Unit 3: Facility (UB-04/8371) Billing

6.3 Present on Admission/Adverse Events

6.3 National Correct Coding Initiative (NCCI) Edits

6.3 Guidelines for HIPPS Reporting

6.3 Outpatient Services Prior To An Inpatient Stay

6.3 Modifier Required for Off-Campus Outpatient Services

6.3 Skilled Nursing Facility Consolidated Billing

6.3 Skilled Nursing Facility Billing Outpatient Services

6.3 Guidelines for Skilled Nursing Facilities Billing Portable X-Ray Services for Medicare Advantage

6.3 Home Health Agency Billing Home Infusion Services for Medicare Advantage

6.3 Reimbursement for Inpatient Hospice When Discharge Status Indicates Expired

6.3 Diagnostic vs. Routine Pap Smears

6.3 Revised and Discontinued Bill Types for Home Health

6.3 Facility Billing Overview

Highmark requires facility providers to bill electronically via 837 Institutional (837I) electronic transactions. HIPAA-compliant UB Claim Submission is also available in Availity®. In some cases, claim submission may be necessary on UB-04 paper claim forms.

Billing Professional Services

Highmark requires hospitals to bill all services performed by physicians and associated professionals via an 837P transaction (or, in rare circumstances, a 1500 claim form).

If Highmark audits find professional services are billed in error on 837I/UB-04 claims, payments will be retracted.

Billing Highlights

Billing Highlights are available in Pennsylvania to help facilities identify the information from the UB-04 locator fields that are required when billing specific facility type claims. In addition, helpful tips are offered to assist facilities with providing the needed information for each facility type claim submitted to Highmark.

The Billing Highlights are available on the Provider Resource Center when accessed via Availity — select Claims from the main menu and look under Reimbursement Resources.

For More Information

Please see also Chapter 4.3: Facility-Specific Guidelines that contains information and guidelines specifically for facilities that may also include reporting guidelines (e.g., Observation Services).

6.3 Present on Admission/Adverse Events

Present on Admission (POA)

Highmark requires the submission of Present on Admission (POA) information on inpatient claims for all hospital providers. This applies to all inpatient acute care hospitals (including critical access hospitals and children’s inpatient facilities) for all claims.

This requirement is designed to identify and prevent additional reimbursement to the provider for situations in which specified conditions occur during the course of an inpatient stay but, were not present at the time of admission. This mechanism serves to implement Highmark's policy on hospital-acquired conditions in the inpatient acute care hospital setting.

Potential Reduction in Payment for Hospital Acquired Conditions (HAC)

Medicare Grouper for all Diagnosis Related Groups (DRG)-reimbursed inpatient acute care hospitals, including critical access hospitals for commercial business, features logic that prevents the assignment of a higher Medicare Severity Diagnosis Related Groups (MS-DRG) to a claim reporting certain conditions not present on admission (when no other condition on the claim would otherwise trigger a higher MS-DRG).

Highmark will also apply a separate methodology and process to potentially reduce payment to non-DRG reimbursed hospitals for claims reporting any of the following conditions if not identified as present on admission (in the absence of other complications or major complications on the claims):

- Foreign object retained after surgery

- Air embolism

- Blood incompatibility

- Stage III and IV pressure ulcers

- Falls and trauma

- Catheter-associated urinary tract infection (UTI)

- Vascular catheter-associated infection

- Surgical site infection-mediastinitis after coronary artery bypass graft (CABG)

- Manifestations of poor glycemic control

- Deep vein thrombosis (DVT) and pulmonary embolism (PE) following certain orthopedic procedures

- Infections after bariatric surgery

- Surgical site infection following certain orthopedic procedures

- Surgical site infection following cardiac implantable electronic device (CIED) procedures

- Iatrogenic pneumothorax with venous catheterization

Non-Payment for "Wrong" Surgical Events for All Hospital Providers

Consistent with Centers for Medicare and Medicaid Services (CMS) policy, Highmark will not make payment for the following three “wrong” surgical events:

- The wrong surgical or other invasive procedure was performed

- Surgery or other invasive procedure was performed on the wrong body part

- Surgery or other invasive procedure was performed on the wrong patient

Reimbursement Policy RP-036

For additional information applicable to Highmark commercial products, please refer to Highmark Reimbursement Policy Bulletin RP-036: Preventable Serious Adverse Events.

Reimbursement policies are available on the Provider Resource Center's Reimbursement Policies page.

6.3 National Correct Coding Initiative (NCCI) EDITS

The National Correct Coding Initiative (NCCI) edits were developed by the Centers for Medicare and Medicaid Services (CMS) to promote national correct coding methodologies and reduce paid claim errors resulting from improper coding and inappropriate payments. Highmark began to systematically follow CMS guidelines and apply Medically Unlikely Edits (MUEs), a subset of these edits, effective Jan. 1, 2012.

Highmark applies the NCCI edits on a systematic basis to outpatient facility claims rendered in an acute-care hospital for both commercial and Medicare Advantage business.

Systematic Application NCCI Edits

Although Highmark has always required contracted facilities to comply with industry coding standards such as those incorporated in the NCCI edits, it has not systematically applied this logic via claims edits under all reimbursement methods. Effective Oct. 1, 2013, Highmark expanded the application of the NCCI edits to all acute care hospitals for outpatient Commercial and Medicare Advantage facility claims in order to produce more accurate payments and reduce the need for claim adjustments due to clerical or coding errors.

The systematic edits will be applied based on the date of service of the claim submitted.

Quarterly Updates

Highmark is unable to implement CMS-driven reimbursement changes (such as changes to the NCCI edits) on the CMS effective date. In some cases, the changes are transmitted to Highmark via its software vendor and cannot be implemented until the vendor has distributed the updated software. Even when a software vendor is not involved, all such changes must be evaluated in light of Highmark contracts and system constraints prior to implementation.

Highmark's implementation of CMS-driven changes to the quarterly version updates to the NCCI edits will therefore occur after CMS' implementation and after appropriate evaluation.

6.3 Claim Adjustments

To make changes to claims that have already been submitted to Highmark, facility providers are to use Adjustment Bill Types XX7, XX8, or XX5 for claims previously submitted by paper and electronically.

Corrected/Adjustment Bill Types

Please follow the specific guidelines provided in the table below for Adjustment Bill Types XX8, XX7, and XX5:

|

Adjustment Bill Type |

When to Utilize |

Highmark Action |

|---|---|---|

|

XX5 Late Charges Only |

This code is to be used for submitting additional new charges or lines which were identified by the facility after the original claim was submitted (use XX7 for BlueCard®). |

Adjust the original claim to include the additional charges. |

|

XX7 Replacement of prior claim |

This code is to be used when a specific bill or line has been issued and needs to be restated in its entirety. When this code is used, Highmark will operate on the principle that the original bill is null and void, and that the information present on this bill represents a complete replacement of the previously issued bill. |

The replacement claim will be processed as the new claim, and the original claim in adjusted claim link (ORIG CLAIM NO) will be retracted. The new payment amount will be reflected on the replacement claim. If the replacement claim is denied, providers will be notified. |

|

XX8 |

This code reflects the elimination in its entirety of a previously submitted bill. Use of XX8 will cause the bill to be completely canceled from the Highmark system. |

Void the original claim on the remittance. |

Codes Used to Report Adjustment Claim on 835

Highmark uses the following codes to report adjustment claims on the 835:

- Claim Adjustment Group and Reason Code CO129 (“Prior processing information appears incorrect”) will be used to deny the claim.

- Remark Code N770 (“The adjustment request received from the provider has been processed. Your original claim has been adjusted based on the information received.”) will also be used on these claims.

Original Claim Number Required

The original claim number is required when submitting adjustment bill types XX5, XX7, and XX8 on claims via Availity's Claims and Encounters or HIPAA 837I.

The original claim number should be reported in the Adjustment Claim Link (ACL) field.

Exceptions

Although the automated process handles the majority of electronically submitted adjustments, there are certain categories of adjustments that still require manual intervention. Among these are adjustments to previously adjusted claims.

Highmark will make every effort to avoid separation between the retraction and repayment components of these adjustments.

Remittance Advice

The Highmark Remittance Advice informs providers of the amount Highmark will pay for a specific claim. It will also detail both paid and denied claims.

Please refer to Chapter 6.7: Payment/EOBs/Remittances for specific and detailed information pertaining to the Remittance Advice.

6.3 Billing Outpatient Services When Unplanned Inpatient Admission is Determined Not Medically Necessary

For emergency (urgent, unplanned) admissions, the hospital is asked to obtain an authorization within 48 hours of the admission or as soon as the necessary clinical information is available.

- If the inpatient admission is authorized, the hospital should follow normal billing protocols and report the emergency room or observation services on the member’s inpatient claim.

- If the inpatient admission is not authorized, the hospital should report the services provided as an outpatient claim after deciding not to appeal the inpatient denial or after the denial has not been overturned on appeal.

Claim Submission for Outpatient Service

Highmark recommends that facilities wait to submit claims until all authorization determinations are made and, if inpatient admission is not authorized, until the facility decides whether to pursue an appeal. When it is determined that inpatient admission is not medically necessary, all outpatient services provided (e.g., emergency, observation) may be billed.

If an inpatient claim was submitted prior to a final determination, the provider can submit a claim for the outpatient services that were provided if the inpatient claim was denied. The provider must first submit an XX8 adjustment claim to void the original inpatient claim, and then a new claim can be submitted for the outpatient emergency or observation services.

If a facility submits an inpatient claim to Highmark without seeking preservice review and the required authorization, the claim will deny. The facility can request a retrospective review and submit the applicable medical records for the claim to be considered for payment. Appeal rights would apply in the event of a medical necessity denial.

Note: Condition code 44 should not be billed to Highmark on an outpatient claim when an inpatient admission has been denied (applies to traditional Medicare only).

Medical Record Documentation

If billing for outpatient services when it is determined that criteria are not met for inpatient admission, the medical record should clearly support the services actually provided and billed.

6.3 Guidelines for HIPPS Reporting

Health Insurance Prospective Payment System (HIPPS) rate codes represent specific sets of patient characteristics (or case-mix groups) on which payment determinations are made under several prospective payment systems. Case-mix groups are developed based on research into utilization patterns among various provider types.

The Centers for Medicare and Medicaid Services (CMS) requires Health Insurance Prospective Payment System (HIPPS) codes on all Medicare Advantage claims for home health agency and skilled nursing facility providers, effective July 1, 2014.

Requirement

Highmark follows the CMS HIPPS reporting guidelines for both commercial and Medicare Advantage business. Home health and skilled nursing facility providers are required to submit the applicable HIPPS codes on claims for all commercial and Medicare Advantage Highmark members for dates of services on and after July 1, 2014.

Providers are required to report codes that are valid as of the date of service. Always consult the most current national UB Data Specifications Manual for the most updated list of codes.

This requirement does not change your current reimbursement method. Providers should continue to submit claims according to your contract.

Revenue Codes

Please report applicable revenue code that represent the prospective payment mechanism as follows:

|

Provider Type |

Revenue Code |

Guidelines |

|---|---|---|

|

Home Health |

0023 |

This revenue code (and the corresponding HIPPS codes) should be reported in addition to the revenue lines representing the home health service billed by the facility. |

|

Skilled Nursing Facility |

0022 |

This revenue code (and the corresponding HIPPS codes) should be reported in addition to the revenue lines representing the skilled nursing service billed by the facility. Bill the revenue line of 0022 with the appropriate Resource Utilization Group (RUG) code and the Assessment Reference Date (ARD). |

HIPPS Codes

Ensure the appropriate HIPPS code is reported on all Commercial and Medicare Advantage claim submissions. Generate a new HIPPS code for each home health or skilled nursing episode according to CMS guidelines.

6.3 Outpatient Services Prior to an Inpatient Stay

Highmark’s policy on outpatient services prior to an inpatient admission applies a “three-day rule.” Such services include, but are not limited to, Emergency Department (ED), Observation (OBS), and Pre-Admission Testing (PAT).

Background

The three-day rule, also known as the “72-hour rule,” concerns diagnostic services furnished by an admitting hospital , or an entity affiliated within the health same system, three days prior to, and including the date of the beneficiary’s admission; these services are considered inpatient services and are included in the inpatient payment.

When outpatient services have been performed within this designated period prior to an inpatient admission for an unrelated diagnosis, those services are not to be included on the inpatient claim. The hospital is permitted to separately bill the services if they are unrelated to the inpatient admission. However, if the non-diagnostic outpatient services are related to the inpatient admission, the services are considered inpatient services and are not separately reimbursable.

6.3 Modifier Required for Off-Campus Outpatient Services

Requirement

Hospitals are required to report modifier PO (“Services, procedures, tests and/or surgeries furnished at off-campus provider-based outpatient department”) with every Healthcare Common Procedure Coding System (HCPCS) or CPT (Current Procedural Terminology) code for all outpatient items and services furnished in an off-campus, provider-based department of a hospital.

This mandatory billing requirement will help the Centers for Medicare and Medicaid Services (CMS) collect data on the frequency of, type of, and payment for services provided in off-campus provider-based hospital departments. Highmark has adopted this requirement for all lines of business, Commercial and Medicare Advantage, for similar reasons.

Main Campus and Off-Campus Defined

The main campus of a provider is defined as “the physical area immediately adjacent to the provider’s main buildings, other areas and structures that are not strictly contiguous to the main buildings but are located within 250 yards of the main buildings.”

“Off-campus” references all other facilities or locations not meeting this requirement that are deemed to be provider based.

Where to Report on Claims

The PO modifier must be reported on your 837I electronic submissions (Loop 2400, SV2 Segment) and on any paper claim submissions (UB-04/CMS 1450 – Locator 44) for services performed at an off-campus provider-based outpatient department.

Reminder: Providers are required to provide the “Service Facility Location” information if it is different than the billing address (Loop 2310 E NM1, N3, and N4 on the 837I version 5010). For more information, see Chapter 6.1: General Claim Submission Guidelines.

6.3 Skilled Nursing Facility Consolidated Billing

The Balanced Budget Act of 1997 (BBA), Public Law 105-33, Section 4432(b), contains consolidated billing requirements for skilled nursing facilities (SNFs).

Consolidated billing requires the SNF itself to bill for the entire package of services that its residents receive, other than those individual types of services that appear on the list of exclusions specified in Section 1888(e)(2)(A)(ii) of the Social Security Act and regulations at 42 C.F.R. § 411.15(p)(2) or its successor.

Guidelines and Excluded Services

Highmark follows the Centers for Medicare and Medicaid Services (CMS) SNF consolidated billing guidelines for Medicare Advantage and commercial products.

There are a number of services excluded from SNF consolidated billing. These services are outside the Prospective Payment System (PPS) bundle, and are separately billable when furnished to a SNF resident by an outside supplier. The categories of services excluded from consolidated billing are:

- Physicians’ services furnished to SNF residents

- Physician assistants (PAs) working under a physician’s supervision

- Nurse practitioners and clinical nurse specialists working in collaboration with a physician

- Certified nurse-midwives

- Qualified psychologists

- Certified registered nurse anesthetists

- Services described in Section 1861(s)(2)(F) of the Social Security Act

- Services described in Section 1861(s)(2)(O) of the Social Security Act

- Hospice care related to a resident’s terminal condition

- An ambulance trip that conveys a beneficiary to the SNF for the initial admission or from the SNF following a final discharge

Technical Component of Physician Services

Many physician services include both a professional and technical component. Although the professional component is excluded from consolidated billing, the technical component is subject to consolidated billing.

The technical component of physician services must be billed to and reimbursed by the SNF.

Physician "Incident to" Services

The consolidated billing exclusions do not apply to physician “incident to” services furnished by someone else as “incident to” the practitioner’s professional services. These “incident to” services furnished by others to SNF residents are subject to consolidated billing and must be billed by the SNF itself.

Therapy Services

Section 1888(e)(2)(A)(ii) of the Social Security Act specifies that physical, occupational, and speech-language therapy services are subject to consolidated billing, regardless of whether they are furnished by (or under the supervision of) a physician or other health care professional.

Complex Services

Specific types of outpatient hospital services that are intensive, costly, or emergent that are not within the scope of care the SNF can provide are also excluded from consolidated billing. These services are billed by and payment is made to the provider who rendered the services. The medically necessary ambulance services that are furnished in conjunction with these services to transport the member to and from the hospital are also excluded from SNF consolidated billing.

These excluded categories include:

- Cardiac catheterization

- Emergency services

- Computerized axial tomography (CT) scans

- Radiation therapy services

- Magnetic resonance imaging (MRIs)

- Angiography

- Ambulatory surgery that involves the use of an operating room

- Certain lymphatic and venous procedures

Skilled Benefit Exhausted or Non-Skilled Level of Care

When a SNF provides care to a Medicare Advantage member who has either exhausted their skilled nursing benefit days or is receiving a non-skilled level of care, the SNF is no longer eligible for an inpatient per diem under Medicare Advantage.

However, the member may still use their Medicare Advantage coverage for certain Part B ancillary services. The SNF would be required to bill Highmark for all Part B ancillary services (including, but not limited to, lab, radiology, physical therapy, occupational therapy, speech therapy) provided to a Medicare Advantage member who is a resident of the SNF. This does not apply to durable medical equipment, prosthetics, orthotics, and respiratory equipment and to the complex services identified above.

This includes situations where the hospital’s phlebotomist draws or collects specimens at the SNF for laboratory services that are performed at the hospital. The SNF will need to make arrangements for reimbursement to the hospitals for payment of these services.

The hospital is not permitted to bill for these ancillary services when administered to members who are residents in a SNF.

Reimbursement

Medicare Part B authorized services for Medicare Advantage members will be reimbursed via the Highmark SNF Outpatient Fee Schedule for Medicare Advantage Members.

For More Information

For more detailed information, please visit the SNF Consolidated Billing page on the CMS website at: https://www.cms.gov/Medicare/Medicare-Fee-for- Service-Payment/SNFPPS/ConsolidatedBilling.html

6.3 Skilled Nursing Facility Billing Outpatient Services

The Centers for Medicare and Medicaid Services (CMS) allows skilled nursing facilities (SNFs) to provide physical, occupational, and speech therapy services on an outpatient basis for beneficiaries residing in assisted living, residential, or personal care settings. These outpatient therapy services are available under the Part B benefit and the SNFs bill the services via the 837I/UB-04.

Highmark also allows SNFs to bill for outpatient therapy services for Highmark members with commercial and Medicare Advantage coverage. However, different guidelines apply for commercial and Medicare Advantage. These guidelines are outlined below.

Commercial Facility Agreements

Commercial agreements with SNFs are only inpatient agreements and do not contain provisions for outpatient services. However, SNFs contracted with Highmark for commercial products are able to bill for outpatient physical, occupational, and speech therapy services under the conditions outlined below:

- All therapists must be credentialed and contracted with Highmark.

- The SNF must establish a Highmark Assignment Account in order to bill on behalf of the credentialed/contracted therapists.

- All services must be billed via an electronic 837 Professional transaction or a 1500 claim form.

Before a SNF can bill for outpatient therapy services rendered to Highmark members with commercial coverage, the SNF must secure a Highmark Assignment Account. The Assignment Account allows SNFs to bill on behalf of the therapists.

Highmark provides an online form to request an Assignment Account. To access the form, go to the Provider Resource Center's Provider Information Management Forms page.

Payment will not be made for outpatient therapy services under the Commercial SNF Agreement when services are billed on an 837I or UB-04 claim.

Medicare Advantage Facility Agreements

Medicare Advantage agreements cover inpatient, Part A exhaust, and limited outpatient therapy services in a skilled setting. SNFs may also bill for authorized Part B outpatient physical, occupational, and speech therapy services for Highmark Medicare Advantage members residing in an assisted living, residential, or personal care setting.

SNFs must bill outpatient therapy services provided to Highmark Medicare Advantage members via an electronic 837 Institutional transaction or a UB-04 claim form.

This section provides instructions to skilled nursing facilities (SNFs) when billing for portable X-ray services rendered to Highmark Medicare Advantage members who have exhausted Part A benefits or are no longer receiving a Medicare skilled level of care.

Background

When billing for portable X-ray services when a Medicare Advantage member has exhausted Part A benefits or is no longer receiving skilled care, the site at which the service is rendered determines whether the SNF or the portable X-ray provider is responsible for the service.

- When the portable X-ray service is provided in a participating SNF, the SNF is responsible for billing the service to Highmark via an 837I electronic transaction or UB-04 claim form.

- When the portable X-ray service is rendered in a personal care home, assisted living facility, or independent living unit of a retirement community organization, the member is not considered a patient of the SNF. Therefore, the service must be billed by the portable X-ray provider via an 837P electronic transaction or 1500 claim form, even if the site is located on the campus of a participating SNF.

When the SNF is responsible for billing Highmark for the portable X-ray services, the SNF should follow the instructions provided below.

Three Components of the Service

When a portable X-ray provider renders services to a Highmark Medicare Advantage member in a participating SNF and the member has exhausted their Part A benefits or is no longer receiving a skilled level of care, the SNF can bill for three components of the service:

- The taking of the X-ray itself;

- Setup; and

- Transportation of the X-ray equipment and personnel to the site where the service will be provided.

In each case, the SNF is to report revenue code 032X plus the procedure codes that most accurately and completely represent the services rendered. Units are required. In addition to the information below, all standard billing protocols apply.

X-Ray Itself

To bill for the X-ray itself, the facility must report revenue code 032X plus the procedure code that most accurately and completely represents the radiological service(s) rendered. National coding guidelines must be followed, including the selection of the most comprehensive code applicable to the services rendered.

Given the choice of the most comprehensive code, units must equal the number of times the services described by the procedure code were performed.

Setup

The setup component of a radiological procedure performed by a portable X-ray provider should be billed using revenue code 032X and procedure code Q0092.

For this component, units equal the number of eligible radiological procedures performed for the patient, except for re-takes of the same procedure.

Transportation for One Member

When only one Highmark Medicare Advantage member is seen by the portable X- ray provider during a given trip, the transportation component should be billed using revenue code 032X and procedure code R0070.

When Multiple Members Seen

The SNF may bill for transportation only once for any given trip regardless of how many Highmark Medicare Advantage members receive portable X-ray services during the trip. Therefore, procedure code R0070 may be reported on only one of the facility’s claims for the Highmark Medicare Advantage members serviced during the trip, as illustrated in the examples below.

Examples

In these scenarios, assume that all services were rendered in a participating SNF and to Highmark Medicare Advantage members who have exhausted their Part A benefits or are no longer receiving a Medicare skilled level of care.

Scenario 1: One Highmark Medicare Advantage Member is Seen During the Trip

Billing for Patient A

|

Component |

Revenue Code |

Procedure Code |

Units |

|

Transportation |

032X |

R0070 |

1 |

|

Setup |

032X |

Q0092 |

The number of eligible radiological services performed for this member |

|

Radiology Service |

032X |

As appropriate for the service provided |

The number of times the services describes by the procedure code were performed for this member during this trip |

Scenario 2: Three Highmark Medicare Advantage Member are Seen During the Trip

Billing for Patient A

|

Component |

Revenue Code |

Procedure Code |

Units |

|

Transportation |

032X |

R0070 |

1 |

|

Setup |

032X |

Q0092 |

The number of eligible radiological services performed for this member |

|

Radiology Service |

032X |

As appropriate for the service provided |

The number of times the services describes by the procedure code were performed for this member during this trip |

Billing for Patient B

|

Component |

Revenue Code |

Procedure Code |

Units |

|

Transportation |

032X |

None |

None |

|

Setup |

032X |

Q0092 |

The number of eligible radiological services performed for this member |

|

Radiology Service |

032X |

As appropriate for the service provided |

The number of times the services describes by the procedure code were performed for this member during this trip |

Billing for Patient C

|

Component |

Revenue Code |

Procedure Code |

Units |

|

Transportation |

032X |

None |

None |

|

Setup |

032X |

Q0092 |

The number of eligible radiological services performed for this member |

|

Radiology Service |

032X |

As appropriate for the service provided |

The number of times the services describes by the procedure code were performed for this member during this trip |

Return Trip

In the event that a portable X-ray provider would be required to make a return trip to a SNF within the same day, the SNF billing protocol would again mirror Scenario 1 or Scenario 2 depending on the number of Highmark Medicare Advantage members seen during the return trip.

Billing Guidelines

When a Medicare Advantage member is being treated under 60-day Episode of Care and concurrently receiving home infusion services, the proper billing methodology must be used by the home health agency.

If home infusion services are being provided, the existing 60-day Episode of Care must be closed and a new claim for a Partial Episodic Payment (PEP) with a discharge status of “06” must be submitted to Highmark.

Unrelated Service

If additional services are provided to the member that are unrelated to the home infusion services, a claim will need to be submitted for these services using the per visit reimbursement methodology.

Note: These additional services will need to be authorized by Highmark Clinical Services.

Infusion Services Completed

After the home infusion services have been completed, another 60-day Episode of Care can be submitted if the member requires additional home health services.

Note: An additional 60-day Episode of Care will need to be authorized by Highmark Clinical Services.

6.3 Reimbursement for Inpatient Hospice When Discharge Status Indicates Expired

Inpatient hospice facilities will receive reimbursement when the member’s discharge status indicates expired. This policy applies to commercial products effective with discharge dates on or after August 1, 2014.

Requirement for Claim Submission

Highmark requires hospice providers to submit the eligible dates of service and the total number of units for inpatient hospice services, including the date of death. Hospice providers must use discharge status codes when submitting claims:

- 40 – Expired at home

- 41 – Expired in a medical facility

- 42 – Expired (place unknown)

Extending the Authorization to Include Date of Death

If the member has expired and the date of death is not covered by the existing authorization period, the facility must notify Highmark Clinical Services. This is to extend the authorization and enable the payment to be made for the member’s expiration date.

6.3 Diagnostic vs. Routine Pap Smears

These guidelines clarify billing for both outpatient diagnostic pap smears and routine pap smears.

Billing for Routine Pap Smears

If billing for a routine pap smear, only report a routine diagnosis on the claim to ensure that the claim will process correctly.

Billing for Diagnostic Pap Smears

If billing for a diagnostic pap smear as a follow-up to a routine pap smear, and no other services are being reported on the claim, the diagnosis code reported should only be diagnostic and related to the symptom or chief complaint of the patient.

Note: If a routine diagnosis code is reported on a claim where the only service being billed is diagnostic, the claim will be viewed as routine and it may be rejected for benefit limitations.

Diagnostic Pap Smears With Routine Services

If billing for a diagnostic pap smear and a routine service:

- Report the diagnosis related to the symptom or chief complaint of the patient for the diagnostic pap smear, and

- Also report the routine diagnosis for the routine service provided.

6.3 Revised and Discontinued Bill Types for Home Health

On October 1, 2013, Highmark aligned with the National Uniform Billing Committee's (NUBC) decision to simplify code sets by revising and discontinuing certain bill types for Home Health providers.

Bill Types Revised or Discontinued

The following bill types have been revised and and/or discontinued:

|

Bill Type |

Description of outpatient bill types prior to October 1, 2013 |

Description of outpatient bill types effective October 1, 2013 |

|---|---|---|

|

032x |

Inpatient (plan of treatment under Part B only) |

Home Health Services under a Plan of Treatment |

|

033x |

Home Health Services under a Plan of Treatment |

Discontinued |

|

034x |

Other (for medical and surgical services not under a plan of treatment) |

Home Health Services not under a Plan of Treatment |

Important!

This requirement does not affect your reimbursement method. Providers should continue to submit claims according to your contract.

6.3 Guidelines for Submitting Paper Claims

Optical Character Recognition (OCR)

Although electronic claim submission is required, you may encounter a situation in which the submission of a paper claim is necessary. If this occurs, you must always print or type all information on the claim form. Clear, concise reporting on the form helps us to interpret the information correctly.

Highmark uses an Optical Character Recognition (OCR) scanner for direct entry of claims into its claims processing system. OCR technology is an automated alternative to manually entering claims data. The OCR equipment scans the claim form, recognizes and “reads” the printed data, then stores the image for audit purposes. The scanner can read both computer-prepared and typewritten claim forms.

Tips for Submitting Paper Claims

To ensure that your facility’s claims are submitted in a format that allows for clear scanning, please observe the guidelines below so that the scanner can “read” and “interpret” the claim data correctly:

- Only use the approved red UB-04 paper claim form.

- Always send the original claim form to Highmark, since photocopies cannot be scanned. If your facility is using a multi-part form, please submit the top sheet, not one of the copies.

- Print the data on the form via computer, or type it within the boundaries of the fields provided on the form. Do Not Hand-Write.

- Use a print range of 10 or 12 characters per inch (CPI).

- Use black ink only. The scanner cannot read red ink.

- Do not use excessive amounts of correction fluid on the claims.

- Change the print ribbon or cartridge regularly to ensure print readability; light print cannot be read by the scanner.

- Do not use a rubber stamp to print data in any fields of the UB claim form.

- Do not highlight anything on the claim form or any necessary attachments; highlighted information becomes blackened out and is not legible.

This tip sheet is designed to highlight the fields of the UB-04 claim form that are required when submitting to Highmark.

Required Information

In order to avoid processing and payment delays, please complete the claim form in its entirety. If required information is not present on the claim, Highmark will return the claim to your facility for completion. Under certain circumstances, Highmark may contact the facility to obtain the missing data.

Exception: Major Medical Claims

Pennsylvania Western Region facilities are required to submit Major Medical claims via a red UB-04 paper claim (available at https://www.nubc.org/), rather than electronically.

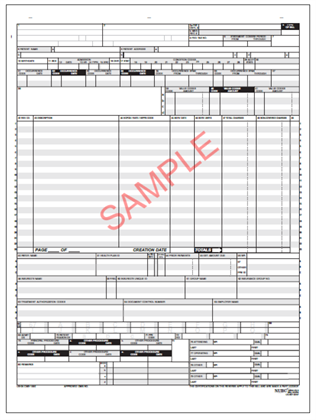

6.3 Sample UB-04 Claim Form

Sample UB-04

Click Here for a full-size version of the sample UB-04 claim form.

This tip sheet is designed to highlight the fields of the UB-04 claim form that are required when submitting to Highmark.

6.3 Disclaimers

The following entities, which serve the noted regions, are independent licensees of the Blue Cross Blue Shield Association: Western and Northeastern PA: Highmark Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Choice Company, Highmark Health Insurance Company, Highmark Coverage Advantage Inc., Highmark Benefits Group Inc., First Priority Health, First Priority Life, Highmark Care Benefits Inc., or Highmark Senior Health Company. Central and Southeastern PA: Highmark Inc. d/b/a Highmark Blue Shield, Highmark Benefits Group Inc., Highmark Health Insurance Company, Highmark Choice Company or Highmark Senior Health Company. Delaware: Highmark BCBSD Inc. d/b/a Highmark Blue Cross Blue Shield. West Virginia: Highmark West Virginia Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Health Insurance Company or Highmark Senior Solutions Company. Western NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Cross Blue Shield. Northeastern NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Shield.

All references to “Highmark” in this document are references to the Highmark company that is providing the member’s health benefits or health benefit administration and/or to one or more of its affiliated Blue companies.

All revisions to this Highmark Provider Manual (the “manual” or “Highmark Provider Manual”) are controlled electronically. All paper copies and screen prints are considered uncontrolled and should not be relied upon for any purpose.