Unit 1: General Claim Submission Guidelines

6.1 Introduction to Claim Submission

6.1 Timely Filing Requirements

6.1 Prompt Payment Requirements

6.1 West Virginia Prompt Pay Act

6.1 New Patient vs. Established Patient

6.1 Reporting National Drug Codes

6.1 Additional Diagnostic Code Reporting (New York Only)

6.1 Reporting Workers' Compensation Related Services

6.1 Documentation Requirements

6.1 Highmark's Internal Billing Dispute Process

In today’s business world, electronic transactions and online communications have become integral to health care. In fact, Highmark’s claim system places higher priority on processing and payment of claims filed electronically.

This unit provides guidelines that apply to both electronic and paper claim submissions and is applicable to both professional and facility providers.

Required Formats

Use the table below to determine the required format for submitting claims:

|

If you submit... |

Then use these formats... |

|

|---|---|---|

|

Electronically |

Professional

Facility |

ASC X12N 837 Health Care Claim: Professional Transaction Version 005010 (“837P”) ASC X12N 837 Health Care Claim: Institutional Transaction |

|

On paper |

Professional

Facility |

1500 Health Insurance Claim Form (“1500 Claim Form”), Version 02/12 UB-04 (CMS 1450) Institutional Claim Form |

Note: If you are using paper forms, please submit the original red claim form. Photocopies or outdated versions of the 1500 or UB-04 forms will not be accepted and will be returned to the provider. In addition, paper claims with missing, invalid, or unreadable information will be returned.

Reminder: Report Appropriate Place of Service on All Claims

Providers are required to report the most appropriate place of service on claim submissions. To ensure proper processing and reimbursement for your claims, please make sure you are accurately selecting the appropriate Place of Service (POS) code for all claims submitted.

Note: Please reference Chapter 2.5: Telemedicine Services for guidelines for reporting place of service for virtual visits and other telemedicine services.

For More Information

For information specific to submitting claims electronically, please see Chapter 6.2: Electronic Claim Submission.

For claim reporting tips and guidelines specific to professional providers or facility providers, please see the applicable unit:

- Facility: Chapter 6.3: Facility (UB-04/837I) Billing

- Professional: Chapter 6.4: Professional (1500/837P) Reporting Tips and Chapter 6.5: 1500 Claim Form Guidelines

Definitions

A clean claim is defined as a claim with no defect or impropriety and one that includes all the substantiating documentation required to process the claim in a timely manner. The core data required on a claim to make it clean are outlined in this section and the next section.

Unclean claims are those claims where an investigation takes place outside of the corporation to verify or find missing core data. An example of this is when a request is sent to the member for information regarding coordination of benefits. This may require obtaining a copy of an Explanation of Benefits (EOB) from the member’s other carrier. Claims are also considered unclean if a request is made to the health care professional for medical records. Claim investigations can delay the processing of the claim.

Important!

You must provide us with the required information in order for the claim to be eligible for consideration as a “clean claim.” If changes are made to the required data elements, this information shall be provided to network providers at least thirty (30) days before the effective date of the changes.

NUBC and NUCC Resources Available

A description of the data elements necessary to ensure that facility claims are without “defect or impropriety” can be found in the current Official UB-04 Data Specifications Manual. This manual is available from the National Uniform Billing Committee (NUBC) and can be found on their website at nubc.org.

For professional services, please see the current 1500 Health Insurance Claim Form Reference Instruction Manual from the National Uniform Claim Committee (NUCC) and available at nucc.org.

What is Timely Filing?

Timely filing is a Highmark requirement whereby a claim must be filed within a certain time period after the last date of service relating to such claim or the payment/denial of the primary payer, or the claim will be denied by Highmark.

Timely Filing Policy

Any claims not submitted and received within the time frame as established within your contract will be denied for untimeliness. If timely filing is not established within your contract, claims must be received within 365 days of the last date of service in Pennsylvania and West Virginia, and within 180 days of the date of service in Delaware, unless the member’s policy provides for a different period.

If Highmark is the secondary payer, claims must be submitted with an attached Explanation of Benefits (EOB) and received within the same timely filing time frames as when Highmark is primary; however, the time frame is based on the primary payer’s finalized or payment date, as shown on the EOB attachment.

New York Timely Filing Policy

All initial claims (original bill type) must be submitted to Highmark Blue Cross Blue Shield and Highmark Blue Shield within 365 days from the date of service/discharge. The calculation begins from the date of service, discharge date, or last date of treatment up to 365 days, including weekends. All corrected claim submissions (bill type ending in 7) must be received within 365 days from the last date of processing of the original claim submission, including weekends. The last finalization date of the original claim will be utilized as the processing date. Claims that are submitted after the above outlined timeframe will be denied. Do not delay the billing of a claim for any reason.

If a claim denies for timely filing and you have previously submitted the claim within 365 days, resubmit the claim and denial with your appeal.

Timely filing does not apply to:

- Early Intervention Providers – There is no time limit

- Workers Compensation

- VA Hospital and Providers – 72 months timely filing

PA CHIP Timely Filing

The Pennsylvania Children’s Health Insurance Program (CHIP) requires providers to submit all claims for services provided to CHIP enrollees to Highmark within 180 days from the date of service or discharge.

Highmark as Secondary Payer

When Highmark is a secondary payer, a provider must submit a claim within the timely filing time frames indicated above and attach an EOB to the claim that documents the date the primary payer adjudicated the claim. Secondary claims not submitted within the timely filing period will be denied and both Highmark and the member held harmless. Electronically enabled providers should submit secondary claims electronically using the proper Claim Adjustment Segment (CAS) code segments.

When it is known or there is a reason to believe that other coverage exists, claims are not paid until the other carrier’s liability has been investigated. Highmark may send a letter/questionnaire to the covered person:

- If the covered person responds to the letter/questionnaire indicating that he/she is covered by additional policies, the records are marked to indicate that the other carrier information is required to complete claims processing when the other carrier’s policy is primary.

- If the covered person does not respond promptly to Highmark’s request for information, Highmark will deny claim payment using a remark code indicating the covered person is responsible. The provider may seek reimbursement from the covered person.

Note: Federal Employee Program (FEP) claims require a response from the covered person. Highmark will not provide benefits for these FEP claims until a response is received.

Pennsylvania

The Prompt Payment Provision of Pennsylvania’s Act 68 of 1998 stipulates that health insurers pay “clean claims” within 45 days of receipt. The 45-day requirement only begins once all of the information needed to process the claim is obtained. The legislation mandates that interest penalties are to be paid to providers for claim payments issued more than 45 days from the receipt of the claim.

The following types of claims are excluded from the interest penalty requirement:

- Rejected (zero-paid) claims

- Voided claims

- Adjusted claims

- Administrative Services Only (ASO Accounts)

- Federal Employee Program claims

- BlueCard ITS home claims

- Claims with Provider Submission errors

- Claims for which the interest payment is calculated to be less than $2

Interest penalty payments are calculated on the basis of 10% annual interest and the number of penalty days. Penalty days are the number of days beyond the 45 day parameter, which were required for the processing of the claim.

The formula for calculating Act 68 interest penalty payments is as follows:

[(annual interest % / payment days in a year) x Amount paid on the claim] x Penalty Days

or

[(.10/365) x Amount paid on the claim] x Penalty Days

Interest payments will appear on the remittance line for each claim to which they apply and will be totaled for each segment of the remittance (e.g., Regular Utilization). The field titled “Interest Calc” on the Claim Detail page displays any prompt payment penalty interest that may apply to a particular claim. The interest information is also reported in the 835 Electronic Remittance.

Highmark consistently processes claims well within the 45-day requirement. In fact, clean claims submitted electronically receive priority processing and are finalized within 7 to 14 days. With this in mind, we encourage you to submit all claims electronically to take advantage of the faster processing.

Delaware

Delaware Insurance Regulation 1310, Standards for Prompt, Fair and Equitable Settlement of Claims for Health Care Services, requires that health insurers pay “clean claims” within 30 days of receipt. The regulation affords an additional time period when more information is needed to adjudicate the claim. The 30-day requirement begins when Highmark Delaware receives a clean claim.

West Virginia

The Ethics and Fairness In Insurer Business Practices Act, W.Va. Code §33-45-1 et seq., commonly referred to as the “Prompt Pay Act” (“the Act”), applies to health insurance contracts insured by Highmark West Virginia, with certain exceptions. For claims subject to the Act, Highmark West Virginia adheres to the standards for processing and payment of claims established by the Act.

Highmark West Virginia will generally either pay or deny a clean claim subject to the Act within 40 days of receipt if submitted manually, or 30 days if submitted electronically. For clean claims subject to the Act that are not paid within 40 days, Highmark West Virginia will pay interest, at the rate of 10% per year, on clean claims, accruing after the 40th day. We will provide an explanation of the interest assessed at the time the claim is paid.

For more detailed information, please see the next section of this unit, West Virginia Prompt Pay Act.

Applicability

The Ethics and Fairness In Insurance Business Practices Act, W.Va. Code §33-45-1 et seq., commonly referred to as the “Prompt Pay Act” (“the Act”), applies to health insurance contracts insured by Highmark West Virginia, with certain exceptions. For claims subject to the Act, Highmark West Virginia adheres to the standards for processing and payment of claims established by the Act. These standards are summarized in this section of this unit or are addressed in other locations of this manual. The Act does not apply:

- To services furnished by providers not contracted with Highmark West Virginia;

- To providers outside of West Virginia;

- To government programs such as the Federal Employee Health Benefit Program, Medicare Advantage, Medicare Supplemental, and the West Virginia Public Employees Insurance Agency (PEIA);

- To most self-funded plans where Highmark West Virginia acts as a third-party administrator;

- To BlueCard® claims;

- To claims that are not covered under the terms of the applicable health plan (e.g., Workers’ Compensation exclusions);

- When there is a good faith dispute about the legitimacy of the amount of the claim;

- When there is a reasonable basis, supported by specific information, that a claim was submitted fraudulently or with material misrepresentation; or

- Where Highmark West Virginia’s failure to comply is caused in material part by the person submitting the claim or Highmark West Virginia’s compliance is rendered impossible due to matters beyond our reasonable control.

Payment of Clean Claims

Highmark West Virginia will generally either pay or deny a clean claim subject to the Act within 40 days of receipt if submitted manually, or 30 days if submitted electronically, except in the following circumstances:

- Another payer or party is responsible for the claim;

- We are coordinating benefits with another payer;

- The provider has already been paid for the claim;

- The claim was submitted fraudulently; or

- There was a material misinterpretation in the claim.

A clean claim means a claim: (1) that has no material defect or impropriety, including all reasonably required information and substantiating documentation to determine eligibility or to adjudicate the claim; or (2) with respect to which Highmark West Virginia has not timely notified the person submitting the claim of any such defect or impropriety in accordance with the information in “Requests for additional information.”

Record of Claim Receipt

Highmark West Virginia maintains a written or electronic record of the date of receipt of a claim. The person submitting the claim may inspect the record on request and may rely on that record or on any other relevant evidence as proof of the fact of receipt of the claim.

If we fail to maintain such a record, the claim will be considered to be received three business days after it was submitted, based upon the written or electronic record of the date of submittal by the person submitting the claim.

Requests for Additional Information

For claims subject to the Act, if Highmark West Virginia reasonably believes that information or documentation is required to process a claim or determine if it is a clean claim, then we will:

- Request such information within 30 days after receipt of the claim;

- Use all reasonable efforts to ask for all desired information in one request;

- If necessary, make only one additional request for information;

- Make such additional request within 15 days after receiving the information from the first request; or

- Make the second request only if the information could not have been reasonably identified at the time of the original request or if there was a material failure to provide the information initially requested.

Upon receipt of the information requested, we will either pay or deny the claim within 30 days.

We cannot refuse to pay a claim for covered benefits if we fail to request needed information within 30 days of receipt of the claim, unless this failure was caused in material part by the person submitting the claim. Highmark West Virginia is not precluded from imposing a retroactive denial of payment of such a claim, unless this denial would be in conflict with the Act’s standards on retroactive denials.

Interest

For clean claims subject to the Act that are not paid within 40 days, Highmark West Virginia will pay interest, at the rate of 10% per year, on clean claims, accruing after the 40th day. We will provide an explanation of the interest assessed at the time the claim is paid.

Limitation on Denial of Claims Where Authorization, Eligibility, and Coverage Verified

Under the terms of its health plan contracts, Highmark West Virginia will reimburse for a health care service only if:

- The service is a covered service under the member’s plan;

- The member is eligible on the date of service;

- The service is medically necessary; and

- Another party or payer is not responsible for payment.

If Highmark West Virginia advises a provider or member in advance of the provision of a service that: (1) the service is covered under the member’s plan; (2) the member is eligible; AND (3) via pre-certification or pre-authorization, the service is medically necessary, then we will pay a clean claim under the Act for the service unless:

- The claim documentation clearly fails to support the claim as originally pre- certified or pre-authorized;

- Another payer or party is responsible for the payment;

- The provider has already been paid for the service;

- The claim was submitted fraudulently or the pre-certification or pre- authorization was based in whole or material part on erroneous information provided by the provider, member, or other person not related to Highmark West Virginia;

- The patient was not eligible on the date of service and Highmark West Virginia did not know, and with the exercise of reasonable care could not have known, of the person’s eligibility status;

- There is a dispute regarding the amount of the charges submitted; or

- The service provided was not a covered service and Highmark West Virginia did not know, and with the exercise of reasonable care could not have known, at the time of verification that the service was not covered.

Retroactive Denials

Under the Act, Highmark West Virginia may retroactively deny an entire previously paid claim insured by Highmark West Virginia for a period of one year from the date the claim was originally paid. The Act and its one-year time limit does not apply:

- To services furnished by providers not contracted with Highmark West Virginia;

- To contracted providers outside of West Virginia;

- To claims paid under an ERISA self-funded plan;

- To government programs such as the Federal Employee Health Benefit Program, Medicare Advantage, and PEIA;

- When a good faith dispute about the legitimacy of the amount of the claim is involved (e.g., disputed audit findings during the resolution process);

- Where Highmark West Virginia’s failure to comply with the time limit is caused in material part by the person submitting the claim or Highmark West Virginia’s compliance is rendered impossible due to matters beyond its reasonable control (e.g., fire, pandemic flu);

- Where the provider is obligated by law or other reason to return payment to Highmark West Virginia or a Highmark West Virginia member (e.g., Unclaimed Property Act);

- To BlueCard claims; or

- To claims that are not covered under the terms of the applicable health plan (e.g., Workers’ Compensation exclusions).

Provider Recovery Process

Under the Act, upon receipt of a retroactive denial, the provider has 40 days to either: (1) notify Highmark West Virginia of the provider’s intent to reimburse the plan; or (2) request a written explanation of the reason for the denial.

Upon receipt of an explanation, a provider must: (1) reimburse Highmark West Virginia within 30 days; or (2) provide written notice that the provider disputes the denial. The provider should state reasons for disputing the denial and include any supporting information or documentation.

Highmark West Virginia will notify the provider of its final decision within 30 days after receipt of the provider’s notice of dispute. If the retroactive denial is upheld, the provider must pay the amount due within 30 days or the amount will be offset against future payments

Policy

Highmark acts only as a third-party administrator for a self-funded benefit plan (i.e., the benefits are not insured by Highmark and our services are administrative only). We shall not be required to pay a provider’s claim for services rendered to a member of the self-funded plan unless and until the self-funded plan pays or reimburses Highmark for the amount of the claim and the administrative cost to process and pay the claim. Highmark does not insure, underwrite, or guarantee the responsibility or liability of any self-funded plan to provide benefits or to make or administer payments.

If a self-funded plan fails to provide payment or reimbursement to Highmark to fund claims (whether such claims have been paid already by Highmark or not), then a provider shall not hold Highmark liable, but must look to the self-funded plan or the patient for payment. Highmark may demand the return of any payment to the provider, or may offset against amounts owed to the provider, for any claims for which a self-funded plan fails to make payment or reimbursement to Highmark.

Identifying Members

Member ID cards identify members of self-funded accounts. Providers may contact the telephone number on the back of the card to inquire about the current eligibility status of the member, or current funding status of the self-funded account.

Special Circumstances for Terminated Accounts

Upon termination of a self-funded group, Highmark will continue to process claims for a period of time as specified in the terminated self-funded account’s contract. This is otherwise referred to as a “run-out period.” Often the run-out period is less than 12 months, and claims received after this period will be denied.

Certain evaluation and management (E&M) Current Procedural Terminology (CPT®) codes distinguish between new and established patients. New patient visits are reported with procedure codes 99202, 99203, 99204, or 99205. Once the provider establishes a new patient, subsequent visits should be billed with 99211, 99212, 99213, 99214, or 99215.

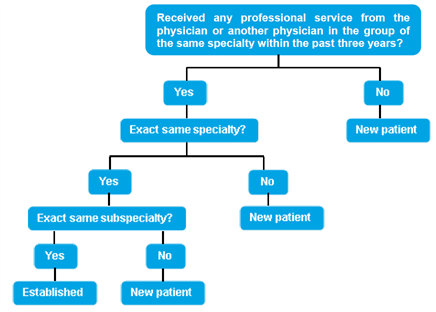

CPT Guidelines for New vs. Established Patients

The 2015 CPT guidelines define new and established patients according to the “three-year” rule.

- A new patient is “one who has not received any professional services from the physician/qualified health care professional or another physician/qualified health care professional of the exact same specialty and subspecialty who belongs to the same group practice, within the past three years.”

- An established patient is “one who has received professional services from the physician/qualified health care professional or another physician/qualified health care professional of the exact same specialty and subspecialty who belongs to the same group practice, within the past three years.”

CPT Decision Tree for New vs. Established Patients

The “Decision Tree for New vs. Established Patients” from the CPT E/M Services Guidelines is reproduced here and can be used to help you determine if a patient is new or established.

Providers are required to report all locations to Highmark so they can be properly enumerated in our system. For professional providers, this includes all practice locations, while facilities must report all off-campus locations. When submitting claims, the actual location where services were delivered must always be reported to avoid unnecessary processing delays, claim denials, or refund requests.

The Service Facility Location field on a claim is used to report the physical location where the services were performed. Highmark requires professional and facility providers to always complete the Service Facility Location when the location where services were rendered differs from the billing address being reported on the claim or from the main facility location (e.g., services delivered at a hospital’s off-site outpatient surgery center).

It is also important to complete the Service Facility Location field to easily locate your patients’ medical records when necessary. Highmark requests records for Healthcare Effectiveness Data and Information Set (HEDIS®) and other quality improvement activities. Identifying the place where services are rendered eliminates unnecessary calls to provider offices to locate medical records.

Important!

A physical street address must be reported for the Service Facility Location — a P.O. Box or lock box will not be accepted.

Professional Claims (837P/1500)

The Service Facility Location is reported on professional claims as follows:

- Electronic 837P: Loop 2310C

- Paper 1500 claim form: Item# 32 a, b

- For additional information for completing Item #32 on the 1500 claim form, please see the manual’s Chapter 6.5: 1500 Claim Form Guidelines.

For more information on submitting professional claims via Availity, click here.

Facility Claims (837I /UB-04)

Facilities report the Service Facility Location as follows:

- Electronic 837I: Loop 2310E

- Paper UB-04 claim form: Form Locator 01

For more information on submitting facility claims via Availity, click here.

International Classification of Diseases (IDC)

The International Classification of Diseases (ICD) is a medical code set maintained by the World Health Organization (WHO). It was developed so that medical terms reported by physicians, medical examiners, and coroners can be grouped together for statistical purposes.

ICD-10 Compliance

Effective Oct. 1, 2015, the International Classification of Diseases, 10th Revision, Clinical Modification (ICD-10-CM) is the standard for reporting patient diagnoses, replacing ICD-9-CM. ICD-10 provides more specific data than ICD-9 and better reflects current medical practice. The added detail embedded within ICD-10 codes informs health care providers and health plans of patient incidence and history, which improves the effectiveness of case management and care coordination functions. Highmark will accept only ICD-10-CM diagnosis codes on claims for dates of service Oct. 1, 2015, and after.

Please Note: ICD-10 diagnosis code reporting does not directly affect provider use of the Current Procedural Terminology (CPT) and Healthcare Common Procedure Coding System (HCPCS) codes.

Highest Level of Specificity Required

Highmark requires you to report the highest level of specificity when reporting diagnosis codes on medical-surgical claim forms.

Since Highmark’s claims processing system applies medical payment guidelines based on diagnosis codes, you must report the most appropriate diagnosis code(s) on every claim. The diagnosis must be valid for the date of service reported.

Document and Code All Coexisting Conditions

The Centers for Medicare & Medicaid Services (CMS) instructs providers to code all conditions that coexist at the time of a visit and impact the member's treatment plan or management of their care.

Do not report conditions that previously existed but are no longer being treated.

Be as Accurate as Possible

Highmark will reject your claims for payment if you submit them without complete or accurate diagnosis codes.

Converting NDCS from 10-Digits to 11-Digits

Many National Drug Codes (NDCs) are displayed on drug packaging in a 10-digit format. Proper billing of an NDC requires an 11-digit number in a 5-4-2 format. Converting NDCs from a 10- digit to an 11-digit format requires a strategically placed zero, dependent upon the 10-digit format.

The following table shows common 10-digit NDC formats indicated on packaging and the associated conversion to an 11-digit format, using the proper placement of a zero. The correctly formatted additional “0” is in a bold font and underlined in the following example. Note that hyphens indicated below are used solely to illustrate the various formatting examples for NDCs. Do not use hyphens when entering the actual data in your paper claim form.

|

Converting NDCS from 10-Digits to 11-Digits |

|---|

|

10-Digit Format on Package |

10-Digit Format Example |

11-Digit Format |

11-Digit Format Example |

Actual 10-Digit NDC Example |

11-Digit Conversion of Example |

|

4-4-2 |

9999-9999-99 |

5-4-2 |

09999-9999-99 |

0002-7597-01 |

00002759701 |

|

5-3-2 |

99999-999-99 |

5-4-2 |

99999-0999-99 |

50242-040-62 Xolair® 150mg vial |

50242004062 |

|

5-4-1 |

99999-9999-9 |

5-4-2 |

99999-9999-09 |

60575-4112-1 Synagis® 50mg vial |

60575411201 |

Lesions

The CPT4 codes for lesion treatments include specific verbiage that needs to be considered in determining whether more than one unit of service or line of service can be billed for a code and if any other codes can be billed with it. Listed below are the CPT4 codes and the maximum number of units that should be reported on a claim for a date of service.

|

Code Verbiage |

Maximum Units |

|---|---|

|

11055 Paring or cutting of benign hyperkeratotic lesion (e.g., corn or callus); single lesion |

01 |

|

11056 Two to four lesions |

01 |

|

11057 More than four lesions |

01 |

|

17000 Destruction (e.g., laser surgery, electrosurgery, cryosurgery, chemosurgery, surgical curretement), premalignant lesions (e.g., actinic keratoses); first lesion |

01 |

|

17003 Second through 14th lesion, each (list separately in addition to code for first lesion) |

13 |

|

17004 Destruction (e.g., laser surgery, electrosurgery, cryosurgery, chemosurgery, surgical curretement), premalignant lesions (e.g., actinic keratoses), 15 or more lesions |

01 |

|

17110 Destruction by any method of flat warts, molluscum contagiosum, or milia; up to 14 lesions |

01 |

|

17111 15 or more lesions

|

01 |

Mammography

Please be sure to use the appropriate CPT codes when billing mammography to differentiate diagnostic from screening.

Diagnostic codes should be used when the procedure is ordered because of a suspicion of breast disease (due to symptoms or clinical findings), patient history of breast cancer or biopsy proven breast disease.

Screening mammography

A screening code should be used when the procedure is done as a baseline or on a routine basis.

Multiple, Bilateral, and Multiple Bilateral Procedures

Surgical

In accordance with Current Procedural Terminology (CPT) guidelines, bilateral procedures should be billed on one line only, utilizing the modifier 50; enter one as 01 in the units field and bill your total bilateral charge.

Bilateral Billing Examples

- Bilateral breast reconstruction – report as code 19357 with modifier 50 on one claim line with 01 in the units field.

- Bilateral lower and upper blepharoplasties – report as:

- 15820 with modifier 50 on the first claim line with 01 units

- 15822 with modifier 50 on the second claim line with 01 units

Note: For bilateral services, do not bill modifier LT/RT or any other site- specific modifier other than 50.

Multiple Procedures

Separate billing is allowed for multiple procedures performed on the same day that add significant time or complexity and are not incidental or an integral part of the primary procedure. The primary procedure is reimbursed at the fee schedule amount; eligible secondary procedures are reimbursed at 50 percent.

Multiple procedures that involve the same service performed more than once (such as CPT code 26100, arthrotomy of each carpometacarpal joint of the left hand), should be billed as five separate lines on the claim form along with the modifier 59 or the HCPCS individual digit modifiers on lines two through five in order to clarify that the additional lines are definitely separate services.

Procedure code descriptions including more than one unit of service provided, (such as code 95117, professional services for allergy immunotherapy, two or more injections, or code 96406, intralesional injections, more than seven lesions), are reported on one line with only one unit.

Final reimbursement is also determined after applying usual edits such as (but not limited to) preauthorization, cosmetic coverage and bundling. In addition, the member’s contract must be active at the time the service is rendered.

Physician Exceptions (Does not apply to hospital category reimbursement)

When the CPT code description includes: "each additional" (for example, code 63048, laminectomy, each additional cervical, thoracic, or lumbar segment), report the code on one line with the number of additional segments indicated in the units field.

When the CPT code states: "specify number of tests, doses" (such as code 95024, intradermal tests with allergenic extracts), report the code on one line with the number of tests, doses, etc., indicated in the units field.

Non-Ionic Low Osmolality Contrast Media

Contrast media will not be considered for separate payment and cannot be billed to the patient. Reimbursement for contrast media is included in the allowance for the radiology service. To maintain accurate records of the use of non-ionic contrast media, use the appropriate CPT/HCPCS code.

Sleep Studies

Modifier 26 (for the physician component/CMS 1500 or 837P claim) and modifier TC (for the hospital or technical services/UB04 or 837I claim) must be used when a sleep study is performed at a hospital or affiliated clinic.

The policies and procedures referenced in this section represent our standard for claims submission, payment, and adjustment. Certain providers may be subject to different guidelines due to contractual limitations or expansions.

|

Type of Claim |

Revenue Codes |

Bill Type |

CPT Codes |

*Roll-Up/Reimbursement |

|---|

1 |

Ambulatory Surgery |

0360-0361, 0490, 0750, & 0790 |

131 |

Yes. Valid Category CPT Code Required. |

Yes. Category and contract may allow for additional reimbursement of eligible implantable prosthetic devices (revenue codes 274 & 278), pacemakers (revenue code 275). Eligible secondary procedures pay at 50 percent. |

1a |

Cancelled Ambulatory Surgery |

0360-0361, 0490, 0750, & 0790 |

131 |

Yes. Valid Category CPT Code Required. |

Bill Claim with Occurrence Code 43. Reimbursement based on record review or use modifier 53. |

2 |

Emergency Room/“Urgent Care” Service within Emergency Department |

0450, 0459 |

13X |

Yes (99281-99285) |

Yes. Case Rate. |

3 |

Observation |

0762 |

13X |

No |

Per diem/per case, pays in addition to ER. |

4 |

Clinic |

Must be billed on a HCFA1500/ANSI837 Professional Form. |

N/A |

Yes |

N/A. Follows physician reimbursement guidelines. TC split for Medicare Primary will be accepted on a UB92. |

5 |

Chemotherapy* |

0280-0289, 0331, 0332, 0335 |

13X |

No |

Identified high-cost drugs, labs and diagnostics pay according to your schedule of allowance. |

6 |

Radiation Therapy |

0330, 0333, 0339 |

13X |

Yes |

N/A. Services pay according to your schedule of allowance in addition to identified high-cost drugs, labs and diagnostics. |

7 |

Home Infusion Therapy |

0640 - 0649 |

33X 34X |

Yes |

No. Schedule of allowance. |

8 |

Transfusion* |

0390, 0391 |

13X |

Yes - 391 36430-36460 |

No. Blood Storage & Processing (Rev Code 390 is not payable. Identified high-cost Injectable drugs, diagnostic services and labs pay according to your schedule of allowance. |

9 |

Cast Room* |

0700, 0709 |

13X |

No |

Labs, diagnostic services and durable medical equipment pay according to fee schedule. |

10 |

Infusion Therapy* |

0260-0269 |

13X |

No |

Labs and diagnostic services pay per your schedule of allowance. Drugs are paid according to guidelines indicated in "High-Cost Drugs" (category #28). |

11 |

Dialysis |

0820, 0821, 0830, 0831, 0840, 0841, 0849, 0850, 0851, 0859 |

13X |

Yes, per contract |

Ancillaries paid in addition if not included in composite reimbursement. |

12 |

Epogen |

0634-0635 |

13X 72X |

Yes |

No. Per Unit. Appropriate HCPCS code should be billed indicating units given in unit field or use value code 68. |

13 |

Pre-Admission Testing |

13X |

Yes |

Refer to Guidelines for Diagnostics. Bill with Occurrence Code 41. Roll-up to ambulatory surgery/IP stay. |

|

14 |

False Labor |

0720 - 0729 |

13X |

No |

Per contract, ER per diem/case rate is paid. 59025 present should pay schedule of allowance. |

15 |

Recovery Room |

0710 - 0719 |

13X |

No |

Roll-up to ambulatory surgery, ER or Observation. Will not pay if billed alone. |

16 |

Ambulance |

0540 - 0549 |

13X |

N/A |

Charges (Should not roll up if billed with 450 - ER). |

17 |

Cardiac Rehab |

0943 |

13X |

Yes |

Schedule of Allowance. Follow applicable protocol for guidelines and limitations. |

18 |

Diagnostic Testing |

0300-0309, 0310-0319, 0340-0349, 0350-0359, 0400-0409, 0460-0469, 0470-0479, 0480, 0482, 0489, 0610-0619, 0621-0622, 0720, 0730-0739, 0740-0749, 0920-0929 |

13X |

Yes |

Schedule of Allowance |

19 |

Durable Medical Equipment (DME) |

0290 - 0293, 0299, 0946, 0947 |

13X |

Yes |

Schedule of Allowance |

20 |

Electric Shock Psych / Other |

0900, 0901, 0902, 0919 |

13X |

Yes |

Schedule of Allowance |

21 |

OP/Alcohol/Drug |

0905, 0912, 0914, 0915, 0916, 0944, 0945 |

13X 89X |

Yes |

Schedule of Allowance |

22 |

Therapies PT, OT, ST |

0420-0429, 0430-0439, 0440-0449, 0530-0539, 0940-0941, 0949 |

13X |

Yes |

Schedule of Allowance for each per day |

23 |

Fetal Non-Stress |

0720 |

13X |

Yes (59025) |

Schedule of Allowance |

24 |

Hospice |

065X |

81X 82X |

N/A |

Flat rate per visit; if Medicare eligible and member elects into Hospice Care, Medicare is responsible for all claims. |

25 |

Home Health Care |

055X, 056X, 057X, 042X, 043X 044X |

33X 34X |

N/A |

Yes. Pays off revenue code per visit except rev code 572 - HHA which pays per hour. |

26 |

Prosthetics and Implantables |

0274, 0278, 0275 |

13X |

HCPCS |

Category and contract may allow additional payment for eligible implantables. Payment equal to invoice cost, subject to post-payment audit. 0276 Intraocular lenses are included in a category 6 or 8 surgery. |

27 |

Treatment Room* |

0760, 0761 |

13X |

Yes |

Pays according to your schedule of allowance. |

28 |

Inhalation Therapy |

0410 - 0419 |

13X |

Yes |

Pays according to your schedule of allowance. |

29 |

High-Cost Drugs |

0636 |

13X |

Yes (HCPCS) |

Pays according to your schedule of allowance. |

30 |

Supplies |

0270, 0271, 0272, 0273, 0277 & 0279 |

13X |

No |

These revenue codes will not be paid if billed with unbundled service. |

31 |

Miscellaneous Pharmaceuticals |

0250-0259 |

13X |

No |

These revenue codes will not be paid if billed with unbundled service. |

32 |

Sleep Studies/ Polysomnography |

0740, 0920 |

13X |

95805-95811 |

Payable per fee schedule. |

33 |

Lithotripsy |

360, 490, 790 |

13X |

Yes. Valid Category CPT Code Required |

0290 - 0293, 0299, 0946, 0947 Yes/Secondary procedures pay at 50 percent. |

*Service could pay up to $50 per day for room charge.

Workers' compensation insurance covers medical expenses for work-related injuries or illnesses. Highmark is not liable to pay claims for members under these circumstances, unless the services are determined to be ineligible under workers’ compensation benefits. Highmark employs several processes to ensure the services provided to our members are paid by the proper insurer and the reimbursement for these services does not exceed the actual charge.

In order for our members’ medical services to be paid in a timely manner, network participating providers must assist in our efforts by properly reporting on claim submissions when services were for employment-related conditions or injuries.

Guidelines are provided below for the additional fields required on claims when reporting services related to workers’ compensation on both professional and facility claims.

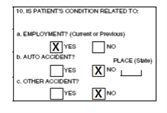

Reporting on the 1500 Claim Form

Item Numbers 10 and 14 must be completed on the 1500 claim form when reporting professional services related to workers’ compensation.

Item #10 – Is the Patient's Condition Related To:

- Enter an “X” in Yes for Employment (10a) to indicate whether one or more of the services reported in Item#24 is for a condition or injury that occurred on the job.

- Place an “X” in NO for 10b and 10c.

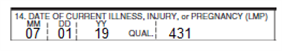

Item #14 – Date Of Current Illness, Injury, Or Pregnancy (LMP):

- Enter the date of onset of the work-related illness or the date of injury in 6-digit format (MM|DD|YY).

- Enter qualifier 431 (Onset of Current Symptoms or Illness) to the right of the vertical dotted line.

Note: If known, additional information that would assist in the processing of these claims can be included to avoid any unnecessary delays in finalizing the claims (e.g., workers’ compensation insurer information or claim denial notice from workers’ compensation).

Reporting on the 837P

For professional electronic claims (837P), the following crosswalk outlines the required fields on the 837P that correspond to the required fields on the 1500 claim form:

|

1500 Form Locator |

837P |

|---|

|

Item# |

Locator Description |

Loop ID |

Segment/ |

Code |

Electronic Description |

|

10a |

Is Patient’s Condition Related To: Employment? |

2300 |

CLM11 |

EM (Employment) |

Related Causes Code |

|

14 |

Date Of Current Illness, Injury, Or Pregnancy (LMP) |

2300 |

DTP01 |

431 |

Onset of Illness Date or Accident Date |

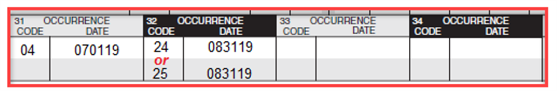

Reporting on the UB-04 Claim Form

For facilities submitting claims for services that are work-related and for which workers’ compensation may apply, Locator 31: Occurrence Code and Date must be completed on the UB-04 (CMS 1450) claim form in addition to all other required fields.

You must enter Occurrence Code 04 to indicate services are “Accident/Employment Related.” And then enter the date of onset of the work-related illness or the date of the work-related accident in 6-digit format (MMDDYY):

In addition, either Occurrence Code 24 or 25 must be entered to report a denial of the claim by the workers’ compensation insurer or the termination of workers’ compensation coverage.

- Occurrence Code 24 = Date Insurance Denied. Code indicating the date the denial of coverage was received by the health care facility from any insurer.

- Occurrence Code 25 = Date Benefits Terminated by Primary Payer. Code indicating the date on which coverage (including Worker’s Compensation benefits or no-fault coverage) is no longer available to the patient.

Note: If known, additional information that would assist in the processing of these claims can be included to avoid any unnecessary delays in finalizing the claims (e.g., workers’ compensation insurer information or claim denial notice from workers’ compensation).

Reporting on the 837i

For institutional electronic claims (837I), the table below identifies the required fields that are equivalent to Locator 31 on the UB-04 for entering occurrence codes and corresponding dates for work-related services.

|

UB-04 Form Locator |

837I |

|---|

|

Locator |

Locator Description |

Loop |

Segment |

Code |

Electronic Description |

|

31 |

Occurrence Code/ Date |

2300 |

HI01-1 |

BH (04 & either 24 or 25) |

Occurrence Code/ Date |

For More Information

To learn more about the processes applied when Highmark members have coverage under another insurer(s), please see Chapter 6.6: Coordination of Benefits.

Highmark requires that patient records document every service submitted for payment. This includes diagnostic tests, medical care, surgery, and any other services eligible for payment by Highmark.* You should not routinely submit this documentation with your claims except in circumstance when required (e.g., when using modifier 22). If documentation is needed, Highmark will request it. Please retain your office records for audit purposes.

Hospital and office records must verify that a service: 1) was actually performed; 2) was performed at the level reported; and 3) was medically necessary. The services billed by the provider must be documented by personal notes and orders in the patient’s records.

*In Pennsylvania, regulations issued by the Pennsylvania Board of Medical Education and Licensure support this policy.

Criteria for Documentation Submission

Highmark will use these criteria to determine if the provider has met the appropriate documentation requirements:

- Hospital medical visits: The admission and discharge records, doctor’s orders, and progress notes should clearly reflect the type, level of care, and medical necessity of treatment billed by the doctor. The records not only should reflect the doctor’s personal involvement in treating the patient, but also should reflect and be co-signed by the interns and residents who write the progress notes and order sheets;

- Surgical services: The operative report should indicate the name of the surgeon who performed the service. Minor surgical procedures not requiring an operative note must be documented in the progress notes. Also, the records should indicate the condition or diagnosis that documents the medical necessity for the surgery;

- Consultation: A consultation includes a history and an examination of the patient by a consultant whose services were requested by the attending physician. There should be a written report signed by the consultant. Additionally, the medical necessity for the consultation must be documented;

- Anesthesia: The anesthesia and/or operative report should indicate the name of the person who actually performed the anesthesia service. Anesthesia time units begin when the doctor begins to prepare the patient for induction and ends when the patient may be safely placed under postoperative supervision and the doctor is no longer in personal attendance. The records should reflect the actual time units reported;

- Medical reports: Office records should contain the patient’s symptoms and/or complaints, diagnoses, tests performed, test results and treatment given or planned. In addition, the copies of hospital records should be clear and readable. In cases involving concurrent medical care, the consulting physician should submit these records with the request for review;

- Emergency medical/accident: Claims for emergency medical and emergency accident services always should include a date of onset and a date of service. Emergency medical services should be reported with the appropriate evaluation and management code, the ET (emergency services) modifier, and a diagnosis code that reflects an emergency medical service.

Providers can check the status of a claim by using Availity® Claim Status or the 276/277 Health Care Claim Status Request and Response transactions. For non-routine inquiries that require analysis and/or research, contact Highmark’s Provider Services.

Claim Status

Claim Status in Availity lets you view real-time, detailed claims information for any member, whether claims were submitted electronically or on paper. You can track the status of a claim from the start of the adjudication process until the time of payment.

To check the status of a claim in Availity:

- In the Availity Essentials menu bar, select Claims & Payments | Claim Status.

- Search for claims by member in the Member Search tab.

276/277 – Health Care Claim Status Request and Response Transaction

The HIPAA-mandated 276/277 electronic claim status request and response are a paired transaction set — the 276 transaction is used by the provider to request the status of a claim(s) and the 277 transaction is used by the payer to respond with information regarding the specified claim(s). The response returned by the payer indicates where the claim is in the adjudication process (e.g., pending or finalized). If finalized, detailed information is provided on whether the claim is paid or denied, and if denied or rejected, the reason is included.

Highmark will accept and return 276/277 transactions in Version 5010 format only. These transactions will only be accepted and returned via real-time; trading partners are not able to submit electronic inquiry transactions in a batch mode.

Information about the 276/277 transactions can be found in the EDI Guide, available on the Electronic Data Interchange (EDI) website. Click on the applicable state's link below to access the site directly:

Providers in all regions can contact Highmark EDI Services by telephone at 800-992-0246.

A claim inquiry is the ordinary means providers use to communicate their questions regarding pending, paid, or denied claims.

When Claim Inquiry is Appropriate

An inquiry should be submitted if the provider has a question about the status of a claim. Complete research should be completed by the provider prior to submitting the inquiry. A claim inquiry is appropriate if any of the atypical situations listed below occurs:

- A claim has been pending for more than 45 days beyond the received date

- A claim has been paid, but the facility or provider questions the payment amount

- A claim is denied and the facility or provider questions the denial reason

Claim inquiries can be launched from Availity® by selecting Message this Payer from the claim detail in Claim Status.

276/277 Health Care Claim Status Request and Response Transactions

Claim inquiry can also be done using the 276/277 Health Care Claim Status Request and Response electronic transactions. Information about the 276/277 transactions can be found on the Electronic Data Interchange (EDI) website. Click on the applicable state's link below to access the site directly:

Providers in all regions can contact Highmark EDI Services by telephone at 800-992-0246.

Disputes Overview

Any provider who treats a Highmark member has the right to dispute claims payment decisions made by Highmark. Any claim dispute between a provider and Highmark arising from a provider’s request for payment is solely a contract dispute between the provider and Highmark, and does not involve any other party. Accordingly, it is important to note that the dispute must not be made against the plan through which a member receives benefits. This limitation applies to plans governed by the Employee Retirement Income Security Act of 1974 (ERISA) and/or the Patient Protection and Affordable Care Act of 2010 (PPACA).

Please note that both plans and plan sponsors are not parties to any contracts with providers. The terms as to which providers are bound by are governed by its contract with Highmark. Such provider contracts are not binding upon any plan or plan sponsor.

Anti-Assignment Provisions

All Highmark insurance policies for members contain anti-assignment provisions. This means that a provider cannot be a "participant" or "beneficiary" or "receive benefits" (covered services) under the terms of a member’s plan (whether insured or self-insured). Only members are entitled to receive benefits. As a result, a provider cannot dispute a claim with benefit plans or plan sponsors in the event a member’s benefits are denied in whole or in part.

Submitting A Billing Dispute

Highmark offers several ways for providers to express dissatisfaction with their claims payment. Network participating providers may:

- Network participating providers can submit an inquiry using Message this Payer in Availity®

- Call Provider Services

- Send written correspondence to Customer Service

It is the provider’s responsibility to submit all necessary information about the billing dispute and any additional documentation. If Highmark determines there is incomplete information, the provider will be contacted to provide the necessary information.

Billing Dispute Process

Once all documentation is received, a billing dispute is routed to the appropriate department for research and review. A service representative will review the applicable claim(s) and determine whether the claim(s) processed correctly.

Individual departments within Highmark have varying levels of review and will notify the provider at various stages of the review, as applicable. In certain instances, internal billing dispute processes are considered final. In cases where eligibility requirements are met, further billing dispute resolution processes may be available.

No matter the outcome, each provider who submits a billing dispute will receive notification advising them of the outcome and the reason for the decision. Actions will be taken to remedy the billing dispute, if the provider’s contention was correct.

BlueCard®

Providers should open a Claim Inquiry in Availity for billing disputes rather than contacting the out-of-area member’s Home Plan.

Unresolved Disputes

In Pennsylvania, a billing dispute with a health services doctor (as defined in 40 Pa. C.S.A. Section 6302) which remains unresolved can be referred to the Medical Review Committee (MRC) for consideration.

Common Claims Reporting Errors

Claims processing experts identified these top errors that cause claims to process incorrectly.

|

Some common reporting errors … |

Correction |

|---|

Missing/incorrect modifiers |

Include all appropriate modifiers to indicate compliance with reporting guidelines/policies and an accurate representation of services performed. |

Incorrect National Provider Identifier (NPI) listed |

Generally, the billing provider NPI is the assignment account, while the performing provider NPI is the individual practitioner. If practices are unsure which NPI to use (assignment account/group or individual practitioner/group member), they should contact Highmark Provider Service using Message this Payer in Availity Essentials, Highmark's provider portal. |

Performing provider name and NPI |

The performing provider name and NPI should be reported on the claim when it is different than the billing provider NPI. |

Invalid place of service codes submitted and/or the facility name and number is not listed |

Ensure the correct place of service code is being used. When the place of service is different than the billing provider’s address (e.g., Hospital or Skilled Nursing Facility), ensure a service facility location and identification number are reported. |

NOC (not otherwise classified) codes listed without descriptions |

Descriptions of the service provided must be reported on the claim for NOC codes. If billing for an NOC code when a more appropriate code is available, the claim will be rejected. The provider will be requested to resubmit the claim with the correct information. The member should not be billed. |

Applicable coordination of benefits/other insurance information and/or documentation is not accompanying the claim |

Always include coordination of benefits and other relevant insurance information. |

Member identification numbers are incomplete |

List the complete member identification number, including any alpha prefix. |

Claims are range-dated but the number of services do not clearly correspond with the date range (e.g., indication that services were performed 01-01-23 through 01-10-23 but list only five services) |

When services span over a period of days, the number of services should correspond on a one-on-one basis if you are range-dating (indicating that services span from one date through another date). If they do not correspond on a one-to-one basis, you should itemize the services. |

Submit Healthcare Common Procedure Coding System (HCPCS) codes that are not valid for the time the service was rendered (e.g., billing for a service performed in 2022 with a code that was not in place until 2023, or vice versa). |

Report correct procedure codes that are valid for the date of service. |

Invalid diagnosis code |

Report diagnosis codes that are the highest degree of specificity and valid for the date of service. |

The following entities, which serve the noted regions, are independent licensees of the Blue Cross Blue Shield Association: Western and Northeastern PA: Highmark Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Choice Company, Highmark Health Insurance Company, Highmark Coverage Advantage Inc., Highmark Benefits Group Inc., First Priority Health, First Priority Life, Highmark Care Benefits Inc., or Highmark Senior Health Company. Central and Southeastern PA: Highmark Inc. d/b/a Highmark Blue Shield, Highmark Benefits Group Inc., Highmark Health Insurance Company, Highmark Choice Company or Highmark Senior Health Company. Delaware: Highmark BCBSD Inc. d/b/a Highmark Blue Cross Blue Shield. West Virginia: Highmark West Virginia Inc. d/b/a Highmark Blue Cross Blue Shield, Highmark Health Insurance Company or Highmark Senior Solutions Company. Western NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Cross Blue Shield. Northeastern NY: Highmark Western and Northeastern New York Inc. d/b/a Highmark Blue Shield.

All references to “Highmark” in this document are references to the Highmark company that is providing the member’s health benefits or health benefit administration and/or to one or more of its affiliated Blue companies.

All revisions to this Highmark Provider Manual (the “manual” or “Highmark Provider Manual”) are controlled electronically. All paper copies and screen prints are considered uncontrolled and should not be relied upon for any purpose.