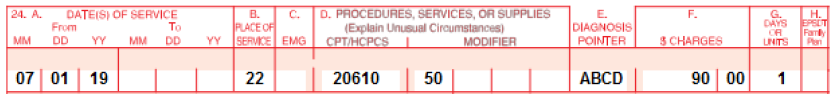

Bilateral Modifier 50

Modifier 50 is used to report bilateral procedures that are performed at the same operative session. When reporting modifier 50 to indicate bilateral procedures, report the procedure on only one line. The number of services should always be “1.”

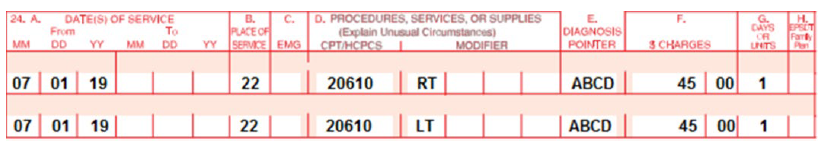

Right (RT) and Left (LT) Modifiers

This option is used when bilateral services are performed on both sides of the body on the same day but not during the same operative session. RT and LT modifiers are not used when modifier 50 is appropriate.

When reporting bilateral services using RT and LT modifiers, report modifier RT on one line and modifier LT on the other. The number of services on each line should be “1.”

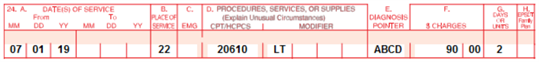

Multiple bilateral services on the same side of the body

Modifiers RT and LT are also used to report bilateral procedures codes when services are performed on only one side of the body. Procedures are reported with either the RT or LT modifier indicating the side of the body on which the procedures were performed.

If you report the same procedure performed in multiple locations on the same side of the body (e.g., right shoulder, right hip), you can report the services on either one or two claim lines. If reporting on one claim line, report the appropriate modifier for laterality (RT or LT) and the applicable number of units:

If you report multiple services for the same side of the body on separate claim lines, you must append modifier 76 for the second line that reports the same procedure code for correct payment to be made:

Payment Rules

The bilateral indicators with their payment rules are listed below:

|

Bilateral Indicator |

Payment Rules |

|---|---|

|

0 |

150% payment adjustment for bilateral procedures does not apply. Codes with this identifier are typically unilateral and modifier 50 is not billable. If the procedure is reported with modifier 50 or with modifiers RT and LT, Highmark will base payment for the two sides on the lower of:

|

|

1 |

150% payment adjustment for bilateral procedures applies. If the code is billed with the bilateral modifier or is reported twice on the same day by any other means (e.g., with RT and LT modifiers or with a “2” in the units field), Highmark will base payment for these codes when reported as bilateral procedures on the lower of:

|

|

2 |

150% payment adjustment for bilateral procedure does not apply. Codes with this identifier are typically identified as bilateral in the code description and modifier 50 is not billable. Fees are already based on the procedures being performed as a bilateral procedure. If the procedure is reported with modifier 50 or is reported twice on the same day by any other means (e.g., with RT and LT modifiers with a “2” in the units field), Highmark will base payment for both sides on the lower of:

|

|

3 |

The usual payment adjustment for bilateral procedures does not apply. Codes with this identifier are typically radiology procedures or other diagnostic tests not subject to bilateral rules. If the procedure is reported with modifier 50 or is reported for both sides on the same day by any other means (e.g., with RT and LT modifiers or with a “2” in the units field), Highmark will base payment on each side or organ or site of a paired organ on the lower of:

|

|

9 |

Codes with this identifier do not apply to the bilateral concept. Modifier 50 is not billable. |

Coding Examples

Below are examples of both correct and incorrect coding of bilateral procedures performed on both sides of the body during the same operative session:

Correct Coding for Bilateral Procedures

|

Procedure code |

Bilateral Indicator |

Modifier reported |

Units reported |

HCPCS Code Descriptor and Rationale |

|

23515 |

1 |

50 |

1 |

“Open treatment of clavicular fracture, includes internal fixation, when performed.” Rationale: Code description does not identify procedure as bilateral; report modifier 50 with“1” unit of service. |

|

64488 |

2 |

1 |

“Transversus abdominis plane (TAP) block (abdominal plane block, rectus sheath block) bilateral; by injections (includes imaging guidance, when performed).” Rationale: Code description identifies the procedure as bilateral; report procedure code without a modifier and with “1” unit of service. |

|

|

52290 |

2 |

1 |

“Cystourethroscopy; with ureteral meatotomy, unilateral or bilateral.” Rationale: Code description identifies procedure as unilateral or bilateral; report procedure code without a modifier and with “1” unit of service. |

|

|

73070 |

3 |

50 |

1 |

“Radiological examination, elbow; two views.” Rationale: Code description does not identify procedure as bilateral; report modifier 50 and “1” unit of service for bilateral services. |

|

23515 |

1 |

RT and LT |

2 |

Do not use modifiers RT and LT on same claim line when modifier 50 applies. |

|

64488 |

2 |

50 |

2 |

Code description identifies procedure as bilateral. |

|

52290 |

2 |

50 |

1 |

Code description identifies procedure as unilateral or bilateral. Do not use modifier 50 or report 2 units of service. |

|

73070 |

3 |

RT and LT |

2 |

Do not use modifiers RT and LT on same claim line when modifier 50 applies. |

Effective beginning April 1, 2016, Highmark follows Medicare’s method of counting minutes for timed therapy codes for professional services for our commercial plans. When more than one service represented by 15-minute timed codes is performed in a single day, the total number of minutes of service determines the number of timed units billed.

Guidelines

Based on the work value of these codes, the expectation is that the provider’s direct patient contact time for each unit will average 15 minutes in length. If only one service is provided in a day, providers should not bill for the services performed for less than eight minutes.

For any single timed CPT code in the same day measured in 15-minute units, providers bill a single 15-minute unit for treatment greater than or equal to eight minutes through and including 22 minutes. If the duration of a single modality or procedure in a day is greater than or equal to 23 minutes, through and including 37 minutes, then two units should be billed. The pattern remains the same for treatment times in excess of the chart below.

Timed intervals for one through eight units are as follows:

|

Minutes |

Units |

|---|---|

|

8 – 22 |

1 |

|

23 – 37 |

2 |

|

38 – 52 |

3 |

|

53 – 67 |

4 |

|

68 – 82 |

5 |

|

83 – 97 |

6 |

|

98 – 112 |

7 |

|

113 - 127 |

8 |

Example 1

7 Minutes of neuromuscular re-education (97112)

7 Minutes therapeutic exercise (97110)

7 Minutes manual therapy (97140)

21 Total Timed Minutes

Appropriate billing is for one unit. The qualified professional would select one appropriate CPT code (97112, 97110, or 97140) to bill since each code was performed for the same amount of time and only one unit is allowed based on the total timed minutes.

Example 2

18 Minutes therapeutic exercise (97110)

13 Minutes of manual therapy (97140)

10 Minutes of gait training (97116)

8 Minutes of ultrasound (97035)

49 Total Timed Minutes

Appropriate billing is for three units. Bill the procedures you spent the most time providing. You would have one unit each of 97110, 97116, and 97140. You are unable to bill for the ultrasound because the total time of timed units that can be billed is constrained by the total timed code treatment minutes (e.g., you may not bill four units for less than 53 minutes total time regardless of how many services were performed). You would still document the ultrasound in the notes.

For More Information

The Centers for Medicare & Medicaid Services (CMS) claims processing Publicationn100-04 can be referenced for additional details.

Claim frequency type codes are used when billing to indicate whether a claim is a new, original claim or an adjustment of a previously adjudicated (approved or denied) claim.

Valid Frequency Type Claims

There are three valid Frequency Type claims that can be initiated:

- Frequency Type 1 is an original claim. All new claims are submitted with this value.

- Frequency Type 7 is a replacement of a prior claim. Frequency Type 7 is used to correct data reported incorrectly on the original claim. The original claim number assigned by Highmark is required on this type of submission.

- Frequency Type 8 is a void/cancellation of a prior claim. Frequency Type 8 is used to completely void a claim that was reported in error. The original claim number assigned by Highmark is required on this type of submission.

Electronic 837P Adjustment Requests

The HIPAA 837P allows you to submit a claim adjustment request electronically using a valid Frequency Type code. Highmark’s automated process allows us to process most of these adjustment requests with both the retraction and the repayment on the same remittance.

In the HIPAA 837P Claim Transaction, the Frequency Type Code is reported in the 2300 Loop, CLM05-3 element. The original claim number is reported in Loop 2300, ORIGINAL REFERENCE NUMBER (ICD/DCN) REF segment.

Note: Adjusted claims can be submitted within Availity®.

1500 Paper Claim Adjustments

When submitting an adjustment request on a paper claim, enter a 7 for a corrected/replacement claim or an 8 to void a prior claim in Box 22 RESUBMISSION CODE, with the original Highmark claim number entered in the ORIGINAL REF. NO. field.

Frequency Type 7 – Replacement of a Prior Claim

Frequency Type 7 is used when a claim has been processed for payment but you identify an error on the original claim that needs to be corrected. The information you enter on the replacement claim represents a complete or partial replacement of the previously submitted claim.

Replacement claims can be submitted when a service was billed with an error such as the following:

- Incorrect procedure or diagnosis code

- Incorrect place of service

- Incorrect total charge

- Incorrect units

The replacement claim will be processed as the new claim, and the original claim in adjusted claim link (ORIG CLAIM NO) will be retracted. The new payment amount will be reflected on the replacement claim.

Providers should not "write off" these amounts as contractual obligation. If the original claim is adjudicated to reflect member liability (e.g., copay or coinsurance), the member is still responsible for these amounts.

Frequency Type 8 – Void/ Cancellation of a Prior Claim

The use of Frequency Type 8 reflects the entire elimination of a previously submitted claim. This code will cause the claim to be completely canceled from Highmark’s system. A voided claim can be submitted when changes such as the following are necessary:

- Change of provider number

- Change to member identification

The replacement claim data is used to void the original claim from Highmark’s system and normal offset processes are followed.

The Frequency Type 8 void/cancellation claim will be reflected as a denied claim on the EOB and/or electronic remittance (835):

- Denials on the EOB will report proprietary code E0775 (“The adjustment request received from the provider has been processed. The original claim has been adjusted based on the information received.”).

- On the 835, Claim Adjustment Group and Reason Code CO129 (“Prior processing information appears incorrect”) will be used to deny the claim.

- Remark Code N770 (“The adjustment request received from the provider has been processed. Your original claim has been adjusted based on the information received.”) will also be used on these claims.

Exceptions: Manual Processing of Re-adjustment Claims

Although the automated process handles the majority of electronically submitted adjustments, there are certain categories of adjustments that still require manual intervention. Among these are adjustments to previously adjusted claims.

Important: Providers should make every effort not to submit adjustments on previously adjusted claims.

The original claim number assigned by Highmark is required for all adjustment Frequency Type claims. This instruction still applies to claims that have already been adjusted and now require a second (or subsequent) adjustment process.

As a reminder, Highmark bases its payment for each adjustment on the updated original claim rather than the rejected Frequency 7 or Frequency 8 claims. To expedite this manual process, please report the original claim number — not the number of the previous adjustment bill — in the REF-ORIG-ICN-DCN field of the new Frequency Type 7 or Type 8 claim.

For the most efficient processing of anesthesia services, submit claims electronically. If you bill electronically, please refer to the Highmark EDI Reference Guide, available on the Highmark EDI Services website, for billing instructions. You can access the website from the Provider Resource Center by selecting Claims & Authorization from the main menu, then Reimbursement Resources.

Coverage for services may vary for individual members, based on the terms of the benefit contract. Please check Highmark members’ benefits via Availity Essentials® or, if not Availity-enabled, call Provider Service. The listing of a procedure code and/or terminology in this section does not necessarily indicate coverage.

For more specific information about anesthesia services, please refer to Highmark Medical Policy. To access, select Policies & Programs from the main menu, and then click on Medical Policy.

Anesthesia Procedure Codes

Use the national CPT (Current Procedural Terminology) anesthesia five-digit procedure codes (00100-01999) to report the administration of anesthesia along with national anesthesia modifier codes.

If you report “not otherwise specified” (NOS) or “not otherwise classified” (NOC) anesthesia services, include an appropriate surgical HCPCS procedure code as the description of the actual service or surgery performed. If the only suitable surgical HCPCS procedure code is an NOC, you must include a complete description of the service performed.

Highmark will only accept a complete description of the services performed. Highmark will not accept the terminology of a national procedure code as a description of the service performed. You must describe the actual service or surgery performed; otherwise, Highmark may reject your claim.

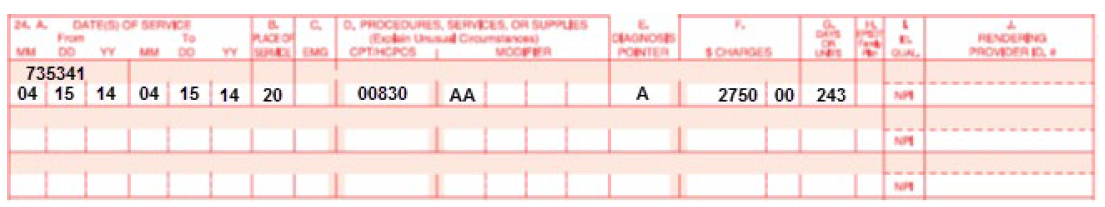

Examples of NOS/NOC Reporting

Below are some examples of how to report “not otherwise specified” or “not otherwise classified” anesthesia services in conjunction with the 7 qualifier in the shaded lines of Item Number 24 on the 02/12 version of the 1500 Claim Form.

If the surgical procedure code is not a NOS/NOC surgical service, please report as follows:

When the surgical procedure code is a NOS/NOC surgical service, report as follows:

Payment of Anesthesia Services

The following types of anesthesia qualify for payment as anesthesia services:

- Inhalation

- Regional:

- Spinal (low spinal, saddle block)

- Epidural (caudal)

- Nerve block (retrobulbar, brachial plexus block, etc.)

- Field block

- Intravenous

- Rectal

- Moderate (conscious) sedation

Anesthesia for diagnostic or therapeutic nerve blocks and injections (01991, 01992 — when the block or injection is performed by a different provider) is eligible for payment.

Local anesthesia (A9270) which is direct infiltration of the incision, wound, or lesion is not a covered service.

Payment for anesthesia services is evaluated according to the base unit value, plus time units, plus eligible modifying units when appropriate, multiplied by a monetary conversion factor.

Anesthesia Base Units

Highmark applies anesthesia base units to procedure codes to determine reimbursement and uses Centers for Medicare & Medicaid Services (CMS) base units for reimbursement determination. Base unit values have been assigned to most anesthesia services (procedure codes 00100-01999) to reflect the difficulty of the anesthesia service including the usual pre-operative and postoperative care and evaluation.

The base value for anesthesia when multiple surgical procedures are performed is the base value for the procedure with the highest unit value. No payment is allowed for the base unit value of a second, third, etc., procedure.

Anesthesia Time Units

Anesthesia time begins when the anesthesiologist or CRNA is first in attendance with the patient for the purpose of creating the anesthetic state. Anesthesia time ends when the anesthesiologist or CRNA is no longer in personal attendance, that is, when the patient may be safely placed under customary postoperative supervision. You must document this time in the anesthesia record, but do not report start and stop times on a claim.

Report the actual time spent administering anesthesia as minutes on the claim. Time must be indicated on all anesthesia claims. Highmark will convert total minutes to time units. A “time unit” is a measure of each 15-minute interval of the actual time reported. Time units are calculated by dividing the total minutes of anesthesia time reported by 15, rounding to one decimal place (e.g., total anesthesia time of 48 minutes divided by 15 equals 3.2 time units). On the 1500 Claim Form, report total anesthesia time as minutes in Item Number 24G, “DAYS or UNITS.”

Exception: Report units, not minutes, for moderate (conscious) sedation procedure codes 99143-99145 and 99148-99150. More information is available on moderate sedation later in this unit.

Medical Direction (Supervision) of Anesthesia Overview

Highmark defines the medical direction or supervision of anesthesia as direction, management, or instruction of anesthesia by one who is physically present or immediately available in the operating suite. A physician performing medical direction should not actually administer anesthesia.

Highmark limits reimbursement to the medical direction of no more than four anesthesia services being performed concurrently. When the physician is medically directing more than four procedures concurrently, he or she must submit documentation of the medical necessity for directing more than four procedures. Highmark will then review the claim on an individual consideration basis.

A physician medically directing four or fewer anesthesia procedures can concurrently:

- Address an emergency of short duration in the immediate area;

- Administer an epidural or caudal anesthetic to ease labor pain;

- Provide periodic, rather than continuous, monitoring of an obstetrical patient;

- Receive patients entering the operating suite for the next surgery;

- Check or discharge patients in the recovery room; or

- Handle scheduling matters.

Medical Direction (Supervision) of Anesthesia Modifiers

To identify who performed the anesthesia service, please report the appropriate anesthesia procedure code modifiers in conjunction with codes 00100-01999. Do not report the modifier’s description on the claim form.

|

Modifier |

Description |

|---|---|

|

AA |

Anesthesia services performed personally by anesthesiologist. (The AA modifier is one of several modifiers Highmark requires to identify who is performing an anesthesia service. Although this modifier’s terminology states, “performed personally by an anesthesiologist,” any duly licensed and trained health care professional who is personally performing anesthesia services can report it. The AA modifier is not limited to physicians who specialize in anesthesiology.) |

|

AD |

Medical supervision by a physician: More than four concurrent procedures. |

|

GC |

This service has been performed in part by a resident under the direction of a teaching physician. |

|

QK |

Medical direction of two, three, or four concurrent anesthesia procedures. |

|

QX |

CRNA (Certified Registered Nurse Anesthetist) service with medical direction by a physician. |

|

QY |

Medical direction of one CRNA by an anesthesiologist. |

|

QZ |

CRNA service without medical direction by a physician. |

|

47 |

Anesthesia by surgeon: Regional or general anesthesia provided by the operating surgeon may be reported by adding modifier 47 to the basic service. (This does not include local anesthesia.)

|

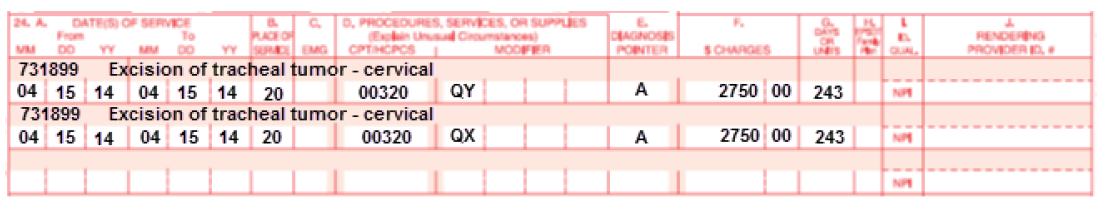

Medical Direction (Supervision) of Anesthesia Reporting/Payment

Medical Direction of a physician-in-training (e.g., intern or resident) – Report modifier GC. Payment will be made in the same manner as for the anesthesiologist’s personal performance of the anesthesia service.

Medical Direction of an employed CRNA – When an anesthesiologist medically directs a CRNA, hired and paid by the anesthesiologist, two lines on the claim form are required when reporting the medical direction. Report modifiers QK and QX or QY and QX, as appropriate. Payment is made in the same manner as for the anesthesiologist’s personal performance of the anesthesia service.

The employer (anesthesiologist) must be immediately available within the operating suite or within the immediate vicinity to assume primary care of the patient, if needed.

Report the name and Highmark provider ID number including the alpha prefix and/or NPI (National Provider Identifier) of the physician who is medically directing the service in Item Number 24J of the 1500 Claim Form. Report the name of the physician who is medically directing the service in Item Number 31 of the claim form. Do not include the CRNA’s name on the claim form.

Medical Direction of Non-Employed CRNA – 50 percent total payment: When an anesthesiologist medically directs a CRNA not employed by the anesthesiologist, e.g., hospital compensated, report modifier QK or QY, as appropriate. Payment of 50 percent of the fee allowed for the anesthesiologist’s personal performance of the anesthesia services is made to the anesthesiologist.

Medical Direction of Independently Practicing (non-employed) CRNA – 50 percent/50 percent total payment: When an anesthesiologist medically directs a CRNA who directly bills his/her services on a fee-for-service basis, i.e., independently practicing, the anesthesiologist should report modifiers QK or QY, as appropriate. The CRNA should report modifier QX. Payment of 50 percent of the fee that is allowed for the anesthesiologist’s personal performance of the anesthesia services is made to the anesthesiologist. The remaining 50 percent is paid to the CRNA who is directly billing his/her services on a fee-for-service basis.

Anesthesia Services Personally Performed by Physician – Report modifier AA when:

- The physician personally performs the entire service; and

- The physician is present in the operating room for the entire case and is actively participating in the administration of anesthesia, even if an anesthetist assists in the care of the patient.

*For additional information, please see Highmark Reimbursement Policy RP-033 Anesthesia Services.

Note: Effective Nov. 1, 2018, this information applies to Highmark West Virginia.

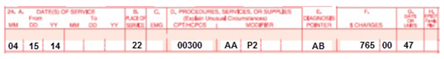

Physical Status Units

Physical status units may be used to report the physical status of the patient undergoing surgery under anesthesia. Physical status should be reported under the appropriate modifier (P1-P6).

Exception: You can report physical status with the applicable modifier. Report this modifier only in conjunction with the appropriate anesthesia procedure code (00100-01999).

The list of modifiers to report physical status include:

|

Modifier |

Description |

Modifying Units |

|---|---|---|

|

P1 |

A normal, healthy patient |

0 |

|

P2 |

A patient with a mild systemic disease |

0 |

|

P3 |

A patient with a severe systemic disease |

1 |

|

P4 |

A patient with a severe systemic disease that is a constant threat to life |

2 |

|

P5 |

A moribund patient who’s not expected to survive without the operation |

3 |

|

P6 |

A declared brain-dead patient; organs removed for donor purposes |

0 |

1500 Claim Form (02/12) Claim Example

1500 claim example for anesthesia services personally performed by physician:

Administration of Anesthesia for Surgical/Nonsurgical Procedures, Same Provider

Anesthesia administered for covered services is eligible when rendered by a professional provider other than the operating surgeon, assistant surgeon, or attending professional provider. When anesthesia is reported by the operating surgeon, assistant surgeon, or attending professional provider, it is not covered. A participating, preferred, or network provider can bill the member for the denied anesthesia service.

A benefit exception is anesthesia administered by the operating surgeon, assistant surgeon, or attending professional provider for covered oral surgical procedures. This anesthesia is eligible for payment in addition to the oral surgery when performed in any place of service other than inpatient.

Use modifier 47 (anesthesia by surgeon) when general or regional anesthesia has been administered by the operating surgeon.

Modifier 59 is appropriate to use when a nerve block and surgery are reported by the same provider as treatment for two separate and distinct conditions, i.e., the nerve block is not performed as anesthesia for the surgery. In this instance, modifier 59 should be reported in conjunction with the nerve block procedure code.

Note: When an associate or member of the same practice group (who is other than the operating surgeon, his assistant, or attending provider) administers anesthesia, payment can be made for covered anesthesia services.

Moderate (Conscious) Sedation

Moderate sedation, also known as conscious sedation, induces an altered state of consciousness that minimizes pain and discomfort through the use of pain relievers and sedatives. Patients who receive moderate sedation usually are able to speak and respond throughout the procedure.

Effective January 1, 2017, the administration of moderate sedation for specified covered procedures that the sedation supports is eligible for separate payment. When moderate sedation has been administered by the operating surgeon who is also performing the procedure, report codes 99151-99153, G0500, as appropriate. Report codes 99155-99157, as appropriate, for moderate sedation for covered surgical services performed by other than the operating surgeon, assistant surgeon, or attending professional.

For moderate (conscious) sedation services on both electronic and paper claims, the provider must report units, not minutes, for codes 99151-99153, 99155-99157, and G0500. In addition, certification modifiers are not required when these codes are reported.

Other Modifiers

If anesthesia must be administered to a patient at two separate and distinct times during the same day, you must identify each anesthesia service performed within the separate session. Report modifier 78 or 79, as appropriate, on each service line of the claim form.

78 – Return to the operating room for a related procedure during the

postoperative period

79 – Unrelated procedure or service by the same physician during the

postoperative period

Consultation Services by an Anesthesiologist

Medicare Advantage Providers Only

Highmark will pay for a consultation (pre-operative work-up) performed by an anesthesiologist prior to surgery in accordance with the member’s benefits.

A consultation is defined as a professional service furnished by a second physician at the written or verbal request of the attending physician. It includes a history, examination of the patient, evaluation of tests when applicable, and a written report filed with the patient’s permanent record.

Anesthesia Related to Obstetrical Care

Anesthesia related to obstetrical care may include any of the following procedures:

- 01958 – anesthesia for external cephalic version procedure

- 01960 – anesthesia for vaginal delivery only

- 01961 – anesthesia for cesarean delivery only

- 01962 – anesthesia for urgent hysterectomy following delivery

- 01963 – anesthesia for cesarean hysterectomy without any labor analgesia/anesthesia care

- 01965 – anesthesia for incomplete or missed abortion procedures

- 01966 – anesthesia for induced abortion procedures

- 01967 – neuraxial labor analgesia/anesthesia for planned vaginal delivery

- 01968 – anesthesia for cesarean delivery following labor analgesia

- 01969 – anesthesia for cesarean hysterectomy following labor analgesia

- 62273, 62281, 62282 – injection/nerve blocks (no catheter insertion)

When epidural anesthesia care is provided either 1) during labor only, or 2) during labor and vaginal delivery, code 01967 should be reported. The total time reported should reflect actual time in personal attendance (i.e., “face time”) with the patient. Payment for code 01967 will be based on the appropriate number of base units (BU) and total time units (TU) in attendance with the patient either during labor only or during labor with vaginal delivery.

When procedure code 01967 is reported in conjunction with either 01968 or 01969, the base units and time units for each code should be reimbursed. Time units reported should reflect actual time in personal attendance (“face time”) with the patient. The appropriate anesthesia modifier should be reported with each code to determine the level of reimbursement for each code, i.e., 100 percent or 50 percent, as in the following examples:

Example 1: The anesthesiologist personally performs the labor epidural and the cesarean section:

| Line 1 | 01967AA | BU + TU x conversion factor = 100% |

| Line 2 | 01968AA | BU + TU x conversion factor = 100% |

Example 2: The anesthesiologist personally performs the labor epidural and medically directs a CRNA (non-employee) during the cesarean section.

| Line 1 | 01967AA | BU + TU x conversion factor = 100% |

| Line 2 | 01968QK | BU + TU x conversion factor x 50% = 50% |

Note: Procedure codes 01960, 01961, and 01962 should not be reported in conjunction with 01967.

Daily management of epidural drug administration (01996) is also eligible for separate payment after the day on which an epidural catheter is inserted. Daily management reported on the same day as the catheter insertion is not covered. A participating, preferred, or network provider cannot bill the member for daily management on the same day as the catheter insertion.

Maximum Time Units for Continuous Epidurals

For Highmark West Virginia, payment for continuous epidurals will be reimbursed up to a maximum of 15 time units for 01967, 01960, and 01961 and for the combined time billed with 01967 and 01968.

A maximum of eight time units will apply to the West Virginia Small Business Plan.

For Highmark New York, Epidural During Labor (01967):

- The reimbursement for epidural pain management during labor is determined by a base unit and a time unit with associated dollar allowances for each. Payment is capped at a maximum of 20 time units.

Guidelines

Do not range-date services, except in the following situations:

- DME monthly rentals.

- End stage renal disease (ESRD) related services.

- In-hospital medical visits may be range-dated if the services are identical and the visits were provided on consecutive dates of service within the same calendar month. An exception to this is prolonged detention care: Do not range-date these services even if rendered on consecutive days.

Note: Do not report future dates of service on the claim form. Only report services that have actually been rendered.

Reporting Dates for Radiation Therapy Code 77427

Five treatments, or “fractions,” of radiation therapy constitute a week of therapy whether or not the fractions occur on consecutive days. Since procedure code 77427 for radiation treatment management represents a week (or five fractions) of therapy management, the number of services reported for each multiple of five fractions should be one unit. The number of services reported for a week of five fractions would be one. Do not range-date these services. Submit code 77427 with a single date of service — not a date range. The date of the first fraction of therapy for the week being reported should be used as the date of service.

Additional information for reporting 77427:

- Date of treatment weeks should not overlap.

- Hyperfractions of radiation therapy occur when two smaller doses are given in one day of treatment. One week of hyperfractions would include 10 hyperfractions or five days. The number of services billed for that week should be one.

- When providing radiation therapy services, the notation “course of treatment ended” should only be used when the final treatment has been administered.

Reporting Requirements

For most services performed by a mid-level provider, it is the billing provider’s responsibility to report the mid-level provider as the performing provider on Medicare Advantage claims. The only exception to this would be for “incident to” services for which the billing provider will report the physician as the performing provider.

These requirements apply to nurse practitioners (NP), physician assistants (PA), clinical nurse specialists (CNS), and certified nurse-midwives (CNM).

Reimbursement for Services Performed by Mid-Level Providers

The reimbursement for all services not considered “incident to” is reduced when they are performed by a mid-level provider. Please see the following Highmark reimbursement policies for additional information:

- RP-001 Assistant at Surgery Services

- RP-010 Incident To Services

- RP-068 Mid-Level Practitioners and Advanced Practice Providers

Reimbursement policies are available on the Provider Resource Center under Claims & Authorization. Look under Reimbursement Programs.

Applicable Medicare Advantage Products

These reporting requirements and reimbursement cutbacks apply only to Highmark’s Medicare Advantage products, including:

- Freedom Blue PPO

- Community Blue Medicare PPO (PA Only)

- Community Blue Medicare Plus PPO (PA Central Region Only)

- Security Blue HMO–POS (PA Western Region only)

- Community Blue Medicare HMO (PA only)

For More Information

For more information on “incident to” billing, please see the Centers for Medicare & Medicaid Services (CMS) Publication 100-02, Medicare Benefit Policy Manual, Chapter 15, Sections 60, 60.1, 60.2, 60.3, and 60.4.

Reminder : CRNPS and PAS must be Enumerated & Listed on the Provider's File

Highmark, in compliance with Centers for Medicare & Medicaid Services (CMS) guidelines, requires all certified registered nurse practitioners (CRNPs) and physician assistants (PAs) to be enumerated and listed on the provider file under the Assignment Account for the group in which they practice. In order for CRNPs and PAs to be enumerated, Highmark must have their Medicare “Welcome” letters on file.

Once the practitioner is enumerated, the provider can update their Highmark provider file by using Provider Data Maintenance or Provider File Management in Availity®.

Split/Shared Visits

A split/shared Evaluation & Management (E&M) service is defined by Medicare Part B payment policy as a medically necessary encounter with a patient where a physician and a qualified non-physician practitioner (NPP), such as a nurse practitioner (NP) or physician assistant (PA), each personally perform a substantive portion of an E&M visit face-to-face with the same patient on the same date of service. A substantive portion of an E&M visit involves all, or some portion of, the history, exam, or medical decision making (all key components of an E&M service). Highmark follows this policy for our Medicare Advantage products.

The physician and the NPP both must be in the same group practice or employed by the same employer. The split/shared E&M visit applies only to selected E&M visits and settings (hospital inpatient, hospital outpatient, hospital observation, emergency department, hospital discharge, office and non-facility clinic visits, and prolonged visits associated with these E&M visit codes). The split/shared E&M policy does not apply to critical care services or procedures and cannot be reported in the skilled nursing facility (SNF) or nursing facility (NF) setting.

The rules for split/shared E&M services between physicians and NPPs, as summarized below, are described in the Medicare Claims Processing Manual, Chapter 12, Section 30.6.1:

- Office/Clinic Setting: When the physician performs the E&M service, or when the E&M service is a split/shared encounter between the physician and NPP, provided to an “established” patient, and meets “incident to” requirements, the service must be reported using the physician’s National Provider Identifier (NPI).

If “incident to” requirements are not met for the split/shared E&M service, the service must be billed under the NPP’s NPI, and payment will be made at the appropriate physician fee schedule payment. - Hospital Inpatient/Outpatient/Emergency Department Setting: When a hospital inpatient, hospital outpatient, or emergency department E&M is shared between a physician and an NPP from the same group practice and the physician provides any face-to-face portion of the E&M encounter with the patient, the service may be billed under either the physician’s or the NPP’s NPI number.

If there was no face-to-face encounter between the patient and the physician (e.g., if the physician participated in the service by only reviewing the patient’s medical record), then the service may only be billed under the NPP’s NPI.

Payment will be made at the appropriate physician fee schedule rate based on the NPI entered on the claim.

Sufficient medical record documentation is the key to proper reimbursement for split/shared E&M services.

Note: “Incident to” a physician’s professional services means that the services or supplies are furnished as an integral, although incidental, part of the physician’s personal professional services in the course of diagnosis or treatment of an injury or illness. Please refer to the Medicare Benefit Policy Manual, Chapter 15, Section 60.1 for more information about incident to requirements.

When you submit claims to Highmark for diagnostic or therapeutic radiology services or diagnostic medical services provided to hospital inpatients or outpatients, you must report the place of service as inpatient hospital or outpatient hospital, as appropriate. In these cases, you will be reimbursed only the professional component of the service.

Definitions

Outpatient – a patient, other than an inpatient, who is treated in a hospital, on hospital grounds, or in a hospital-owned or controlled satellite, when it has been determined that the satellite is an outpatient department of the hospital. This definition does not apply when a treating physician’s sole practice is located in a hospital or hospital-owned building; if the practice is not affiliated or controlled, in any way, by the hospital or a related entity; or, if the practice has been approved by Provider Data Analysis to be recognized as an office practice.

Inpatient – a patient who is an inpatient of a facility, such as a hospital or skilled nursing facility, at the time the procedure is performed. When an inpatient is taken outside the hospital setting, such as to a physician’s office, and is then returned to the hospital, the physician must report services according to the patient’s status, in this case, inpatient. Therefore, you must report only “inpatient” as the place of service, rather than the place, such as “office” or “outpatient hospital”, where the service actually was performed. For example, if a mobile ultrasound, MRI, or CT unit locates on hospital grounds one day each week, all services provided to patients on that day must be reported with inpatient or outpatient, but not office, as the place of service.

Facility Identification Numbers

You must report a facility’s National Provider Identification (NPI) number in addition to the facility name and address in Box 32 of the claim form. Claims submitted without the necessary information may result in payment delays.

For More Information

Please refer to Chapter 4.5: Outpatient Radiology and Laboratory for additional information on the requirements for privileging of providers who perform diagnostic imaging and for prior authorization of selected outpatient advanced diagnostic imaging services, such as MRIs, MRAs, CT scans, and PET scans.

Guidelines for Submitting FEP Claims

To ensure that your claims are accurately processed and paid without delay, please follow these guidelines in completing the claim form:

- When submitting claims for ambulance services, please include a completed trip report and detailed information concerning the medical necessity of the transport. The claim can be submitted electronically using the PWK segment.

- FEP Durable Medical Equipment (DME) claims: Claims submitted via paper or electronic method must be sent with a Certificate of Medical Necessity (CMN) the first time you submit a claim for the rental or purchase of a particular DME item. You can submit subsequent claims electronically for the same DME item while the CMN is in effect without submitting another copy of the CMN. The claim can be submitted electronically using the PWK segment with the CMN faxed or mailed as indicated above.

- Do not range date services.

- Medications: When providing information about medication, be sure to include the name, the dosage, and the individual charge for each drug. Be sure that this information is legible.

- Use the appropriate address when submitting paper claims:

|

Pennsylvania |

Delaware |

West Virginia: |

New York: |

|---|---|---|---|

|

FEP Claims |

Federal Employee Program |

FEP Claims Wheeling, WV 26003 |

Federal Employee Program Buffalo, NY 14240 |

- When reporting inpatient services, also report the service facility name and address.

- Submit FEP claims to the state where the services were rendered.

Exceptions: Lab providers should file FEP claims in the state where the lab tests were performed, not where the specimen is drawn. DME providers should file FEP claims in the state where the provider is located, not where the DME supplies are delivered. The provider locations are determined by the mailing address.

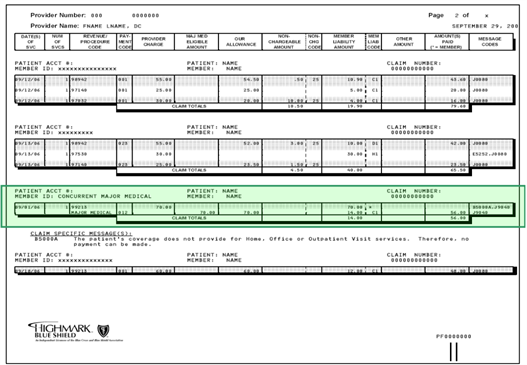

Concurrent Major Medical processing is a feature included with our Classic Blue Traditional product. Classic Blue Traditional offers basic medical-surgical, hospital, and major medical coverage as one benefit package. For processing and payment purposes, the major medical benefits are incorporated into the traditional benefits.

This process simplifies the billing process for providers who can report all professional services on one claim form and send it either electronically or on paper to Highmark. The services will process for basic coverage first, and then automatically process for major medical coverage. One Explanation of Benefits (EOB) shows you the details of both the basic and major medical processing.

You will receive the standard EOB for members who do not have concurrent major medical processing.

Sample EOB

The Major Medical service line is highlighted on this EOB example:

For patients with Highmark Medicare Part B supplemental coverage, it is not necessary to submit a claim for payment after you submit one to Medicare Part B. The supplemental payment by Highmark should automatically follow the Medicare Part B payment.

The Centers for Medicare & Medicaid Services (CMS) consolidated its claim crossover process under a special Coordination of Benefits Contractor (COBC) by means of the Coordination of Benefits Agreement. Under this program, the COBC automatically forwards Medicare claims to the secondary payer, eliminating the need for providers to separately bill the secondary payer.

Medicare Claims Cross Over to Blue Plans

The claims you submit to the Medicare carrier will cross over to the Blue Plan only after the Medicare carrier has processed them. The Medicare carrier automatically advises the Blue Plan of Medicare’s approved amount and payment for the billed services. Then the Blue Plan determines its liability and makes payment to the provider. This one-step process means that you do not need to submit a separate claim and copy of the Explanation of Medicare Benefits (EOMB) statement to the Blue Plan after you receive the Medicare carrier’s payment. Whether you submit electronic or paper claims, it is not necessary to send a separate claim and EOMB statement for the purpose of obtaining payment on a secondary claim.

Please allow 30 days for the secondary claim to process. If you have not received notification of the processing of the secondary payment, please do not automatically submit another claim. Rather, you should check the claim status via Availity® before resubmitting.

To streamline the claim submission process and save your practice time and money, consider revising the time frame for the automated resubmission cycle of your system to accommodate the processing times of these secondary claims.

If A Claim does not Cross Over

If you have not received payment from Highmark within 30 days and, after checking claim status in Availity, there is no indication of a claim, you can submit a claim to Highmark. Please be sure to submit the entire Explanation of Medicare Benefits statement.*

It is not necessary or recommended that you submit claims requiring attachments via paper. These supplemental claims can be submitted electronically using the Paperwork (PWK) segment. The Explanation of Medicare Benefits statement can be faxed or mailed to the applicable fax number or address as indicated below.

When submitting the EOMB, please use the PWK cover sheet for your service area:

- Delaware: PWK (Paperwork) Supplemental Claim Information Cover Sheet

- Pennsylvania: PWK (Paperwork) Supplemental Claim Information Cover Sheet

- West Virginia: Electronic Claims Attachment Cover Sheet

The cover sheet is also available on the Provider Resource Center. Select Resources & Education, and then click on Miscellaneous Forms which is under Forms. For additional guidance on using the PWK segment, please see the section in this unit titled “Claim Attachments for Electronic Claims.”

*Do not highlight the Medicare payments in question. Either circle or place an asterisk (*) next to the information you want to bring to our attention. Provide the patient’s Highmark identification number and his/her complete name and address.

|

Pennsylvania |

Delaware |

West Virginia |

|---|---|---|

|

Attention: Document Preparation/Image |

Attention: Document Preparation/Image |

Attention: CDC Area |

|

Fax to: 888-910-8797 |

Fax to: 888-910-9601 |

Fax to: 844-235-7266 |

|

Mail to: |

Mail to: |

Mail to: |

Paper Claim Submission

If you must submit a paper claim, mail the EOMB with a completed 1500 Claim Form (Version 02/12) to:

|

Pennsylvania |

Delaware |

West Virginia |

|

|---|---|---|---|

|

Medigap: |

All other products: |

Highmark Blue Cross Blue Shield Delaware |

Highmark Blue Cross Blue Shield West Virginia |

The following entities, which serve the noted regions, are independent licensees of the Blue Cross Blue Shield Association: Western and Northeastern PA: Highmark Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Choice Company, Highmark Health Insurance Company, Highmark Coverage Advantage Inc., Highmark Benefits Group Inc., First Priority Health, First Priority Life, Highmark Care Benefits Inc., or Highmark Senior Health Company. Central and Southeastern PA: Highmark Inc. d/b/a Highmark Blue Shield, Highmark Benefits Group Inc., Highmark Health Insurance Company, Highmark Choice Company or Highmark Senior Health Company. Delaware: Highmark BCBSD Inc. d/b/a Highmark Blue Cross Blue Shield. West Virginia: Highmark West Virginia Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Health Insurance Company or Highmark Senior Solutions Company. Western NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Cross Blue Shield. Northeastern NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Shield. ld.

All references to “Highmark” in this document are references to the Highmark company that is providing the member’s health benefits or health benefit administration and/or to one or more of its affiliated Blue companies.

All revisions to this Highmark Provider Manual (the “manual” or “Highmark Provider Manual”) are controlled electronically. All paper copies and screen prints are considered uncontrolled and should not be relied upon for any purpose.